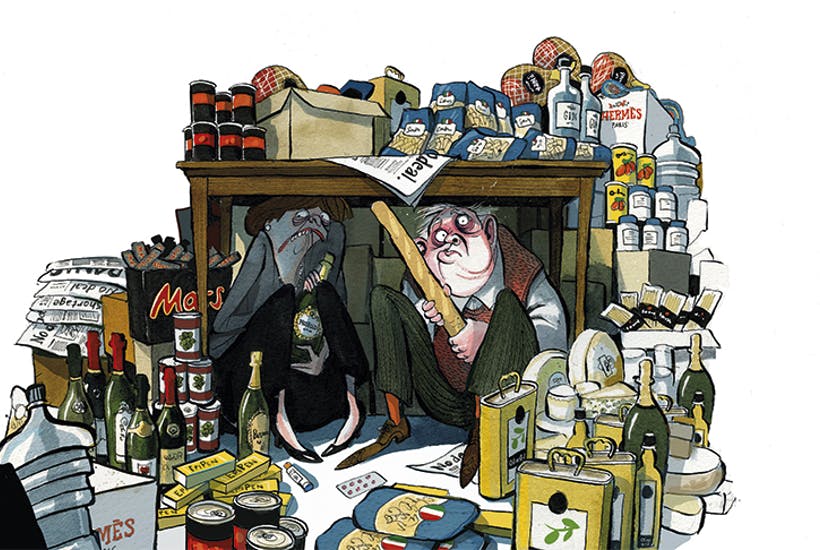

Currency speculators at some of the hedge funds in Mayfair may be feeling quietly pleased. Trade experts will be relieved that their lucrative consultancy gigs will keep on coming. Heck, even financial columnists can safely pontificate about the possible outcome for a while yet, while the FBPE mob on Twitter can carry on predicting the apocalypse every time Nissan adjusts its production schedules. There are a few people for whom today’s agreement between Boris Johnson and European Commission President Ursula von der Leyen to carry on discussing a trade deal will come as a relief. For the wider economy, however, it is little short of a disaster.

It is hard to know exactly what there is still to discuss between Britain and the EU. Four years after the referendum, and heading towards its fifth anniversary, there can hardly be a wrinkle on level-playing fields, a species of fish, or a sub-clause on regulatory alignment, dynamic or otherwise, that hasn’t been discussed in exhaustive detail. Even so, the two sides have agreed to carry on talking. And at this rate, maybe they will carry on through January and February as well.

Sure, most businesses would prefer a deal with the EU. Tariffs and quotas don’t help anyone, and neither do queues of lorries at Calais and Dover. If we can get a free trade agreement with the rest of the continent, then so much the better. Even so, that doesn’t mean that it is worth discussing it forever and forever. Here’s why.

First, it simply prolongs the uncertainty. That is fine for the hedge funds who can bet on the outcome one way or another (although it is worth noting the currency markets are so bored by the whole thing they hardly move anymore). That simply makes it more difficult for any company to plan ahead. Whether there is a deal or not, adjustments need to be made to stocks and supply lines. At a certain point, it is better just to know what needs to be done and get on with it. Next, and more seriously, companies also have to plan for two outcomes, deal or no deal. You don’t need to be a genius at maths to work out that doubles the cost. Finally, with no deal already priced into sterling, and with most companies having already been forced to make preparations, there is vanishingly little upside left to a free trade agreement anyway. Our negotiators are discussing margins within margins. As the months go by, less and less is a stake.

In truth, there is a hit to the UK economy from not reaching a deal with the EU. But at this stage it is relatively minor. The costs have already been absorbed. There may be some political benefits to continuing the talks, but the economic advantages have already evaporated. It would be better to move on with building a post-EU economy rather than dragging on the discussions indefinitely.

Comments