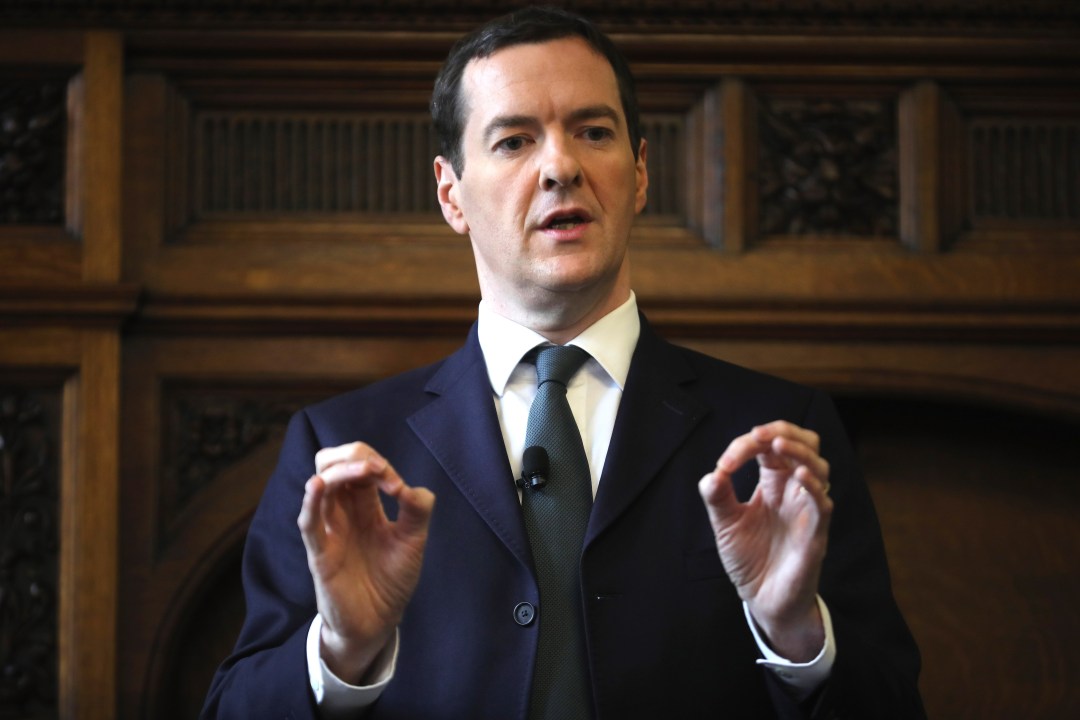

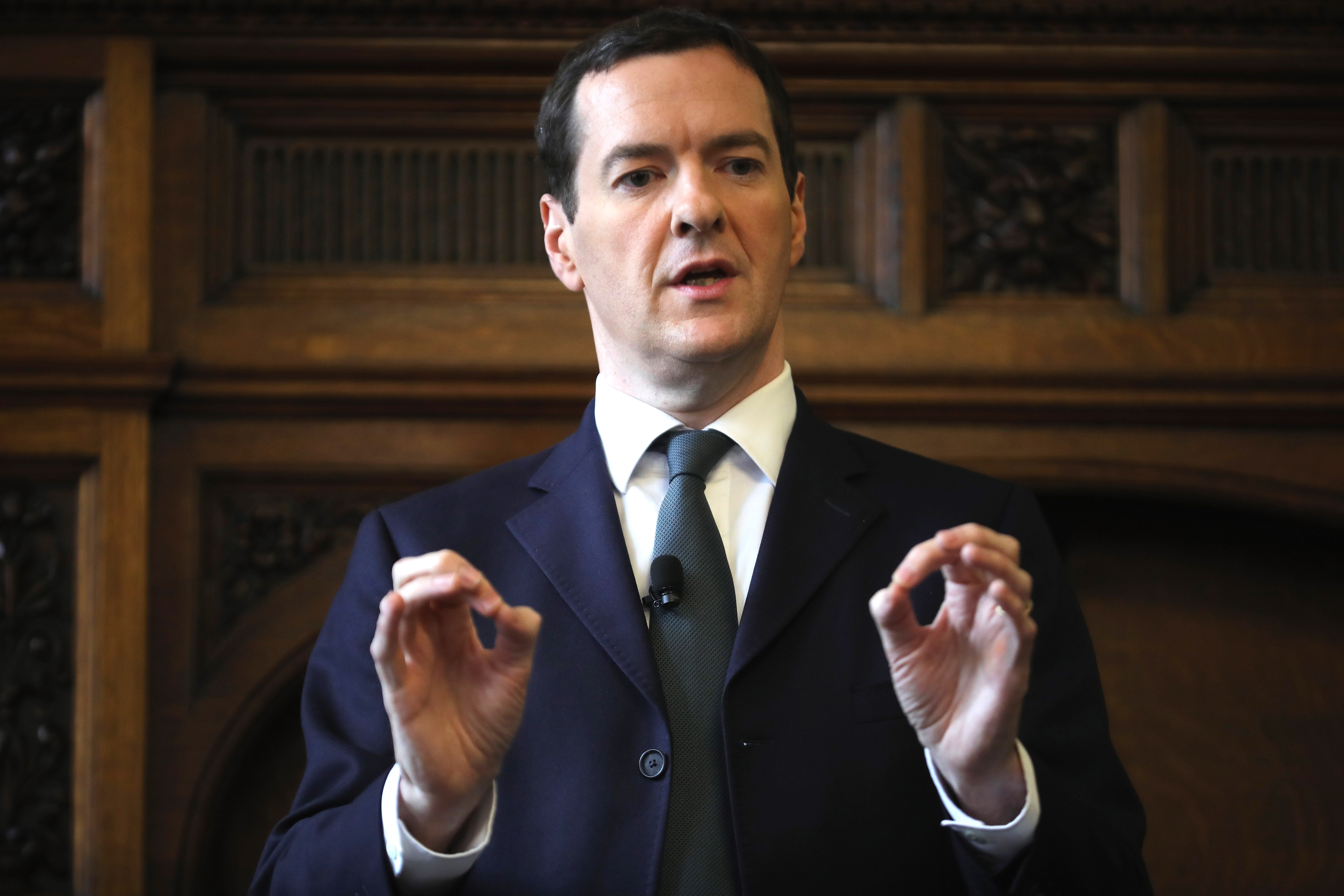

George Osborne hasn’t been shy to take the occasional pop at Boris Johnson’s government and now the reason why seems clear. His family firm Osborne & Little’s annual accounts up until 31 March have just been published and they don’t make for entirely happy reading. The leading wallpaper manufacturer has been forced to report a pre-tax loss of £106,000, down from last year’s profit of £1.4 million, with Brexit cited as having an ‘immediate adverse effect on profits.’

Boris Johnson’s successful efforts to take the UK out of the EU on 1 January 2021 caused the company ‘unforeseen costs’ amounting to an extra £400,000, thanks in part to increased shipping charges and higher duties on goods. Fortunately for the furnishings firm, a new distributor in Germany was set up March, enabling their goods to flow ‘more easily’ ensuring ‘significant cost savings.’

And Brexit isn’t the only Tory policy resented by the beancounters at Osborne & Little. Rishi Sunak’s March Budget 2021 – which Osborne himself slammed at the time for suggesting the UK was not ‘pro-business’ – comes in for some implied criticism in the notes to the financial statements. Sunak’s Budget, it sniffs, ‘announced an increase to the main rate of corporation tax to 25 per cent from April 2023.’ The hike is thus set to whack up their closing deferred tax position by an extra £29,000.

Covid is also cited as having ‘severely’ impacted the firm’s finances, with Osborne & Little receiving £510,000 of job retention scheme support from the UK government. A total of £3.6 million has been taken from the Covid loan scheme over a five year period – no wonder Osborne called for the Treasury to write off billions of such small company loans – but an impressive £1.85 million has been returned early. Still, a shame that Carrie couldn’t help too by asking them to do up No. 10.

Fortunately though it’s not curtains for the wallpaper firm just yet. The wider Osborne & Little Group – which controls the aforementioned wallpaper firm as a wholly-owned subsidiary – managed a pre-tax profit of £558,000, up from this time last year when it recorded a loss of more than half a million. They were helped too by a handy £615,000 Paycheck loan from the US government which was written off at the year end – a special relationship indeed.

And with Osborne’s son’s own events company, Constitution Limited, going from strength to strength with packed out club nights in Bristol, it looks as though Osborne & Little’s leadership will be secure for the next generation too.

Comments