Today’s shocking inflation figures have sparked a fascinating debate. I laid

out my take earlier, and I thought CoffeeHousers may appreciate a different

perspective. Matthew Hancock MP is a member of the Public Accounts Committee, former economist at the Bank of England and former chief of staff to George Osborne. Fraser Nelson.

Today’s shocking inflation figures have sparked a fascinating debate. I laid

out my take earlier, and I thought CoffeeHousers may appreciate a different

perspective. Matthew Hancock MP is a member of the Public Accounts Committee, former economist at the Bank of England and former chief of staff to George Osborne. Fraser Nelson.

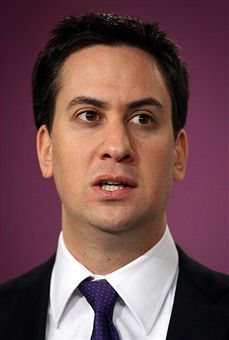

Last week, growth. This week, inflation. Ed Miliband is complaining about both. But the trouble is: the two can’t be taken in isolation. For the main weapon against inflation is for the Bank

of England to raise interest rates. Yet the main weapon to support growth is for the Bank of England to keep interest rates lower for longer. You can’t credibly complain about both.

What the Government can do is ensure there’s no market panic, and keep interest rates lower than they would otherwise be, by getting the nation’s finances in order. And it can promote

long term growth by making Britain competitive again: by reducing burdens on business, improving skills and education, helping businesses start, and attracting global business for example by

reducing corporation tax rates. But all of this takes time.

As for the Bank, they are clear that they look not only at what inflation is today, but also what we know will happen to inflation in the future. The current inflation rate includes the effect of

Alistair Darling’s VAT rise last year. Next month that will drop out of the measure, and the effect of this year’s VAT rise will drop out at the end of this year as we know it

won’t be repeated. The rate of inflation excluding the effects of tax has been below the MPC’s target throughout the past year, as this graph shows:

Since interest rates take up to two years to impact on inflation, changing interest rates now cannot affect that inflation. What matters is not changes to the price level like these, but how much the rise in inflation persists and feeds into other prices and wages. But wage growth is historically low, not least thanks to the public sector pay freeze.

Rising prices are a concern for everyone on a tight budget. In the short term, tackling rising prices is intimately tied to the policy of getting growth going. Balancing the two is crucial. Complaining about both is fruitless.

Comments