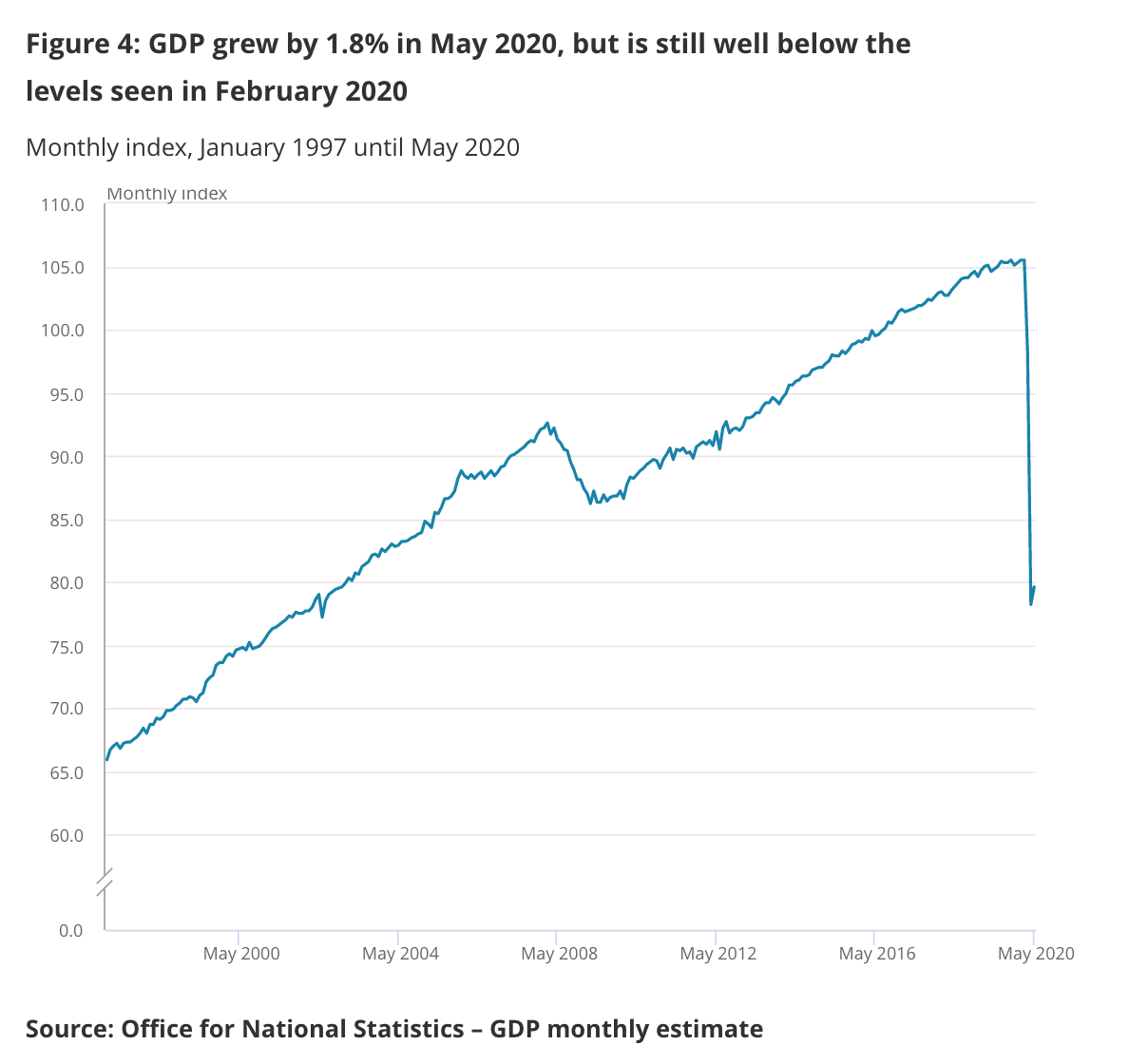

It is an uptick so small that it could almost be comic, but the UK economy started to grow in May: by 1.8 per cent following a 20 per cent slump in April. Office for National Statistics figures out today show that, even in lockdown, surging online retail sales – coupled with signs of a recovery in construction – show a small increase in GDP. The big question is what shape we can now see: a L, a Nike swoosh or a sharp V?

Reopening the economy can only go so far: tackling people’s fear of Covid-19 is key for a V-shaped recovery

Today’s increase suggests growth is – every so slightly – on the up, easing doomsday concerns about an L-shape (that is, no recovery at all). But economists are disappointed – the consensus was for a 5 per cent uptick in GDP, and May’s figures fall notably short. The economy is still a quarter smaller than it was at the beginning of the year. Many are abandoning their hopes for a sharp recovery.

Is it premature to throw the V out with the bathwater? Looking back on the original scenarios from the Office for Budget Responsibility and Bank of England, a major surge in growth was expected to come towards the end of Q2 and beginning of Q3. May is still early, especially considering the UK’s decision to tread slowly out of lockdown. Two months ago, the UK was practising the height of its lockdown rules. The advice was just shifting from ‘stay home’ to ‘stay alert’ and the month’s big announcement revolved around liberalising the rules slightly so you could meet another person outdoors. Non-essential shops didn’t open until June; pubs and restaurants opened just ten days ago.

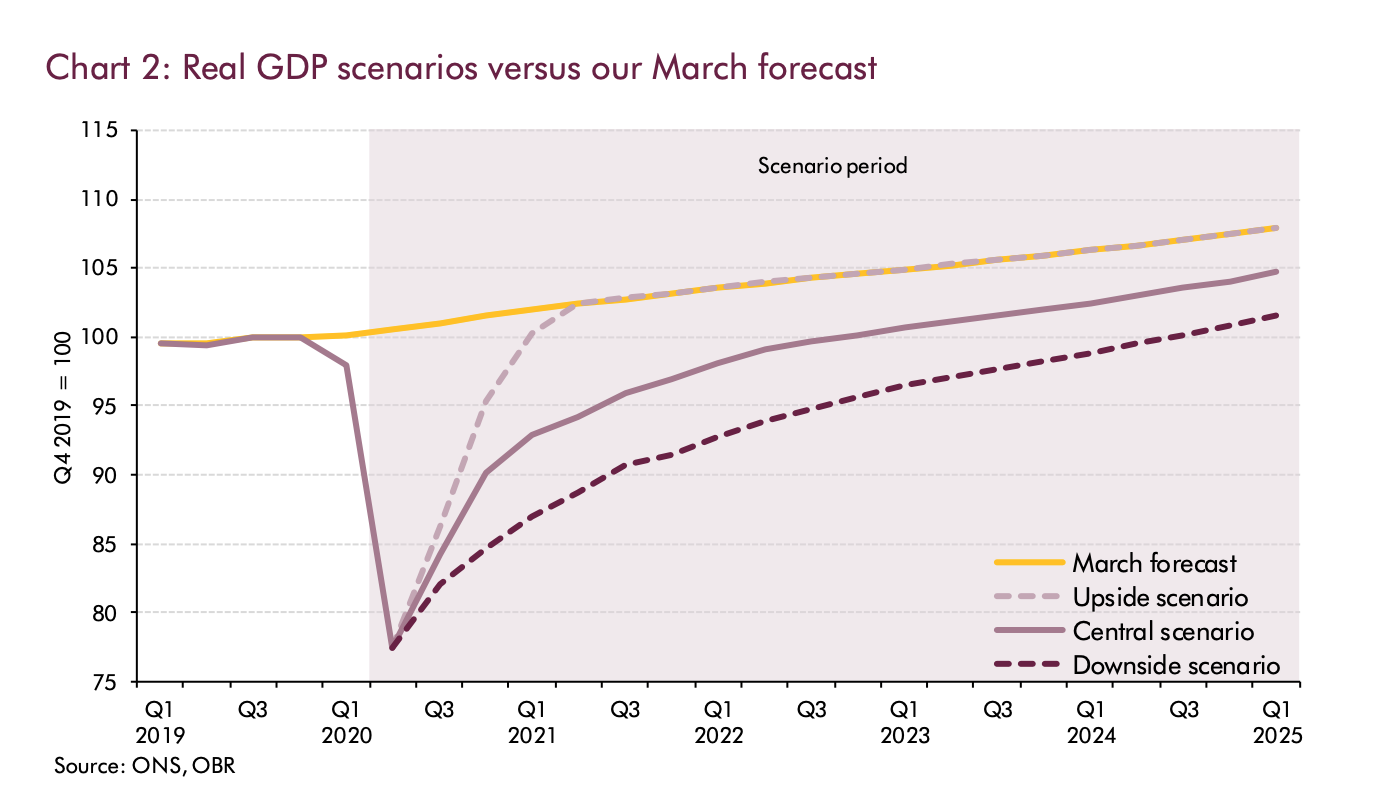

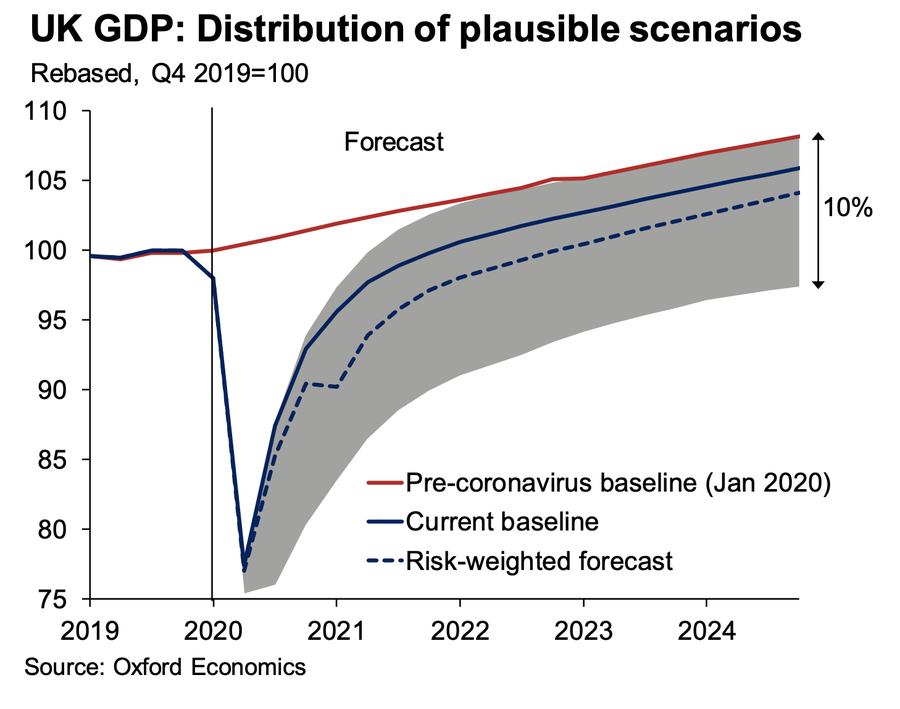

But even the most optimistic scenarios are being revised downwards, as the bounce-back already looks more lacklustre than the original forecasts laid out. The OBR has published an update to their March scenario, now showing a recovery that falls somewhere between a V and the Nike logo. Having originally expected recovery by the end of the year, the OBR now doesn’t expect a return of January’s GDP figures until 2022. Oxford Economics forecasts a more bullish recovery: still, it would restore GDP to its pre-Covid levels half way through next year. This is a big shift from the broad consensus at the start of lockdown that growth would skyrocket within a matter of months. And there’s worry that these new scenarios still err on the optimistic side: they could be revised down even further if data from the coming months disappoints as much as May’s growth figure.

Many of Britain’s economic woes are still ahead of it. For these new recovery scenarios to be realised, GDP will need to be surging upwards at the same time as we expect unemployment to spike. The autumn will see the unwind – and official end – of the furlough scheme, which is expected to reveal thousands upon thousands of redundancies-in-waiting. The lack of a comprehensive test and trace scheme threatens cities and even entire regions heading back into lockdown in the autumn, if the virus starts to spread again. And consumer confidence remains on the floor, as UK residents hesitate to venture back out to their shops, pubs and offices. Perhaps the development of a vaccine or widely successful treatment come autumn could put the original economic scenarios back on track – but such a breakthrough cannot be counted on. Today the Government has confirmed masks will be mandatory in shops in England from 24th July, in hopes this will make people feel safer to head back out. Whether it works or not is yet to be seen, but it serves as a reminder that reopening the economy can only go so far: tackling people’s fear of Covid-19 is key for a V-shaped recovery to take place.

Andy Haldane, the chief economist of the Bank of England, gave a speech at the end of June arguing that the recovery is ‘so far, so V’. This has proved a deeply controversial comment, especially amongst those who think undue optimism about the UK’s recovery will bring a premature end to the money-printing and furlough support. History may be on his side – recoveries from wars and pandemics are always sharp due to the sheer speed of economic activity coming back on. But this is a unique battle, against an unseen enemy that has temporarily stalled economic activity across every sector. May’s figures could be the start of a relatively sharp recovery, but they may well trail off into the painful territory of significantly reduced economic activity.

Comments