Listening to Ed Miliband’s speech today, you’d be left with the impression that the UK is suffering a huge decline

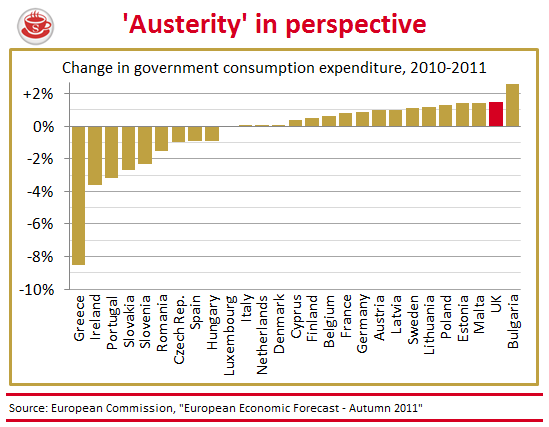

in government spending this year, and that this is to blame for most of our economic ills. The facts are a little different, as the below chart shows. The European Commission estimates that the UK is likely to have the second largest growth in government spending of any of

the EU’s 27 members this year, clocking in at a robust 1.5 per cent increase for the year.

Yet this has done nothing to help the UK’s relative growth performance. The UK is forecast to be the fifth slowest growing economy in the EU this year, ahead of only Greece, Portugal, Cyprus

and Italy. Ireland, still cutting its government spending significantly, is managing to grow more quickly as its export sector lifts them out of its slump. Despite the UK economic establishment

blaming Europe for all our woes, the eurozone is managing to grow almost two and a half times faster than the UK at present:

This is doing nothing to help the UK’s deficit. One thing Labour are right about is that the amount the UK will borrow in coming years will be above George Osborne’s current forecasts.

Only Ireland now has a larger deficit than the UK — the countries currently impacted by the Euro crisis are running deficits on average half that of the UK today.

The UK’s economic problems run much deeper than our proximity to the eurozone and the size of our government overspend. A fundamentally broken banking sector and a lack of competitiveness are

just as much to blame.

Mark Bathgate

Some context for the ongoing growth debate

Comments