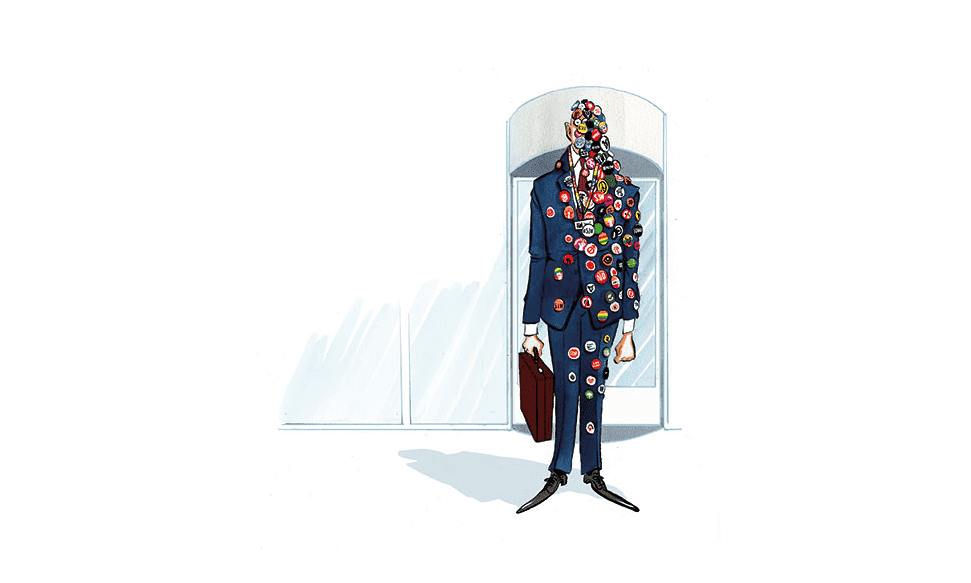

Is this the end of climate activism from pension providers and other institutional investors? BlackRock, which manages $10 trillion in assets, has toned down its enthusiasm for blocking company boards that are not sufficiently committed to a carbon-free future.

In January 2020, BlackRock’s CEO Larry Fink shook up the world of investment by writing an annual letter to the CEOs of companies in which he invests, warning them that in future BlackRock would take a more critical view of their climate change policies. He wrote on that occasion:

Last September, when millions of people took to the streets to demand action on climate change, many of them emphasised the significant and lasting impact that it will have on economic growth and prosperity – a risk that markets to date have been slower to reflect. But awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance… These questions are driving a profound reassessment of risk and asset values. And because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.

It is a timely reminder of what financial institutions are really for: generating returns for their investors

The message seemed to be clear: any company that appeared to be failing to prepare for a low-carbon future faced divestment by the world’s largest investment house. BlackRock would use its financial might to force quicker action on climate change.

But that is an easier message to write when the oil price is in the doldrums and the share prices of fossil fuel companies are going nowhere. It is harder to sustain when oil and gas prices are surging, and oil companies have been the standout performers in what has otherwise been a pretty dire start to the year for investors. The company has just put out another note with a very different tone, warning its own activist shareholders that it will not be sacrificing investor returns in the name of making a stand against companies which it judges are decarbonising their activities too slowly.

Having supported 47 per cent of environmental and social shareholder proposals in 2021, the company notes that ‘many of the climate-related shareholder proposals coming to a vote in 2022 are more prescriptive or constraining on companies and may not promote long-term shareholder value’. In other words, we are worried that climate change action is going to cost us and our investors. It notes that the invasion of Ukraine has changed the dynamics and that in the short-to-medium term there is going to be an emphasis on reducing dependence on Russian oil and gas, requiring an increase in production for many countries.

It is a timely reminder of what financial institutions are really for: generating returns for their investors. Sometimes, that objective might happen to coincide with the aims of climate campaigners – but equally, there are times when it will not. BlackRock can see all too well that it is not alone in having vast power to reallocate capital as it sees it – its own clients have collective power, too. And if they are not getting the returns they think they deserve, they will not hesitate to reallocate their own capital to funds that are delivering the goods.

Comments