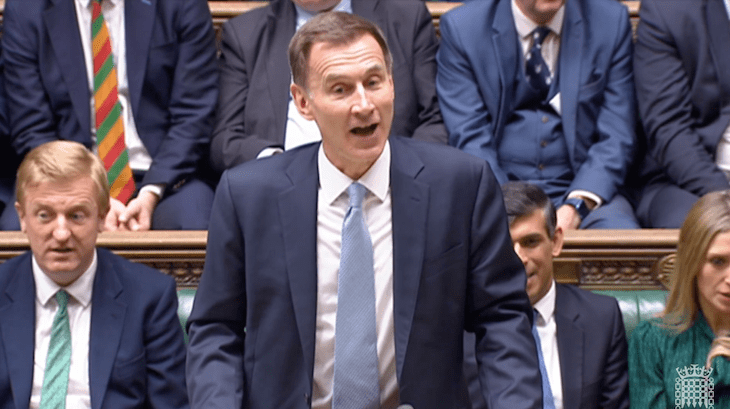

Jeremy Hunt’s Budget was short on surprises. The Chancellor cut National Insurance for workers by another 2p in a bid to address the Tories’ poll slide ahead of the upcoming general election. Hunt also announced a shake-up to child benefit charges, said that ‘non-dom’ tax status would be scrapped and said that alcohol and fuel duty would be frozen. Here are the Budget announcements in full:

- From April, employee National Insurance will be cut by 2p, from 10 per cent to 8 per cent.

- Child benefit will be based on household, rather than individual, earnings from 2026. The high income threshold will be raised from £50,000 to £60,000.

- The ‘non-dom’ tax regime will be abolished, saving £2.7 billion a year for the forecast period.

- The windfall tax on oil and gas companies will be extended until 2029, raising £1.5 billion.

- Alcohol duty will be frozen until February 2025. Tobacco duty will be increased.

- Fuel duty will be frozen for a further 12 months, with the 5p cut maintained.

- Capital gains tax on property sales will be reduced from 28 to 24 per cent.

- The NHS will receive £3.4 billion to update its IT systems, as well as an additional £2.5 billion this year.

Follow all the analysis as it unfolded on our live blog:

Comments