New cars could soon start disappearing from Britain’s forecourts, with the latest supply chain crunch threatening to cripple the global motor industry. It’s a crisis that once again delivers a stark warning about the dangers of over-dependence on China and the costs of succumbing to Beijing’s predatory trade practices.

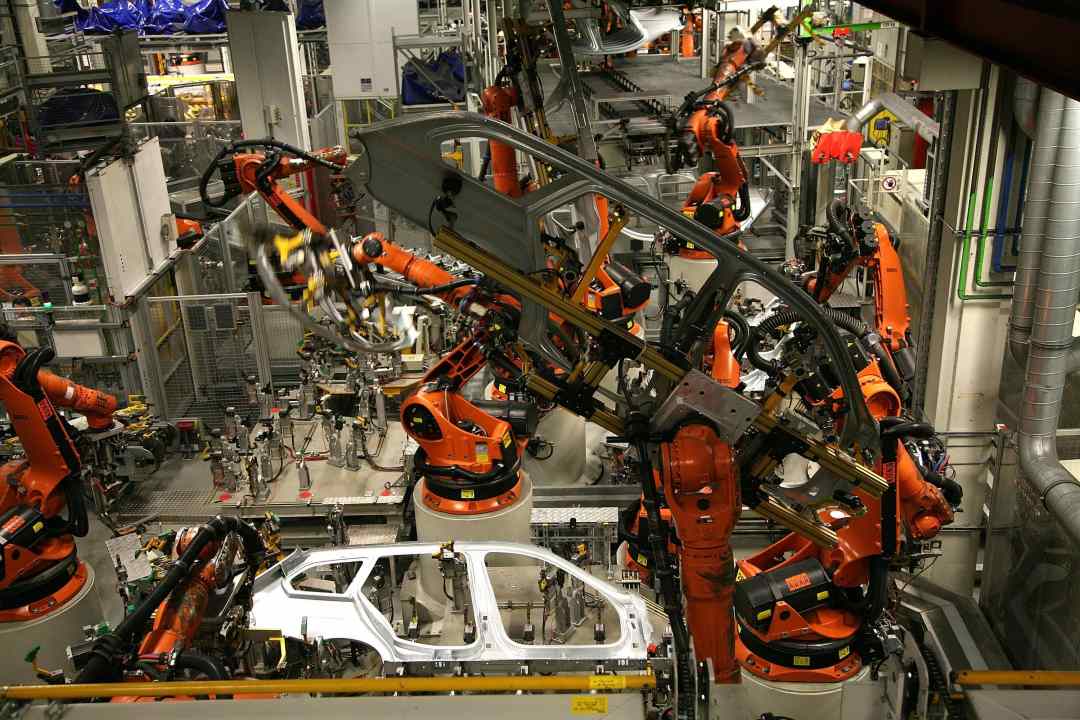

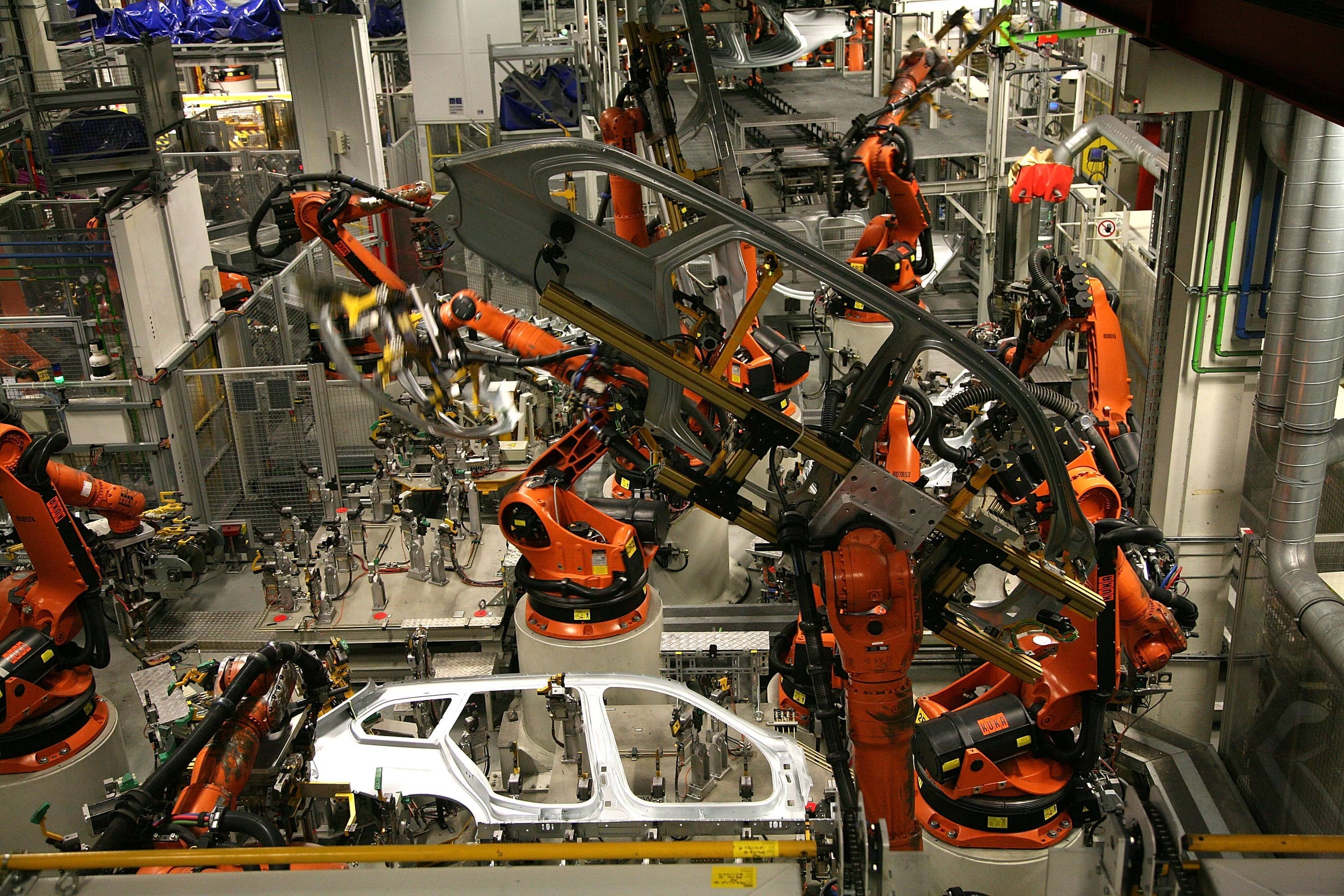

The automotive industry is currently facing a critical shortage of magnesium, which is an essential raw material for the production of aluminium alloys, including gearboxes, steering columns, fuel tank covers and seat frames. Stockpiles are running low, there is no substitute for magnesium in the production of aluminium sheets, and China has a near monopoly on the market.

In Germany, Europe’s motor manufacturing powerhouse, there are concerns that supplies might be exhausted by the end of next month. ‘It is expected that the current magnesium inventories in Germany and respectively in the whole of Europe will be exhausted by the end of November 2021,’ said Germany’s association of metals producers in a letter to the German government. One Canadian metals company told its clients last week that supplies has ‘dried up’.

There has been much talk in Europe and America of ‘strategic autonomy’, breaking free of an over-reliance on China

The immediate cause of the shortage is China’s power shortage. Some 90 per cent of the world’s magnesium supplies come from China, with a good chunk of that originating from a single town – Yulin in Shaanxi Province. The local government has reportedly ordered 35 of 50 smelters to close until the end of the year in order to preserve energy. Others have been told to cut their output.

The leaders of Germany and the Czech Republic, Europe’s other big motor manufacturer, reportedly raised the issue at an EU summit last week, with Czech prime minister Andrej Babiš saying that the industry is facing ‘disaster’. EU officials have been in touch with their Chinese counterparts. They have received vague promises that the disruption will be short-lived, but no firm guarantees. European officials fear that China will direct its dwindling output to its own industry, cutting off exports completely.

The wider fear is that the shortage of magnesium might stall Europe’s industrial recovery from the Covid-19 pandemic, and while car manufactures are the immediate concern, it could also hit construction, packaging, aircraft and electronics.

The motor industry is already reeling from a shortage of semi-conductors, where production is concentrated in Taiwan and South Korea – though in this case the crisis was largely self-inflicted. Early in the pandemic, car makers reduced their orders for chips, anticipating a fall-off in car sales, but when demand snapped back they could not get the chips they needed and many were forced to cut production. The chip crunch is estimated to cost car makers more than $210 billion in sales in 2021, with global production falling by more than seven million units.

The price of magnesium imported to Europe has surged, up by 75 per cent in a month to a record high of more than $9,000 a tonne, according to Argus Media, a price assessment company. Unlike Europe, the United States does still have one large domestic producer, US Magnesium, which offers some protection. European producers shut down production because they could not compete with cheap imports from China. The Europeans accused China of large-scale dumping, selling at below cost to force out rivals, and over two decades Chinese producers created their near monopoly. It is a familiar accusation of predatory trade practices, which has now left the world almost entirely dependent on Beijing for a key commodity.

There has been much talk in Europe and America of ‘strategic autonomy’, breaking free of an over-reliance on China – talk that was hastened after Covid-19 highlighted a dangerous dependence on China for medical and other supplies. The magnesium crunch shows how far this has to go before it becomes a reality.

Earlier this month, the London Metals Exchange held its annual dinner in the Great Room of Grosvenor House Hotel. Last year it was cancelled because of Covid. It’s usually a glitzy affair with plenty of free-flowing champagne and bullish talk. This year it was reportedly subdued, the talk of erratic markets and metal shortages. The more perceptive among them were also casting one eye on the future, on raw materials such as lithium, nickel and cobalt, where China has a tight grip on supply chains. These are all essential to technologies of the future, including for ‘green’ tech such as batteries for energy storage and electric vehicles. If the magnesium crunch tells us anything, it must surely be how foolhardily Western democracies have been to allow themselves to become so dependent upon Beijing for such strategic supplies, and the urgent need to shift supply chains away from China.

Comments