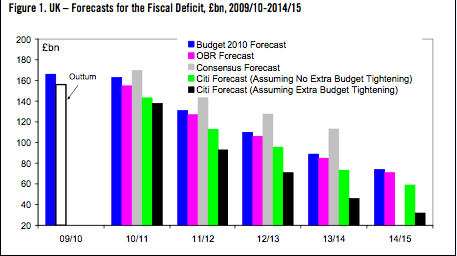

The below chart sums up the extraordinary announcement from the Office for Budget Responsibility. George Osborne did his best to maintain the “things are worse than we thought” line but the reverse is true. Unemployment, inflation, the deficit – everything is better than not only the Treasury forecast but better than the market had been preparing for. (And Citibank, which compiled the graph, thinks things will get better still – because the economy will keep surprising in the upside).

I have a piece in the Daily Telegraph saying that this will be deeply irritating for Osborne. His plan was conceptually fine: that he’d create an external agency, which would demolish Brown’s Potemkin Village and show the full unvarnished truth. But the OBR has made its first announcement just as the economy is on the turn. Manufacturing, house prices, gilt yields – on almost every metric you can think of, things are not as bad as had been feared. What jumped out at me was that the OBR says that on current government policy (ie, without Osborne’s recent £5.7bn of cuts, on the Darling trajectory) the structural deficit would be reduced from 8% now to 2.8% in 2014-15. That is to say, Osborne’s manifesto pledge – to eliminate “the bulk” of the structural deficit – would have happened under Darling. So no extra cut, or tax hike, is needed to meet this pledge.

Osborne has plenty other reasons to cut, though. Now, I suspect CoffeeHousers will be thinking “didn’t Budd radically downgrade the growth forecasts? Doesn’t that make it worse than we thought”? Yes – but the only point about GDP growth is that it is supposed to be a proxy for tax revenue. GDP is revised down, but the tax haul is revised up. These two apparent irreconcilables can be explained, I am told, because HM Treasury quietly decoupled GDP growth from tax revenue without telling Brown. So when he encouraged the Treasury to forecast what Cameron rightly ridiculed as a “trampoline recovery” the public finance projections did not get the tax revenue follow-through that you MIGHT expect. I’ve only heard this from one source, but hope it’s true. In the Mid 70s, advisors in HM Treasury gave exaggerated spending figures to Denis Healey, who then had to call in the IMF. (When he found out the real figures, he mused that he didn’t need the emergency loan). Perhaps the Treasury did operate – I suspect with Darling’s connivance – a policy of keeping the truth from Brown and Balls. This may sound far-fetched, but it’s the only explanation that fits with this strange ‘GDP down, revenues up’ narrative which Budd came out with today.

Osborne is about to embark on a crucial, historic and critical mission to reduce the deficit. Above all, he needs to be seen to be straight with voters – which is why he should drop the “oooh, this is worse than we thought” device. Yes, growth is downgraded and the structural deficit is seen to be (slightly) higher than previously. But on the metrics that matter – the overall deficit, dole, tax, manufacturing, house prices, money supply, gilt yields – things are better than they looked two months ago.

Comments