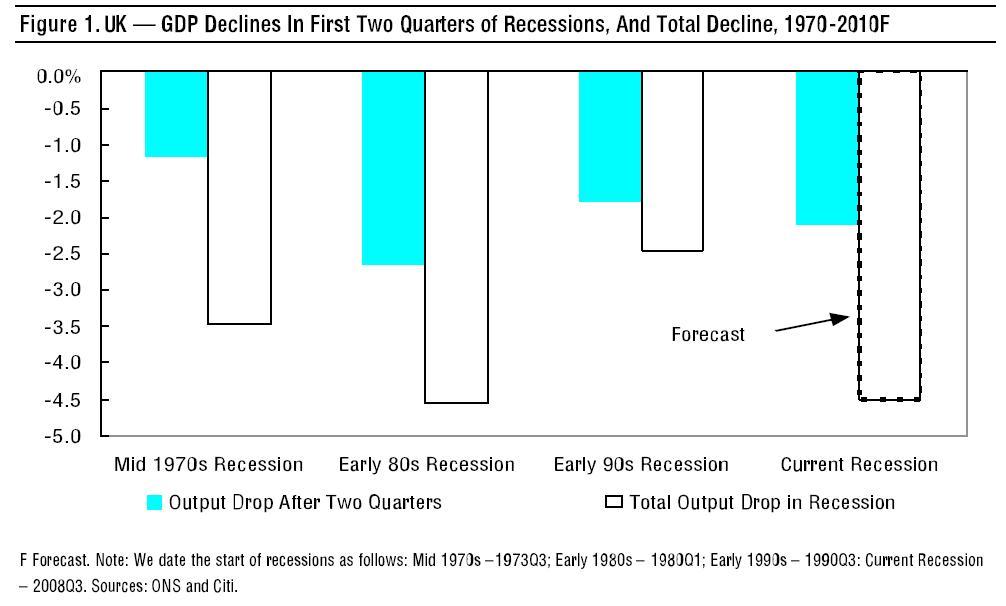

I’ve noticed that Gordon Brown has stopped bragging about how this recession is not as bad as 1990s. And with good reason. It’s far worse – and not just because unemployment and repossessions are rising more quickly. It’s summed up in a graph – and CoffeeHousers who are into this sort of thing may find it useful. It’s from CitiGroup, which warns that even the below picture for the current downturn is optimistic. Citi is now forecasting a 3.3% contraction of the economy this year – last month it was forecasting a 2.5% drop. It says in the note “Apologies for the frequent updates, but the economy is in freefall”. So is Britain well placed to handle the downturn?, I hand over to Michael Saunders from Citi when discussing the 3.3% GDP drop he now expects for this year:

“To put that in context, no G7 country has recorded a GDP decline of more than 3% in any year during the last 50 years. And it may be even worse. If GDP continues to fall by 1.5% QoQ during 2009, then GDP will fall by about 5% in 2009 as a whole. To put that in context, this would be similar to the worst year of the 1930s slump (1931),which saw UK GDP plunge 5.5%…. From here, a recession that lasts for only a year or two would qualify as a relatively good outcome.”

Comments