The permatanned television ‘entertainer’ Dale Winton is hosting an unintentionally hilarious series of commercials on daytime television these days. Using the same format as The Antiques Roadshow, the ads for something called CashMyGold show members of the public sitting round a table with Winton and an ‘expert’ who values their gold trinkets. They beam in delight when the jeweller informs them what he thinks the bling is worth. One of them even says: ‘That’s a lot more than I thought.’

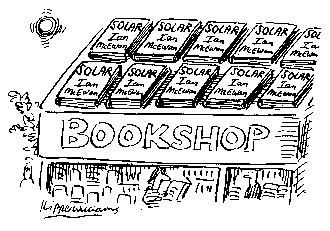

On the face of it, these ads are very convincing. After all, the gold price at the moment is indeed higher than it has been for years. At the beginning of this month, gold reached new record highs of more than £750 an ounce. But the reason that investors in CashMyGold or any of the other companies bombarding couch potatoes with their messages are doing so well is not only because bullion is trading at record levels, but because it would be hard to find a more gullible breed of consumer than the credit-crunched, daytime-television-watching jewellery owner.

According to a recent survey by the consumer rights champion Which?, ‘Cash-for-gold buyers are paying shockingly low rates for jewellery and offering customers a poor service’. Which? sent an identical set of three items of 9-carat gold jewellery — costing £115, £215 and £399 — to four gold buyers that advertise heavily on television. In addition to CashMyGold, they went to Cash4Gold, Money4Gold and Postal Gold.

As it turned out, the company promoted by Winton turned out to be the lowest bidder. CashMyGold gave quotes of £6.43 for the £115 gold bracelet, £9.64 for the £215 gold bangle and £22.50 for the £399 gold necklace. But the truth is that all four were guilty of what looks like a shameless exploitation of the general public’s ignorance of their baubles’ value.

The gold buyers’ defence is that their only interest in the jewellery they are buying is its gold content. No amount of finely wrought metalwork on a necklace will attract a higher price when it is destined to be thrown into a smelter with the meanest bracelet.

Cash4Gold, which came up with the highest prices, offered just £10.31, £14.57 and £31.48 respectively. The company attributes its status as the best payer to the fact that it began life as a refiner, Albar Precious Metal Refining of Pompano Beach, Florida. Chief executive Jeff Aronson launched his consumer subsidiary in early 2007 and it now claims to have completed 900,000 transactions worldwide. Cash4Gold employs 300 people and receives more than 1,700 ounces of gold per day, with 94 per cent of respondents accepting its cash offers. It launched in Britain in July last year and plans to continue its international expansion into six more countries during 2010.

On its website, Cash4Gold is quite open about the fact that it may not always offer the best solution for sellers. ‘The company has always been up front with its customers, pointing out that it may not always be the best option for every gold seller,’ it says. ‘Cash4Gold values items based on their precious metals content, or “melt value”. Because the retail price of a piece of jewellery may be marked up anywhere from three to more than 20 times the actual melt value, other buyers, including local jewellers or pawn shops, might pay more for a particular piece of jewellery.’

But this is not something it stresses in its commercials — and marketing is at the core of its success. Last year it took the unprecedented step, at an estimated cost of $2.5 million, of advertising in a break during the Super Bowl, the championship football game that is America’s most-watched annual television event. It was the first direct-response advertiser ever to aim so high: the 30- second spot starred hip-hop star MC Hammer and entertainment legend Ed McMahon, both of whom have had financial troubles at some point in their lives, trying to outdo each other in sending off increasingly kitsch gold items to raise cash.

Hammer went on to become an investor in the company and when the time came to recruit a spokesman for the brand in the UK there was a natural candidate in the form of his fellow musician, Goldie. Before he made his name on the music circuit, the aptly dubbed Goldie sold ‘grills’ — gold teeth — in New York and Miami; he sports an ostentatious set of them himself.

All the companies in this field operate very similar business models. The customer is first exhorted to call a ‘freefone’ number to request a secure package. They then collect up their unwanted gold jewellery and send it off. After putting the contents through its valuation process, the gold buyer will then send back a quote, and unless the seller declines the offer within a set period, often just seven to twelve days, their trinkets will be melted down and a cheque put in the post. This system of assumed acceptance and the relatively brief period of time the sender has to reject the buyer’s valuation has attracted the attention of the Trading Standards Institute. Indeed, following a series of complaints from disgruntled consumers, the Institute has launched an inquiry, which is ongoing.

The signs are, however, that the relentless onslaught of advertising is winning the media battle. Last year, an estimated 35 tonnes of bullion was produced from scrap gold. How much of it is the product of theft or burglary is another issue that worries critics of the gold buyers. Provenance could potentially be a big problem for companies which, however grasping they may be, do not want to be branded handlers of stolen goods.

Cash4Gold has been particularly pro-active in this area: ‘The company has instituted a full range of security measures to ensure that goods sent in are owned by the sender, including verifying contact information of customers, training staff to identify suspect merchandise and making available digital photos of goods to law enforcement. Cash4Gold is proud to work in close partnership with law enforcement agencies, and the company regularly receives commendations from police forces. In June 2009, with the strong support of Cash4Gold, the Florida state legislature passed America’s first legislation enhancing the regulation of the mail-in gold-buying industry that Cash4Gold pioneered.’

The truth is, though, that perhaps the best deterrent to a burglar with a bag full of gold swag from using this particular sales channel is that the television gold buyers would be the most tight-fisted fences in the business.

Comments