With the largest transfer of liabilities in British history – the insurance of the risk of loss on £240 billion of toxic RBS assets by taxpayers – proceeding, there is worryingly little information being given about either what these assets may be or what risks there are to the taxpayer. Rather than the parliamentary enquiry and detailed disclosure Swiss parliamentarians demanded when UBS needed similar assistance, a small press release noting such exotics as “structured credit assets “ has been issued. The spin continues to be that there is nothing to worry about and all this money will come back fine.

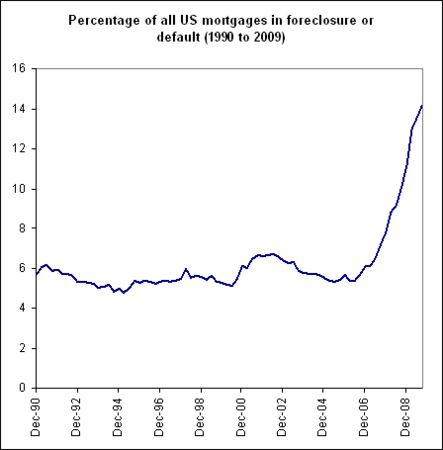

Bank of England data shows that UK bank exposure to the US increased increased by over half a trillion dollars between 2004 and 2007 to 1.2 trillion. As the unemployment rate in the US has doubled to above 10% over recent quarters, the number of mortgage defaults has similarly soared. As the above chart shows, over 14 percent of all US mortgages are now in default. With three quarters of US households having no more than 2 months outgoings covered by savings, people walk away very quickly. The mortgage crisis has spread well beyond sub-prime, with almost 7 percent of prime mortgages now in default. US banks have chosen to take interest rate cuts and their massive government subsidies in windfall bonus gains rather than pass on lower interest rates to borrowers, further exacerbating the default problems. UK banks seemed to have failed to pay attention to the fact that many states have laws that allow people to walk away from mortgages without further liability. As the $30 billion loss one trading desk at RBS took on mortgage exposure shows, the losses here are very real.

The situation in Dubai is no better. As the above Bank of England data shows, the UK banks hugely increased their lending to the UAE around the same time as Dubai went on their global shopping spree. The data does not prove that this is all to Dubai, but it does seem a rather unnerving coincidence of timing, especially as Governments elsewhere are reluctant to endanger their own solvency by continuing idiotic lending. The comments made by one of the savviest investors in the Middle East, Prince Alaweed, are telling:

A bad bank – which the asset protection plan is an attempt at – is, ultimately, likely to be a key part of getting the UK banking system fixed. The main point of transferring risk to the taxpayer, though, is to ringfence the problem debt and allow private sector equity capital to return. For this to work, the transfer of potential losses has to be done in tandem with a credible and open assessment of the remaining bad assets. The basics of how to make this work have escaped both the government and their highly-paid investment bank advisors – as demonstrated by the news that taxpayers, rather than private investors, will hand over a further £33bn to the troubled banks. Given this ongoing fiasco, it’s no surprise that George Osborne has made reforming UK bank regulation a key priority. Until then, this sorry farce of “trust us, we’re experts, you’ll get all your money back, guv” with Labour and their investment banker friends drags on at potentially huge cost to UK taxpayers.“These banks are very mature banks, and they have to differentiate between a corporate loan and a sovereign loan. When things go sour, you can’t have some banks in the West going to Dubai and saying ‘oops’ and crying wolf and saying, ‘You should have guaranteed those loans’”

Comments