The ONS has today revised upwards its growth for most of 2013, to show a recovery far stronger than it admitted at the time. This fits a trend: in economics, good luck tends to come in waves. And the tools economists have to work out what’s happening are so crude (and often useless) that it takes years to work out what really happened. Only in 2011, for example, was it clear that Gordon Brown had incubated the worst economic overheating since the war – hence the crash. But by the time this was clear, everyone blamed bankers for the crash – when, in fact, it was just reckless economic management. Which all the economists, with their ‘output gap’ spreadsheets, missed.

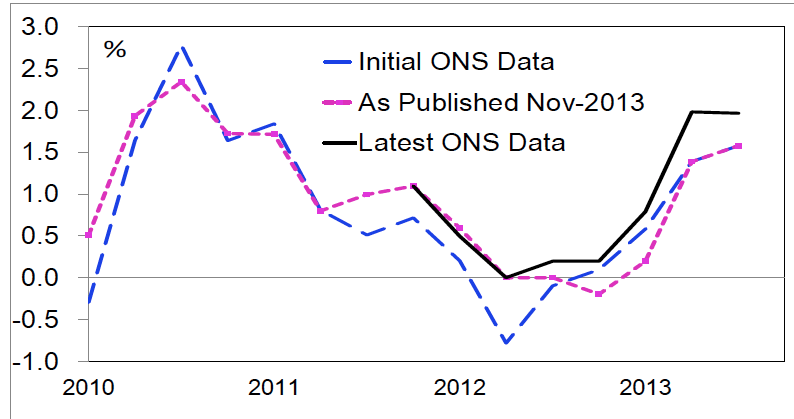

Remember the triple dip? The above graph, from Citi (pdf), shows what nonsense that turned out to be. And how much better things look now (in black).

This has implications for George Osborne in 2014. The Treasury’s forecasts, now outsourced to the quasi-autonomous Office for Budget Responsibility, are more in line with the consensus rather than the optimistic outlook of the Bank of England (its comparison below). This suits Osborne politically: far better to stand up with better news than worse news. But each month, the BoE forecasts look that much more likely. This suggests that, when the Chancellor delivers his 2014 Budget, he’ll have more cash to play with.

Comments