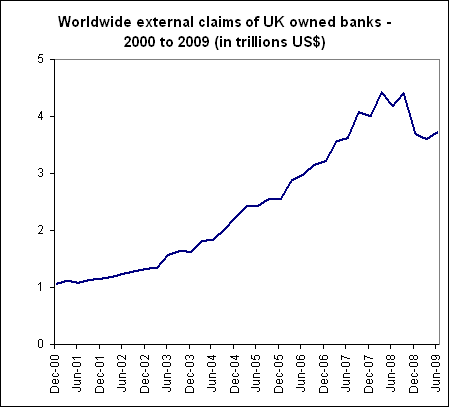

The potentially huge exposure of UK banks in Dubai, depreciating some UK bank share prices again this morning, is a reminder of just how much UK bank lending grew in recent years. The above chart shows the growth in external claims of the UK owned banks around the world over the past decade. The sums lent almost quadrupled to nearly $4 trillion in 8 years. Anyone interested in discovering which bubbles the UK banks (and now taxpayers) have funded can find the data on the Bank of England website – $1.2 trillion in the United States, $125 billion in Spain, $183 billion in Ireland, $50 billion to the UAE/Dubai. Bank profits soared, and the “New North Sea Oil” of booming bonus pools was taxed to fund ever growing government spending.

As the above chart shows, RBS managed the quite exceptional feat of quadrupling in size in just 3 years, almost surpassing HSBC as the world’s largest bank with nearly £2.5 trillion of global lending. With over £53 billion of taxpayers’ money now pumped into RBS, and a further £240 billion of their dodgy loans about to be foisted upon the taxpayer, it doesn’t look like they made a great job of finding sound borrowers during this frenzy. It is likely that a fair amount of this lending was linked to investment banking deals: the dash for upfront fees, creating bigger bonuses and tax payments, may have led to less than prudent lending standards being observed. For as long as the bank leverage funded Gordon Brown’s spending addiction, questioning risk does not seem to have been at the forefront of the government’s mind.

The taxpayer is now on the hook for a lot more than the near £100 billion that’s been pumped directly into RBS, Northern Rock, Bradford and Bingley et al. Going off the above chart from the Bank of England’s latest inflation report, UK banks have been given the right to issue tens of billions of pounds of debt around the world with a UK taxpayer guarantee. As Iceland has discovered to its cost, when a bank endangers depositors in several jurisdictions, EU law apportions sole liability to the taxpayers of the country in which that bank is domiciled.

The quite unprecedented array of subsidies: cheap central bank funding, debt guarantees, loans, payments, competition removal, and fees given to the banks has helped the banks’ bonus pools recover – proving that the Labour Party has indeed managed to help some people through the recession. While champagne glasses will be raised in some investment banks in recognition of Gordon Brown’s brilliance, taxpayers have reason to feel some trepidation. It is unsurprising that some in the City do not welcome the potential arrival of George Osborne and a Conservative government with the ability to distinguish between a free market and a free ride.

Comments