Given that Vince Cable was once a lecturer in economics, it’s odd to see him feign ignorance over its basic concepts. Listen to his speech today.”There are politicians on both left and right who don’t [get it]. Some believe government is Father Christmas. They draw up lists of tax cuts and giveaways and assume that Santa will pop down the chimney and leave presents under the tree. This is childish fantasy. Some believe that if taxes on the wealthy are cut, new revenue will miraculously appear.”

It’s perhaps worth quoting one such ‘childish’ politician who was articulating this long before Art Laffer doodled on a cocktail napkin. In 1962, John F Kennedy was trying to

kick-start the American economy – and wanted to secure more revenue by cutting taxes. In a speech to the Economic Club of New York that year (above), JFK had this to say:

‘In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now. The

experience of a number of European countries and Japan have borne this out. This country’s own experience with tax reduction in 1954 has borne this out. And the reason is that only full employment

can balance the budget, and tax reduction can pave the way to that employment. The purpose of cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding

economy which can bring a budget surplus.

I repeat: our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate

revenues and a restricted economy, or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve, I believe — and I believe

this can be done — a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.’

This is not quite how Cable put it. He paraphrased the argument of those who believe that lowering the 50p tax would bring in more revenue. “I think their reasoning is this: all those British

billionaires who demonstrate their patriotism by hiding from the taxman in Monaco or some Caribbean bolt hole will rush back to pay more tax but at a lower rate. Pull the other one!”

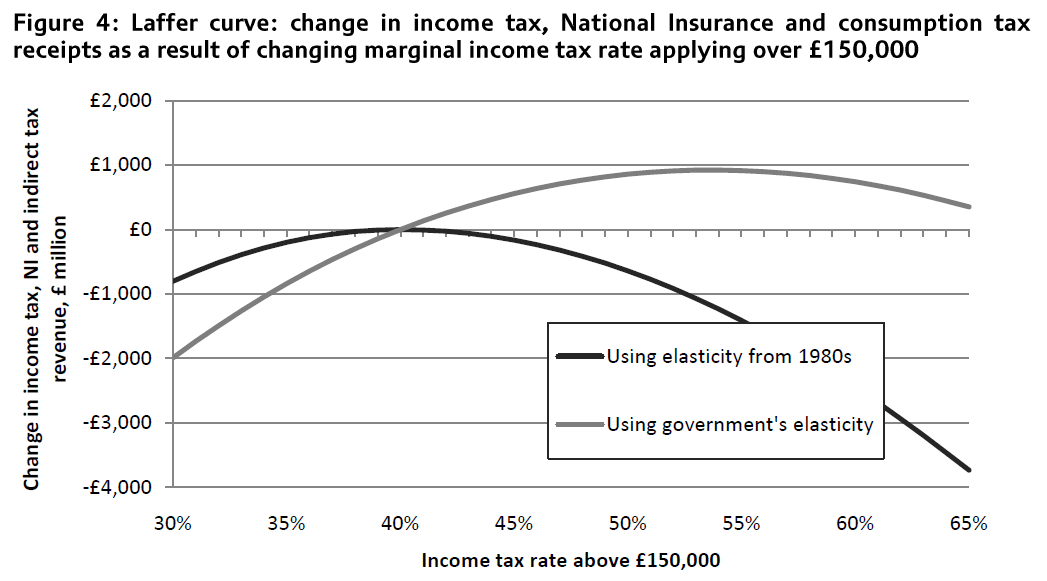

When he was teaching economics, Cable might have come across tax yield graphs such as the below published by the Institute for Fiscal Studies:

The frightening thing about today’s debate in Britain is that if JFK were to say this now he’d be denounced by the leadership of the Tories and LibDems as a tax-cutting head banger. Or a ‘punk tax-cutter’ as Danny Finkelstein likes to put it. A crazy person, beyond the pale. Fifteen years of refusing to listen to the arguments of low-tax economics has rendered the leadership of all three parties ignorant of the basics which JFK grasped so clearly. Shorn of ideas, today’s leaders just ask the Bank of England to print even more money – hoping to create the illusion of recovery, just for a little while longer.

There is another, surer way to recovery. As JFK put it in his economic report of January 1963:

‘Tax reduction thus sets off a process that can bring gains for everyone, gains won by marshalling resources that would otherwise stand idle – workers without jobs and farm and factory capacity

without markets. Yet many taxpayers seemed prepared to deny the nation the fruits of tax reduction because they question the financial soundness of reducing taxes when the federal budget is already

in deficit. Let me make clear why, in today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarged the federal deficit—why reducing taxes is the

best way open to us to increase revenues.’

And make clear he did. The full text of JFK’s economic report is here, page XIV. George Osborne could do worse than read the full thing, ahead of his speech to the Tory conference. Because we are at a moment of grave danger for the economy. If the Business Secretary isn’t sticking up for business, who is?

Comments