The law of unintended consequences is one that Westminster unfailingly passes, and there are signs that the massive Quantitative Easing programme is making it harder for companies to raise money, because the government is flooding the market with its own IOU notes. The Bank of England today confirmed that less than 1% of the £44.5bn it has printed has gone to buy company loans – it had indicated that as much as a third of the £150bn pool would go to companies. Instead, it is a mechanism to help the government issue the £240bn of gilts it’s issuing this year. Why is this important? Because if the markets think QE is actually a way of one department of the government printing money for the other departments to spend (a la Weimar Germany), then confidence in the currency collapses. And right now, it looks very much like the Bank of England’s asset purchase programme is a device to buy state debt, masquerading as an attempt to target inflation.

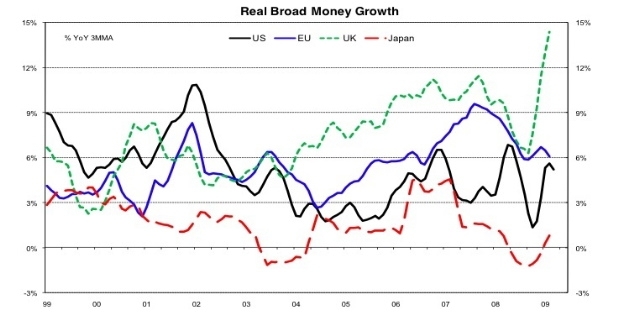

Two trends right now strike me as alarming. The first is how the money supply in Britain is exploding, thanks to QE:

But if you have a look at the credit being supplied to companies (excluding the almost-entirely-nationalised banking sector) it is collapsing, far beyond the rate seen elsewhere:

Does this matter? One explanation is that British companies are simply paying down debt. Another is that the government’s debt issuance is so extreme that it is crowding out other forms, and that companies will be going to the wall because they face credit constraints that are partly caused by the UK government’s own need for cash.

We’re in this strange situation where the future of our country will be decided not in Parliament, but by the bond markets. What matters to companies are not Brown’s promises of things that might happen in six months time, but whether they can renew their debts now. I have a feeling there are CoffeeHousers better qualified than myself to say what’s going on, but it looks mighty fishy to me.

Comments