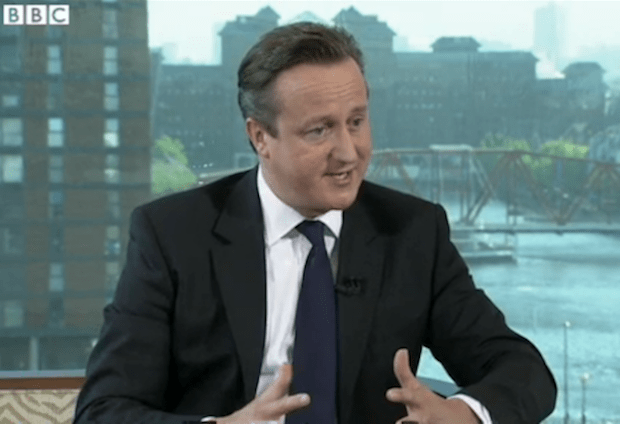

Here’s what jumped out at me from David Cameron’s interview with Andrew Marr in Manchester this morning:

- Tax cuts: the Tory weapon ‘As this economy has started to recover, it’s very difficult for people to make ends meet. Their wages are relatively fixed, and the prices are going up. That’s why cutting people’s taxes is so important. That’s why lifting people out of the first £10,000 of income tax is so vital. That’s why freezing the council tax matters.’ So Cameron acknowledges Miliband’s premise, that the cost of living is an issue, then presents tax cuts as the solution. Precisely the right strategy, as tax cuts are bankable and Miliband’s claim to freeze energy bills is less so. Cameron’s problem is that he has so few tax cuts to point to so far, and has to use the mainly rhetorical device of saying he has ‘lifted people out of tax’. To blunt Miliband’s attack, he’ll need more of these tax cuts. But anyway, he’s offering…

- Low energy prices until 2033 ‘I want low prices not just for 20 months, I want them for 20 years,” he said. “we’ve got to make these markets more competitive, we’ve got to make sure companies behave properly and put people on the lowest tariff and we’re legislating for that.’ A good line, rehearsed in his recent Yorkshire Post interview.

- Rules out wealth taxes. ‘To go after someone’s house each year with a wealth tax: I don’t think that’s a sensible thing to do.’ He’s right. As I revealed George Osborne planned to give the Liberal Democrats their ‘mansion tax’ by creating two extra bands of council tax. Cameron vetoes him, saying it would hurt Boris as it was, in effect, a tax on Londoners. But it’s good to know, now that he’d veto it if Prime Minister. As he said, it’s a crazy idea being dropped over Europe because it doesn’t work.

- Cameron knew he lost before polling day Cameron was asked about one of the (many) disclosures from Matthew d’Ancona’s long-awaited book: that he, Osborne and Hague concluded before the election that they could not win it so he’d have to cut a deal with the Liberal Democrats. He gave a non-denial denial (“That’s not how I remember it,”) so I think he can take that as a yes.

- Depressingly, Cameron weds himself to low interest rates. ‘But don’t let’s forget this issue about mortgage rates. If a Labour government came in and said it’s okay to borrow more, spend more and tax more and the deficit goes up, interest rates go up, mortgage rates go up, and that would wipe out any gain of anything else that is done on any other price. Because mortgages are such a big part of so many people’s family budgets in this country. ‘This is unwise. Bank rates are at rock bottom, 0.5 per cent, and a successful economic recovery will see them back to average at about 5 per cent. But Cameron has just told us that this would be a calamity, which we should vote Tory to avoid. If re-elected, he’ll have to eat these words.

- Britain’s problem? Not enough debt. ‘Today, the average family cannot afford the average house. And that’s not a problem with our housing market, it’s a problem with our banks and our mortgage market.’ He’s quite right: if banks offer mortgages at below the rate of inflation they’re effectively paying people to borrow and creating an asset bubble. But no, Cameron’s problem is that there’s not enough debt and he wants to force banks issue lots more. And to those deemed the greater credit risks. ‘I’m not going to stand back’ he said, with Syria-style solemnity. ‘We need to act.’ Come on ladies, cheap cheap debt…

- ‘Talk of a housing bubble here in Manchester or Salford and they would literally laugh in your face’ So is he saying houses there are affordable? In which case, why interfere with Manchester’s housing market? And if Cameron were to go to Oldham, where prices are up 7 per cent year-on-year at a time when incomes are flat, they may not laugh in his face. Or to Bolton, where they’re up by 5 per cent.

- And if it goes wrong, blame Mark Carney! ‘Let’s put our trust in the Bank of England’ he said. In other words: if the market goes tits-up then blame that Canadian bloke we’ve just hired at great expense. Unfair because Carney is not the one hawking Help-to-Buy and Funding-for-Lending; the vote-hungry Osborne is. And teh Chancellor is working to a May 2015 deadline. Interesting to see how quick Cameron is to lay so much at the door of the Bank of England. Including his line that:-

- ‘The Bank of England have advised that there is no housing bubble’ and we all remember them warning us about the bubble last time, don’t we? Em, no. The Bank did not spot anything wrong during what we now know to be the worst economic overheating in decades. As Alan Greenspan said, central banks are useless at spotting bubbles. It’s unnerving to hear Cameron claim otherwise, as it (again) suggests key lessons from the crash have not been learned.

- Might HS2 have a reverse gear after all? ‘Of course there’s a limit – we’re not going to just spend any money on this,’ he said. So what might that limit be? As Transport Secretary, Philip Hammond suggested the limit might be if the cost-benefit ratio, which started at £2.40 for every £1 spent, sank below £1.50. A recent Newsnight analysis suggested it was below £1. ‘HS2 is going to happen,’ the PM said – but, clearly, not at any cost. I do hope Cameron has started to prepare as well for dropping HS2 as he prepared for coalition with the LibDems.

But overall Cameron gave a strong performance, as usual. Far better than Ed Miliband’s attempt on Marr’s sofa last week. He’ll try to deflate the Miliband bounce by posing as the statesman, who is already doing plenty for the poor – versus Ed Miliband who is promising crazy “nuts” schemes that fall apart under scrutiny. Most encouragingly, the Miliband offer to freeze energy prices seems to have amplified his tax-cut message. Let’s hope there’s more to come this week.

Comments