Donald Trump has his eyes on Britain’s Digital Services Tax (DST). The tariff-touting US President insists that the tech firm tax must be scrapped if the UK is to have the ‘deep’ trade deal on technology it desires. So far the government has demurred, but, with Keir Starmer disclosing last week that there are ‘ongoing discussions’ about the tax, it may yet capitulate. I think it would be foolish to do so.

Trump thinks the tax is a punitive one aimed directly at the US. It’s true that big US tech firms are the largest payers. But as the shock emergence of Chinese firm DeepSeek proved earlier this year, there’s no reason to assume the next trillion-dollar tech business will come from California, and the sources of income from the DST are likely to diversify over time.

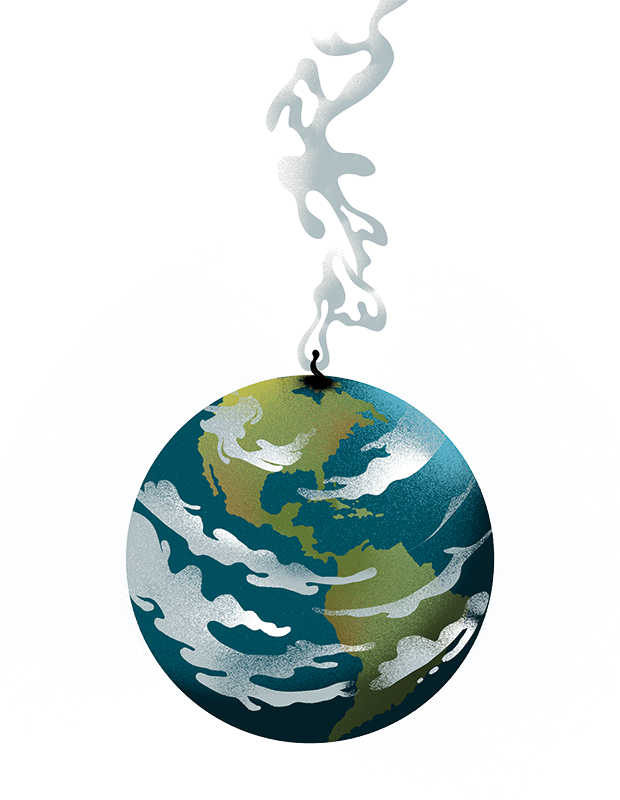

Do we really want to give Donald Trump veto power over UK fiscal policy?

Trump also thinks the DST means US firms will pay higher average rates of tax in the UK, putting them at a competitive disadvantage to domestic firms. But the reverse is true: tech firms typically face less than half the tax bill of traditional bricks-and-mortar businesses, because they are less exposed to things like business rates. And big US firms tend to pay a lower UK tax bill than their domestic counterparts, in part because of complex schemes like paying a service fee for intellectual property to a parent company in the Bahamas, a manoeuvre few British businesses emulate.

It’s true that big US tech firms have invested heavily in the UK over the past decade. Google, Microsoft, Amazon and Meta each employ thousands of staff and have spent billions on data centres and big shiny London offices. But it’s worth noting how much the state has invested to support their growth. The overwhelming majority of traffic carried via new fibre optic cables being laid across Britain will be from services by Google, Amazon and Meta, while recycling centres have had to be scaled up to support the millions of extra parcels delivered by firms like Amazon.

At the moment, the tax take from the DST is small – it is unlikely to generate more than £1 billion for the exchequer this year. That is partly down to its modest 2 per cent rate (indeed, when then-chancellor Philip Hammond first proposed it, Labour said the low rate ‘lacked ambition’). But as a greater share of the economy becomes digital over time, its significance will grow, while the share of revenues from bricks-and-mortar taxes like business rates will deteriorate.

If the Treasury loses the DST money, Rachel Reeves cannot be trusted to find a suitable replacement. Hamstrung by her election tax pledges and her precarious fiscal headroom, in October the Chancellor resorted to hiking national insurance rates, a move that has proved disastrous for small and medium-sized businesses, if the recent jump in corporate insolvencies is anything to go by. Her next move could make matters worse. But keeping the DST, or even doubling it, is unlikely to push Google over the edge.

Regardless of the merits of the tax, there are good reasons to think a trade deal should not give either party the right to interfere with the other’s domestic tax policies. That is quite different from, for example, the bilateral tax treaty on national insurance signed with India earlier this week, a common agreement which only applies to specific foreign workers.

Do we really want to give the US – and in particular, Donald Trump – veto power over UK fiscal policy? You don’t have to be the staunchest anti-Maga campaigner to feel reticent. And given Trump recently tore up parts of a trade deal he personally signed with Canada, there’s no reason to think he won’t come back for more.

All trade deals require give and take on both sides, but UK concessions on chlorinated chicken would be easier to stomach (no one has to buy it) than having our tax rules dictated by the White House. Deal or no deal, we mustn’t let DJT take our DST.

Comments