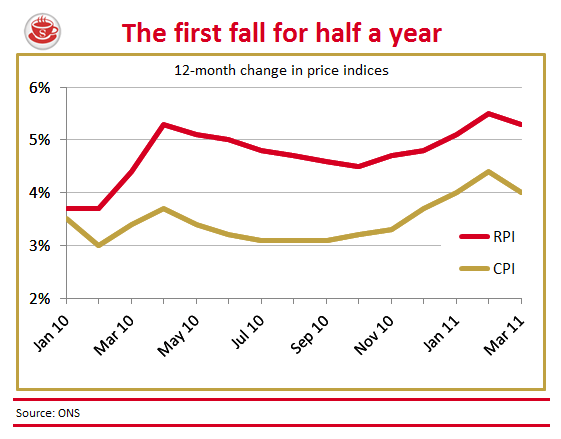

Is the inflation panic over? After rising for five consecutive months, CPI inflation went down by a 0.4 percentage points in March, to 4.0 per cent, taking the City by surprise. RPI inflation also went down, by 0.2 percentage points. The numbercrunchers at the Office for National Statistics put it down, largely, to a fall in food and drink prices. The cost of fruit is 2.7 per cent down on last March. The cost of bread and cereals, 2.6 per cent.

Yet we shouldn’t get ahead of ourselves. While this will certainly reduce the short-term pressure on the Bank to increase rates — as well as on the nation’s pocketbooks — one month does not maketh a trend. The inflation debate in Britain is always carried out in the absence of a key metric: inflation forecasts. And those forecasts suggest that CPI inflation is zig-zagging its way towards a peak of over 5 per cent this year. If might well be that everyone is wrong, and our that Mervyn King has indeed slain the dragon of inflation. But it’s more likely that this is a blip, in a pretty horrible trend.

The below graph shows inflation forecasts from Citi and the Office for Budget Responsibility. On Citi’s estimates, it will then remain above the 2 per cent target for as long as they can foresee. On the OBR’s, it will take until June 2013:

Crucially, the OBR also has inflation outstripping wage growth until at least the end of 2012. The cost of living has not stopped being live political issue because of today’s figures, far from it.

And interest rates? The below graph shows Citi forecasting a march back to 5 per cent starting this autumn. Today’s inflation data may, at most, have delayed this process — but that process is still expected to kick in shortly:

Comments