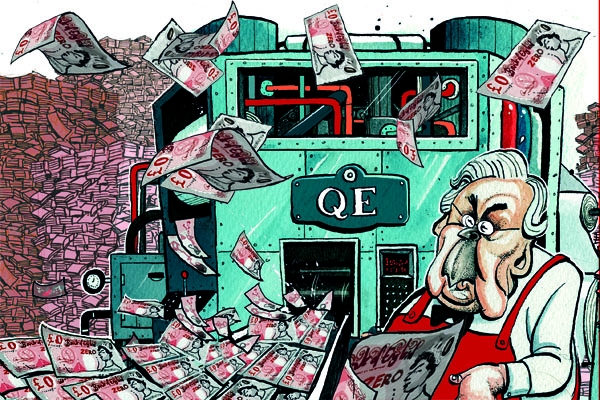

It’s official: Quantitative Easing has marked the biggest transfer of wealth to the rich of any government policy in recent documented history. The Bank of England released an analysis today, which was rejected as being an underestimate by the former government pensions adviser Ros Altman. But it was shocking enough, and the strongest point was made by the brilliant Ed Conway, economics editor of Sky News, who put it into a graph who would benefit from a QE-inspired boom in asset prices described by the Bank of England today. “10th” means the richest tenth of the population, and so on.

This is our new graph system: hover your mouse over each line, and the value should come up. And do not adjust your sets: the data shows negative £779 for the poorest tenth, so they lose out. The richest tenth do rather well.

Last December I interviewed Nassim Taleb, the Black Swan author who is well heeded in Cameroon circles. I’ve looked again at the transcript, and this is what he had to say about QE:

Quantitative Eeasing is a transfer of wealth to the rich. It brings up the housing prices. The state is subsidising the rich, it is the top 1 per cent that benefit from quantitative easing, not the 99 per cent. Quantitative easing really is flooding banks with money so they pay themselves bonuses with it. Banks have money and assets so now they can borrow easily. The poor guy here who is unemployed and can’t borrow is not going to benefit from QE.

Look at the Germans, or every single country [that has printed money]. The trap is you ease, you ease, you ease, you don’t see inflation and then suddenly – puff! – you have a huge amount of inflation coming. Like you try to pour money out of the ketchup bottle and nothing comes out, nothing comes out and then everything splashes, this is how inflation comes. Inflation doesn’t come in a pretty nice way so don’t mess with inflation. Every single person who has done quantitative easing or a form of printing money has effectively lost the argument.

PS I should add that, while I’m prepared to believe that QE is regressive, the Bank of England’s figures strike me as a stab in the dark. Money can’t be created out of thin air, so what one guy gains another has to lose: now, or in the future. The distributional effects of QE would have to take in inflation, the effect on pension schemes, a guess at which income group is most exposed to share prices and in which sectors etc. My greatest concern about QE is that no one really knows what we’re doing, what the effect will be or what will happen when it is unwound.

Comments