Is inflation really falling? I am understandably taken to task by some CoffeeHousers for claiming that it is. When Brown claimed it was in PMQs yesterday, it was submitted to me as a possible Brownie. But what he says is perfectly true, and it’s worth looking at in more detail – for this not only explains today’s rate cut, but much about the nature of the deep recession we have now entered. It also underlines what I regard as a flaw in business reporting. You can pick up the papers and find the price of shares, bonds, wheat etc. But nowehere can you read forecasts – ie, where the markets think inflation, bank rates, forex etc will be in 6 or 12 months time. If the bank knows more than you, it can sting you for an expensive fixed-rate mortgage. And Brown can claim in PMQs that inflation is falling (as he did yesterday), and then mysteriously be proved right. There is an asymmetry of information: the public are told yesterday’s prices. Those with Bloomberg machines can find out tomorrow’s prices – or, at least, the forecasts. So the big story, the coming drop in inflation, isn’t being told.

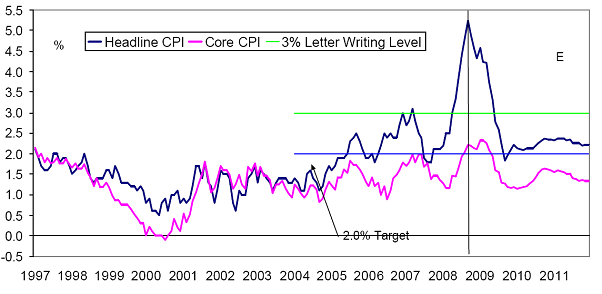

The BoE made its cut today by looking at a variant of the below graph, CitiGroup’s forecasts for UK inflation. These show it has now peaked, and will fall as quickly as it rose. This is not a shot in the dark, but compiled by using all manner of indicators (factor gate prices, etc). Today’s news (30% drop in construction orders, 22% drop in new car registrations, 15% drop so far in Halifax house prices, IMF says UK economy will shrink – yes, shrink – by 1.5% this year) confirms the depth of the recession. Without demand, price inflation will collapse.

You can bet Brown is basing his political strategy on this graph, preparing to boast next summer that he has somehow tamed inflation. He’s itching to use the narrative and got ahead of himself (as he always does) in boasting about it in PMQs yesterday. Of course, if gas prices shoot up 50% this winter and don’t rise next winter it’s still bloody expensive to heat your house. But if next year’s prices are as unaffordable as this year’s, it technically counts as zero inflation. It’s just waiting to be made into a Brownie.

Today’s rate cut, incidentally, is a massive mea culpa from the BoE – as Iain Martin explains over on Three Line Whip. We’re in this mess mainly because they let the tap of cheap debt run for too long.

Comments