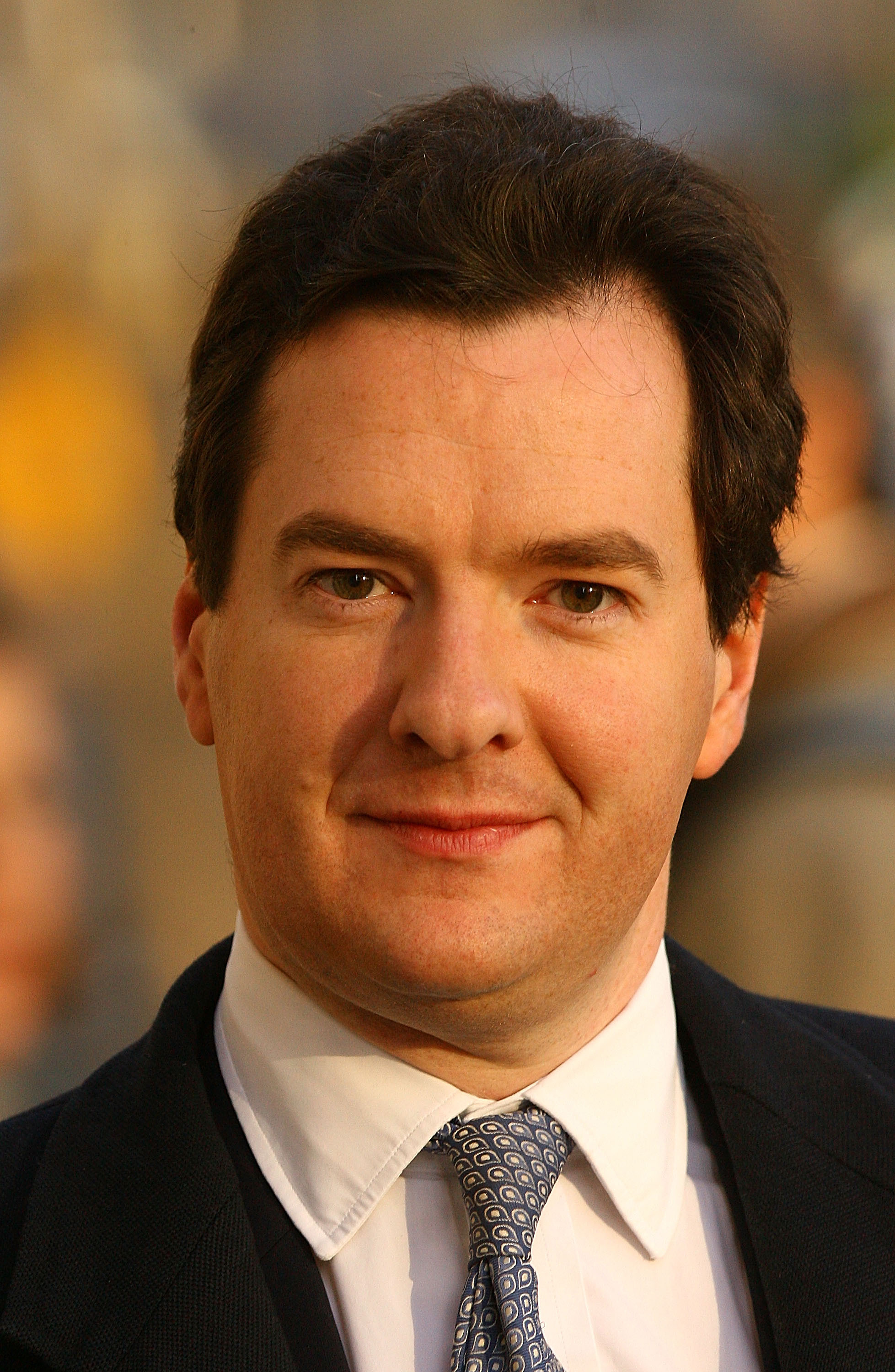

So, whither Tory economic policy? It was George Osborne’s turn to discuss it today, and, overall, it’s very good news. The shadow chancellor’s speech appears to be a rejection of Brownite rules-based economics. Inflation targeting was not enough to prevent the crash, and Osborne appears to say he’d empower the Bank of England governor to take a free view to regulating the City. But, as with a lot of Tory speeches at the moment, the desire to devolve power clashes with the desire to tinker. So Osborne proposes greater freedom of regulatory powers, but he’d like the banks to be smaller. Anyway, his full speech is here. My ten-point take below:

So, whither Tory economic policy? It was George Osborne’s turn to discuss it today, and, overall, it’s very good news. The shadow chancellor’s speech appears to be a rejection of Brownite rules-based economics. Inflation targeting was not enough to prevent the crash, and Osborne appears to say he’d empower the Bank of England governor to take a free view to regulating the City. But, as with a lot of Tory speeches at the moment, the desire to devolve power clashes with the desire to tinker. So Osborne proposes greater freedom of regulatory powers, but he’d like the banks to be smaller. Anyway, his full speech is here. My ten-point take below:

1) SMALL BANKS The headline proposal is Osborne saying he wants small banks. I’m sceptical: Canada had large banks. They worked very well because they were properly regulated. Size doesn’t matter, it’s what you do with them that counts. But I think we can safely disregard this: would Osborne impose a maximum balance sheet? Maximum market share? I suspect this is little more than a formula for disposing of the nationalised banks in a normal pre-amalgamation way. And lets not forget EU regulation will enforce this anyway.

2) OSBORNE DEFENDING CAPITALISM

a. “China’s market reforms that began in the early 1980s and India’s opening to trade at the beginning of the 1990s have done more to raise the living standards of more people than any other government policy in the history of the world. Abandoning that progress or turning our backs on open markets would be a tragedy.”

b. “Markets can behave irrationally. The people who make up markets can behave irrationally. This isn’t a failure of capitalism, it is a feature of capitalism.”

This might sound tautological to CoffeeHousers, but it is genuinely bold of Obsorne to be defending the free market in the current climate. He is resisting the desire to pander to the anti-capitalist instinct out there. Bravo.

3) BEEFED UP BANK OF ENGLAND “We propose giving the Bank of England a new responsibility to supervise the overall level of debt and credit growth in the economy as a whole.” Great, but how? The way one controls credit is by fixing its price, and that is done via interest rates. Osborne is resistant to this conclusion – he thinks you can’t use one instrument (interest rates) to target both consumer prices and asset prices. So if a Tory government is worried about house prices (unlikely, as house prices makes the electorate feel richer and more likely to vote for the government) it would try to make mortgage lending more difficult for banks. Sounds rather fiddly to me.

4) CHANGE THE INFLATION TARGET “A change of government would provide a sensible opportunity to review, with the Governor of the Bank of England, what changes would be appropriate so that housing costs are properly reflected.” This means a return to RPIX inflation targeting, away from CPI. A wise move, but the bigger concern is that the MPC’s remit is expanded to take account of asset prices as well as the ECB does (to an extent). I’m not sure why Osborne doesn’t address this: after what he says about asset prices and M4, it seems the logical next step. Nonetheless, a serious change from the status quo.

5) LIMITATION OF RULES “Of course new rules – especially on capital and liquidity – will play an important part, but experience teaches us that no rule is flexible enough to deal with every situation.” The credit bubble is partly due to the fact that central bankers fell in love with their metrics. They thought inflation targeting was all, and didn’t notice the imbalances – or argued that they were irrelevant. And as Osborne says, a new set of rules may lead to exactly the same trap.

6) IMPORTANCE OF IMBALANCES “Gordon Brown claims that our economy was fundamentally sound when it was hit by a banking crisis that came out of the blue from America. What went wrong in our banks was a reflection of fundamental imbalances that were allowed to build up throughout our economy over a decade.” Osborne is precisely right here: it’s a new way of seeing macroeconomics. It chimes very well with what William White, ex-BIS chief economist, told the Spectator’s inquiry into the recession (see his evidence here). The big question is: what would Osborne do about it? It implies a new macroeconomic framework, fundamentally different to the inflation targeting fundamentalism of most developed economies (to a greater or lesser extent). Osborne is talking about fine tuning incentives for saving – thinking this will combat the currenyt account deficit. Again, I see it as a matter of base interest rates. If they are low, people wont save. If they are high, they will.

7) GLASS STEAGALL “Whether any form of separation between retail and investment banking, even within the same financial group, is feasible or desirable…” He didnt say much about this, but my understanding is that Osborne is attracted to a proposed separation between investment and commercial banking. This is the best solution. It means that investment banks can stand as a domino far away from the rest of the economy – if it collapses, no one else will be hit.

8) CALIFORNIA DREAMING “We know from California that when people are given this information, and find out that they’re using more electricity than their neighbours, they quickly take action to become more energy efficient.” He’s talking about ‘nudge’ and choice framing (or ‘libertarian paternalism’ to give the doctrine its proper name) We recently ran a spread on the Californian influence on Osborne’s thinking – the ‘nudge’ stuff is another example of it.

9) A LITTLE TOO MUCH AMERICA “Our banks borrowed money from China to lend to us, so we could buy the goods the Chinese produced. We could see it in the huge current account deficit that persisted for a decade.” Osborne needs to be careful here. The China argument crops up in a lot of US post-crash books that he’s evidently been reading (he’s even spelling ‘recognizing’ thus). But there isn’t the same read-across with the UK. For a start, the Arab world bought a lot of our debt, and now UK state-owned banks are mysteriously snapping it up.

10) EYEBROWS “It used to be said that one twitch of the Governor’s eyebrows was enough to force unruly bankers into line – well we will give the Governor back his eyebrows in a way that suits modern financial markets.” Hmmm. The Chancellors with the most noteable eyebrows were Healey, Lamont and Darling. Big eyebrows is not always a good omen for macroeconomic stability.

Comments