Home

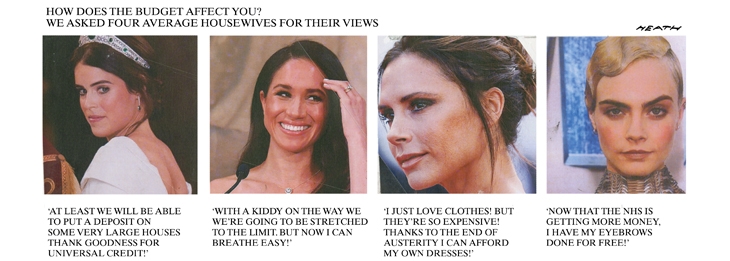

Austerity was ‘finally coming to an end’, Philip Hammond, the Chancellor of the Exchequer, said in the Budget. He was helped by what he did not call a magic money sapling, in the form of revised estimates of public borrowing in 2018, £11.6 billion lower than forecast. Debt as a share of GDP, from a peak of 85.2 per cent in 2016-17, would still be 74.1 per cent by 2024. Mr Hammond repeated a pledge of an extra £20.5 billion for the NHS over the next five years, with an extra £2 billion a year for mental health services. Councils would get £700 million more for care. The personal tax allowance would rise from £11,850 to £12,500, a year earlier than announced, benefiting 31 million employed people by at least £130 a year. Higher rates would start at £50,000 instead of £46,350. Allowances would in future rise by the rate of inflation. The National Living Wage would rise from £7.83 to £8.21 an hour.

Alcohol duties were frozen, except for wine, up by 7p a bottle, which a trade spokesman curiously described as a ‘hammer blow’. Cigarettes went up by 33p, and would rise in future by inflation plus 2 per cent a year. The Housing Infrastructure Fund would get £500 million, towards the building of 650,000 houses, it was said. Universal Credit was ‘here to stay’, Mr Hammond declared, allocating £1.7 billion to in-work benefits and a billion to tide over new recipients. A tax on UK revenues of technology companies with more than £500 million global revenues would be imposed from 2020. Money was earmarked for potholes and for planting trees. Belfast would get a spare £2 million to help it recover from a fire at Primark. Japanese people would be able to use e-passport gates at airports. Relief on business rates would apply to lavatories available for public use. Budget documents confirmed that a 50p coin would mark Brexit next spring, though the Chancellor did not care to mention it in his speech.

Seven men of British Pakistani background were convicted of sexual crimes in Rotherham between 1998 and 2005 against girls, including one who gave evidence of being sexually abused by ‘at least 100 Asian men’ before the age of 16. A helicopter crashed on taking off from Leicester City Football Club, killing five, including the club’s owner, Vichai Srivaddhanaprabha. Evans Cycles, sold to Sports Direct International after being put into administration, will see half its 62 shops closed. Nine refurbished high-speed trains coming into service for ScotRail were found to dump human excrement onto the track.

Abroad

After 11 worshippers were shot dead at the Tree of Life Synagogue in Pittsburgh, police shot and wounded Robert Bowers, 46, who was charged with murder. After 14 mail bombs were posted to Democrats including Hillary Clinton and Barack Obama, and sympathisers such as George Soros, police charged a 56-year-old bodybuilder and disc-jockey, Cesar Sayoc, of Aventura, Florida. The Pentagon sent 5,200 troops to the border with Mexico in Operation Faithful Patriot, as thousands of Central American migrants approached on foot through Mexico in a caravan still 1,000 miles from the United States; ‘Many Gang Members and some very bad people are mixed into the Caravan,’ tweeted President Donald Trump. A judge in Ecuador ruled that requiring Julian Assange to clear up after his cat while he stayed in the embassy in London did not breach his human rights.

Jair Bolsonaro, a 63-year-old retired army officer, was elected President of Brazil. He leads the Social Liberal Party and wants to widen gun ownership to combat crime. The Supreme Court in Pakistan overturned the death sentence on Asia Bibi, a Christian woman convicted of blasphemy, who had been on death row since 2010. In eastern Syria, Islamic State resisted the advance of the US-backed Syrian Democratic Forces, killing 70. China said that rhinoceros horn and tiger parts from captive creatures could be authorised for medical use.

Angela Merkel said she would resign as Chancellor of Germany in 2021 and would not seek re-election next month as leader of the CDU party, which she has headed since 2000. The CDU had lost ground in elections this week in the state of Hesse. Niels Högel, 41, a nurse serving a prison sentence for murdering six people, pleaded guilty to murdering another 100. Economic growth in the eurozone fell to 0.2 per cent in the third quarter of 2018. Venice was badly flooded when acqua alta reached 156cm (61in), the fourth highest level ever recorded. CSH

Comments