It was a busy weekend for euro-crisis observers. Mario Draghi, an Italian member of the

European Central Bank, was finally appointed as its new President; Mervyn King, Governor of the Bank of England, acknowledged that the European sovereign debt crisis is a ‘material threat’ to

British banks; David Cameron announced that Sir Jon Cunliffe, a Treasury civil servant, will be the UK’s next ambassador to the EU; and, according to reports, French banks have laid plans for a ‘Brady bonds’-style solution to Greece’s troubles.

It was a busy weekend for euro-crisis observers. Mario Draghi, an Italian member of the

European Central Bank, was finally appointed as its new President; Mervyn King, Governor of the Bank of England, acknowledged that the European sovereign debt crisis is a ‘material threat’ to

British banks; David Cameron announced that Sir Jon Cunliffe, a Treasury civil servant, will be the UK’s next ambassador to the EU; and, according to reports, French banks have laid plans for a ‘Brady bonds’-style solution to Greece’s troubles.

In the short run, the last of these will be the most important. Named after US Treasury Secretary Nicholas Brady, the innovative Brady Bonds programme helped solve the 1980s Latin American debt crisis. Under the programme, private creditors voluntarily swapped their loans for bonds, thereby lightening the debtor countries’ repayment burden. To incentivise this swap, the debtor countries provided ‘enhancements’ to the new bonds, usually Treasury bonds that were purchased and held in escrow for release in case of default, a financial hostage of sorts.

This process bought participating countries time to re-establish their economic footing and grow their way out of economic crisis, while avoiding the pains of a default. Although Ecuador defaulted on its Brady bonds, Mexico, the Philippines, Colombia, Brazil and Venezuela all paid them back.

To mimic the Brady Bonds model, the French proposal suggests that current creditors voluntarily roll-over 50 percent or more of their maturing Greek bonds to long-dated (e.g., 30-year) bonds and collateralize these new bonds with high-quality securities that will pay-out in case of default. (A variant on this plan was also recently suggested by the Center for Financial Stability in New York.)

Giving Greece a de-facto haircut could buy the state breathing space to get its finances in order; creditors would benefit from an insurance policy on their new bonds and, in theory, a reduced chance of default.

It’s easy to see why the Brady Bonds model is attractive: almost everyone agrees that Greece needs to restructure its debt, but an outright default or credit market event would be very painful. In theory the Brady Bonds model offers a magical solution: a non-default, truly voluntary debt restructuring.

Unfortunately, it’s hard to see the Brady Bonds model working in practice. Whereas Latin America’s debt was in the form of bank loans, Greek is burdened by sovereign bonds; swapping unrated loans for bonds is simpler than swapping bonds for bonds. There’s a greater risk of triggering a default call by ratings agencies and it’s not clear what form the collateral for the new loans will take (return of the euro-bonds proposal?). And any voluntary plan would face greater collective problems than in Latin America: the number of creditors to Greece is simply much larger.

The other potential problem, of course, is the ECB. Under its previous President, Jean Claude Trichet, the Bank was implacably hostile to anything that remotely looked like a debt restructuring. Although Greece needs less debt – it’s quite simply insolvent – the ECB has rejected such talk as defeatist and dangerous. Therefore the more useful the Brady Bonds proposal – in terms of reducing debt – the less likely it will be to get the Bank’s support.

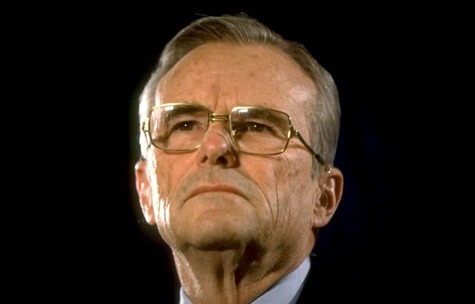

That’s why in the long-term, the appointment of Mario Draghi may be the most important of the weekend announcements. Although Draghi has shown no signs of changing the ECB’s tune, he will now be in a position to choose whether to maintain the Bank’s hard line on debt restructuring or to soften it, paving the way for an orderly debt restructuring under the Brady Bonds model or another scheme.

Comments