The Bank of England has voted to hike interest rates to 0.75 per cent, the third successive rise, which puts rates back to their pre-pandemic levels. Historically, we’re still at ultra low levels, but the rise is anything but insignificant.

After the Federal Reserve made its first move to lift interest rates by 0.25 per cent (its first rise since 2018), it was all but guaranteed that the Bank would vote to lift interest rates again. The Fed had been holding out longer than most, with CPI in the United States hitting nearly 8 per cent, a 40-year high, before it took action. But the narrative that price hikes are ‘transitory’ finally broke down and no one – on either side of the pond – is credibly pretending this is a temporary phenomenon any longer.

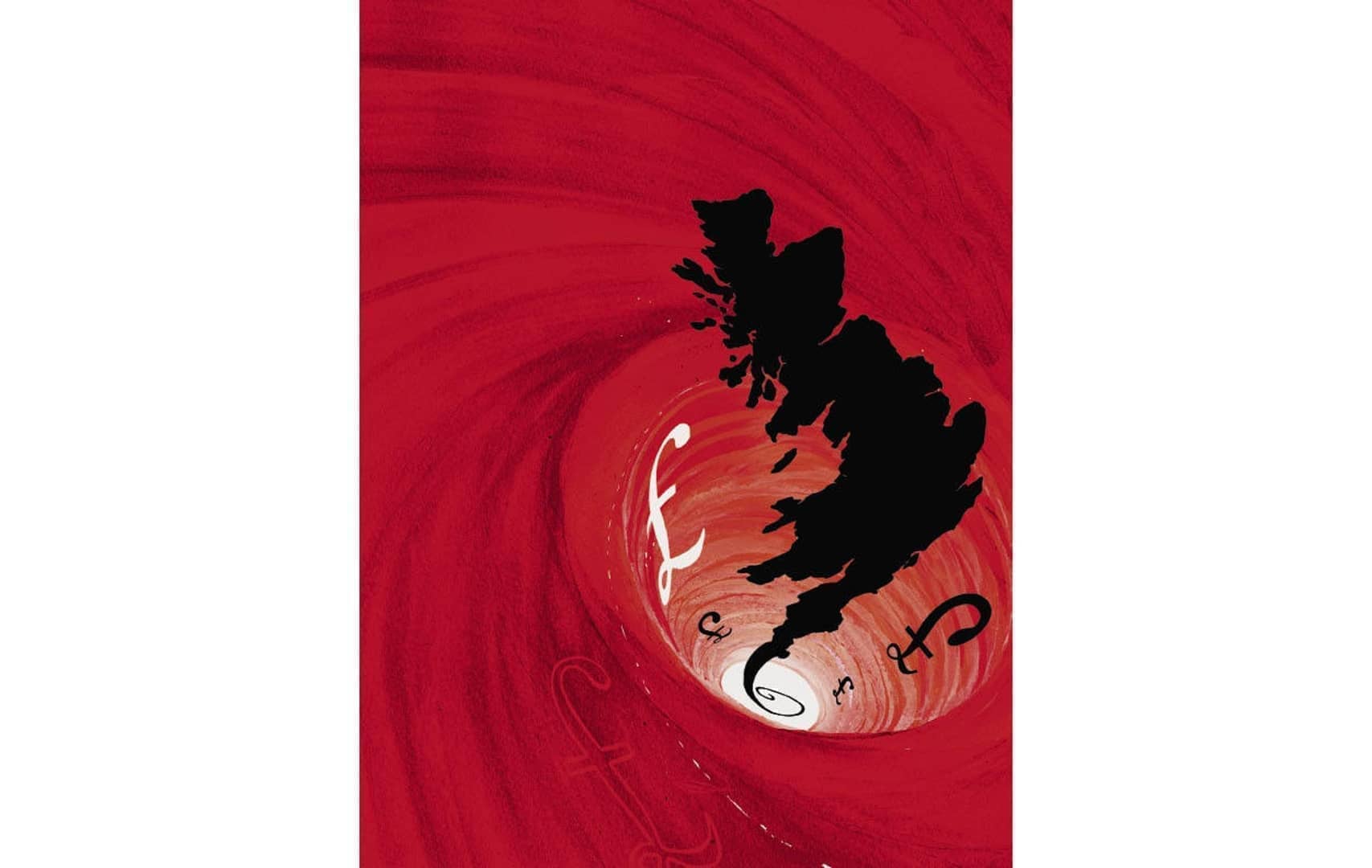

The Bank’s lift to 0.75 per cent per cent straddles an attempt to rein in inflation here – at 5.5 per cent according to the latest calculation from the Office for National Statistics – while balancing the increasing risks of recession. The Bank now estimates inflation will hit 8 per cent in the second quarter of this year, up from its 7 per cent forecast last time it hiked rates, and thinks the headline rate will go ‘perhaps even higher later this year.’ Headline inflation figures have been outpacing predictions for months now and inside Whitehall it’s feared that forecasts are still too low. Treasury officials are bracing for relatively high, sustained inflation – not just this year, but for several years to come.

But global growth is increasingly being downgraded (yesterday Capital Economics reduced its forecast for 2022 from 4.0 to 3.2 per cent), and the fear remains that soon that global trend will be reflected in the UK. While Britain is not nearly as dependent on Russia for its energy supplies (3 per cent of our gas supplies come from Russia, compared to over 30 per cent for Germany), the serious economic sanctions and global rush for non-Russian energy will eventually take their toll on Britain’s economy.

And as I write for this week’s magazine, the cost of living squeeze was tightening long before Russia invaded Ukraine. Prices and taxes were all on an upwards trajectory, meaning an interest rate hike (especially for mortgage owners, many of whom will be unfamiliar with inflation and rate spirals) would always come with pain of its own, even without the actions taken against Putin’s Russia in recent weeks.

But with the Bank so far off its target of 2 per cent inflation, today’s rate hike feels more like catch-up than it does pre-emptive action. The problem for central bankers is that it’s always harder to tame inflation when it’s already spiralling upwards.

Comments