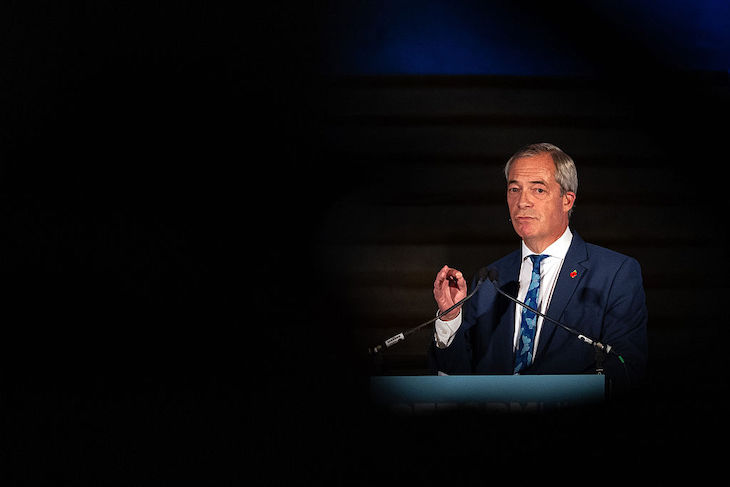

Nigel Farage has shelved massive tax cuts in favour of slashing public spending in a bid to balance the books. The Reform leader said in a speech this morning that ‘substantial tax cuts given the dire state of debt and our finances are not realistic at this current moment’.

The ‘back-of-a-fag packet’ economics that characterised Reform’s election manifesto last year have been disposed of

No doubt a fair few Reform supporters will be disappointed: it means that, if Farage wins power at the next election, the tax burden will remain at a post-war high for at least a couple of years. We won’t be hearing very much about the Laffer Curve during the election campaign. But make no mistake: Farage is right. Bold tax cutting would have turned a Reform administration into Liz Truss 2.0, and the bond markets would have quickly consigned it to history before it had a chance to enact the change Britain badly needs.

If it wasn’t clear before, it shows that the ‘back-of-a-fag packet’ economics that characterised Reform’s election manifesto last year have been disposed of. Instead, Farage’s major speech in the City of London today was a far more sober offering. He is clearly positioning himself as a potential prime minister, and not just the leader of a protest movement.

By far the biggest shift is the abandonment of huge upfront tax cuts designed to stimulate growth, with the argument that they will pay for themselves by generating more revenue. Instead, a Reform government will start the hard work of steadily cutting spending, and boosting growth, using the proceeds of that to gradually reduce the tax burden.

Sure, this latest announcement risks turning a Reform government into a revamped Conservative party, offering little more than continuation of the stale economic consensus of the last thirty years. It even offers up the possibility of Reform being outflanked on the libertarian right by Kemi Badendoch’s Tories. And yet with the party holding onto a commanding lead in the polls, it needs to focus both on winning the election, and surviving its first year in office.

Intellectually it may well be perfectly correct that the UK is now so over-taxed that tax cuts, especially of the top rate, and on entrepreneurs, will more than pay for themselves. The catch is that almost no one believes it, and it is hard to see the policy surviving a brutal general election campaign. More seriously, it will trigger a bond market melt down as soon as prime minister Farage takes office. Bond investors, contrary to popular belief, don’t care very much about growth, and they certainly don’t care about the tax burden. Most of them are based somewhere else and don’t pay British taxes. Perfectly reasonably they care about the interest bills being paid on time, and ‘self-financing tax cuts’ raise questions about that.

In reality, Farage has learned the lesson of the Truss debacle. A Reform government could easily be destroyed by the financial markets within its first few weeks of taking power. Instead, Farage has seen that it is better to bet on growth, especially from scaling back Net Zero, and potentially opening up the UK’s plentiful reserves of shale oil and gas, and then use the revenues from that to steadily lower the tax burden. It is dull, and doesn’t promise many fireworks. But it is also a lot more likely to actually work.

Farage’s latest speech is hardly tantalisingly, but it makes one thing plain to see: this is a man, and a party, that is serious about winning power.

Comments