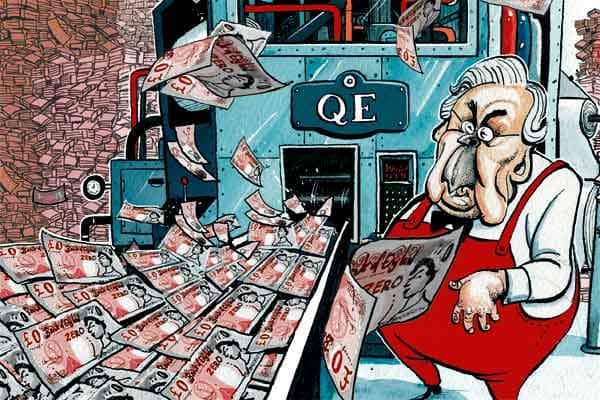

Some £500 billion was printed by the Bank of England during the pandemic – a staggering sum that caused very little public debate. Those sceptical about so-called ‘quantitative easing’ argue that it causes inflation – and with today’s news that inflation rose 9 per cent on the year in April, is anyone linking the two? Step forward Mervyn King, former governor of the Bank of England, who was surprisingly critical when speaking to Andrew Marr on LBC last night.

One of the major problems, Lord King said, was that the Bank went too hard and too fast with its money printing. ‘Governments stepped in and put in a lot of money for furlough schemes or raising unemployment benefits. That was very sensible,’ he said. ‘The problem was that central banks also printed a great deal of money and that wasn’t needed… it put a lot of money into the system.’

Under classical economic theory, when a lot of money is put into the system (as it has been in the UK and in the US with the Federal Reserve printing about $4.8 trillion), inflation follows. So we shouldn’t be surprised to see a graph looking as it does below.

But to what extent has QE contributed to this problem? To what extent is inflation homegrown? At this week’s Treasury Select Committee hearing, the Bank’s Governor Andrew Bailey was desperate to suggest 80 per cent of the inflationary pressures were due to factors completely out of the UK’s control – especially Russia’s war in Ukraine. But Lord King dismissed this as ‘debatable figure’ and pointed instead to the decisions made by central bankers: ‘central banks around the world have made serious mistakes in not acting much sooner,’ he said, ‘including ours.’

Not only is Lord King’s intervention one of the first high-profile admissions in Britain that quantitative easing may have contributed significantly to the inflation spiral we’re seeing now – it’s also coming from an unlikely source. He has been a defender of QE in the past, ushering it in during his time in the Bank of England to manage the financial crisis.

But King has been wary for some time of central bankers using QE as a ‘universal remedy’ for economic problems, including the extent to which it’s been used during the pandemic. The Bank printed more money in the first year of the pandemic than it did in all the years between the crash in 2020, increasing the money supply by £360 billion to support the government’s pandemic efforts.

King’s criticisms are particularly important, as he is able to weigh in on monetary policy while politicians generally choose not to. The Bank’s independence has not just come to mean a detachment of monetary policy from the Treasury; it has been stretched to put politicians under strict instructions not to comment on any of the Bank’s decision-making. But this set-up is put under serious strain when not only are prices spiralling, but the Bank’s governor, Andrew Bailey, is claiming he is ‘helpless’ under the circumstances.

Over in the United States, Joe Biden’s trillion-dollar stimulus packages and the Federal Reserve’s huge money printing schemes have been targeted as contributing heavily to the inflation woes being experienced throughout the country now. But so far in Britain, the emphasis continues to be put on international factors – supply chain issues, the energy crisis – and not on the decisions made by domestic actors at the height of the Covid crisis. It’s refreshing to hear someone like King point out the ‘serious mistakes’ made by the Bank, even if the criticisms are coming too little too late.

Comments