Today’s Andy Davey cartoon in The Sun (click at the bottom of this link to see it) deserves to go on Darling’s fridge. Because two more pieces of data have just come out which can be confused for good news. One is that personal insolvencies are at a lower level than 2006 and, next, that manufacturing prices rose 1.5% in January. Both are freakish mirages, in the desert of Darling’s misery.

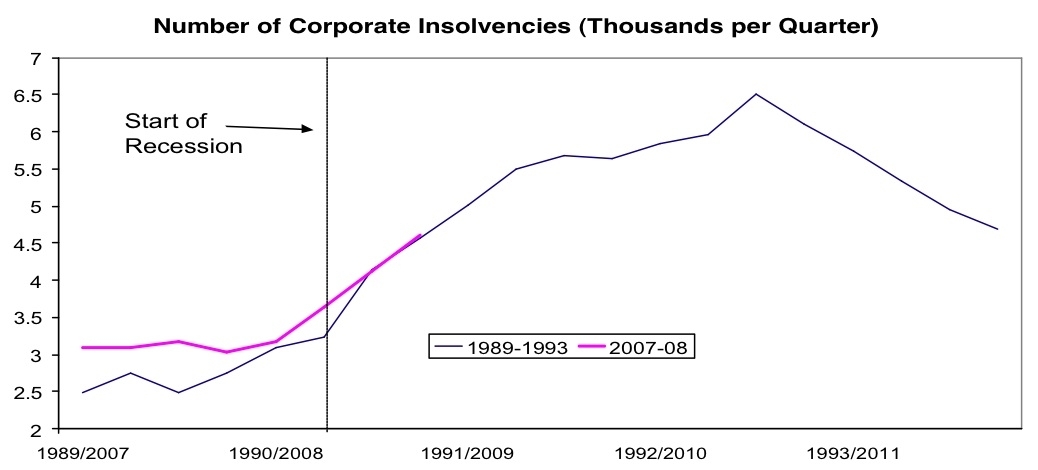

The personal insolvencies in 2006 were pumped up artificially when new laws made it easier to declare yourself bust. The far more important indicator is company insolvencies, and they are especially worrying. They’re up 55% to the highest level since 1994 – but, crucially, this is just the beginning. The below graph, courtesy of Citi, shows the trajectory of companies going under in the last recession versus this one. We’re just beginning what will be a very painful process of companies going pop. And when they do, jobs are lost. As for those manufuactuturing prices – as the bottom graph shows, it seems that for all the weakness in the pound, we are following the trajectory of a deep and long fall-off in manufacturing. It has just begun a long and lonely path of misery.

Comments