The $5.79 trillion budget plan Joe Biden submitted to Congress yesterday was more notable for what it didn’t include, rather than what it did. There were no line items on the environment or education – key pillars of his ‘Build Back Better’ agenda – but it did call for a new minimum tax requiring ‘billionaires’ to pay at least 20 per cent of their income in taxes, including on the gains on investments that have not been sold. This will, apparently, reduce the government deficit by $360 billion over the next decade.

The President is in a tight spot. Since the turn of the year, his approval ratings have fallen to their lowest levels since he took office, with voters justifiably concerned by the nation’s largest inflation spike in four decades. The Biden administration believed it could take an overheated economy and run it hotter. They were wrong, they’re getting burned, and now they’re using hostility towards the super-rich as an analgesic.

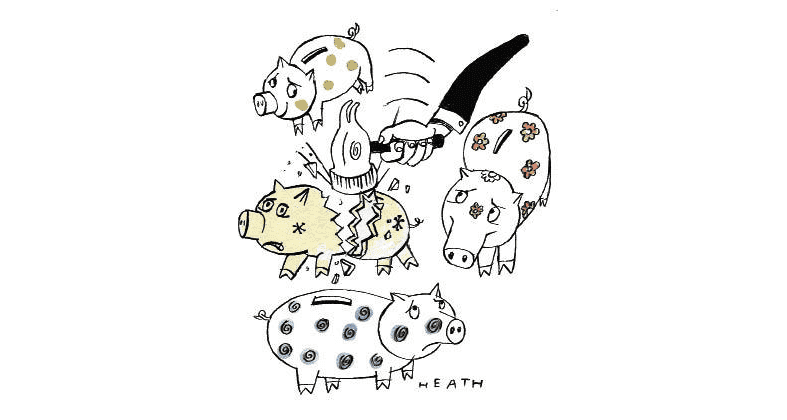

But the term ‘billionaire’ is notoriously difficult to measure – as we can see from the fact this tax on ‘billionaires’ will actually be levied on people with a tenth of that fabulous sum. Taxing unrealised gains is an effective wealth tax, with likely negative consequences for financial markets (as the wealthy are compelled to sell assets to cover tax bills) and inherent unfairness. If their stock is worth $200 million and the government demands $40 million, but their shares later collapse, would they get their tax back? Fat chance.

Two centuries ago, 90 per cent of the global population was living in extreme poverty. Today, the figure has fallen to just 10 per cent

Worse would be the dynamic effects on the economy. Taxes never change in isolation: behaviours change, too. Individuals may work fewer hours or retire sooner, and look at other ways to legally reduce their tax burden, including domiciling abroad.

Bashing billionaires is nothing new. Before the pandemic, Democratic senator and former presidential candidate Bernie Sanders tweeted that ‘there should be no billionaires’. The charity Oxfam – which now spends more time worrying about the rich than it does the poor – has claimed a new billionaire was created every 26 hours during the pandemic. It regards this as an ‘obscene’ development, and one that ought to be corrected ‘through taxation’. It blamed ‘inequality’ for contributing to the death of one person every four hours, as though wealth at the top was the direct consequence of sapping the life from the bottom.

Before the dawn of capitalism, roughly two centuries ago, 90 per cent of the global population was living in extreme poverty. Today, the figure has fallen to just 10 per cent, with half of the decline occurring in the last 35 years. In that same period, the number of billionaires rose sharply. In 2000, there were 470; today there are 2,755. The economist Rainer Zitelmann suggests that the increase in the number of billionaires and the decrease in the number of people living in poverty are ‘two sides of the same coin: capitalist globalisation’.

And without Zoom or Amazon, lockdown wouldn’t have been possible. Social media was no substitute for real-life interaction, but it did keep the isolated connected. It enabled nearly half of us, at one point, to work from home. It bought us time, lowering the transmission of Covid until life-saving vaccines were developed.

Of course, not all billionaires are equal. There are those who have become hyper-rich through immoral and illegal means. Billionaires sit on a sliding scale from outright criminality to legitimate capitalism – and if the President wanted to go after the dodgy few, hardly anyone would object. But this is not what Biden is proposing. Instead, he wants to hammer those who are creating hundreds of billions in economic value, not to mention millions of jobs, worldwide.

These individuals produce significant value for society by building extraordinary products that improve lives. Many donate vast sums to charity. Their riches are the result of small-ish purchases made by millions, if not billions, of people – and the profits on each purchase can be considered a small tribute by each of us to the benefits their companies bring. But it’s also a tribute to the policy frameworks in which they operate. We need societies in which people can go from rags to riches, not ones where, as the economist Tyler Cowen put it, billionaires are ‘demeaned’.

A successful tax system does not judge taxpayers. It does not try to decide what each taxpayer should ‘morally’ pay. It sets a basic set of rules and punishes those who break them. If it is up to the state to decide what our minimum ‘fair share’ is, there is no knowing where it will stop. Why 20 – and not 80 – per cent?

We’ve seen how the story ends. When France flirted with a 75 per cent tax on earnings above €1 million, introduced in the name of fiscal ‘fairness’, thousands of wealthy individuals fled. It has been estimated that the wealth tax in place between 1988 and 2017 cost the French economy twice as much as it raised. Lambasting billionaires may be a vote-winner, but it doesn’t make for good policy.

Comments