The Chancellor’s emergency package for the self-employed is one of the most generous schemes to be offered worldwide so far, covering up to 95 per cent of the UK’s self-employed workforce. The details of the scheme, explained here, include a taxable grant worth up to 80 per cent of one’s profits over the past three years, capped at £2,500pm – notably on par with salaried workers who earn, on average, £340 more each month than self-employed workers.

There were plenty of potential pitfalls and unnecessary giveaways the Treasury managed to dodge: wary of dishing out cash to super-wealthy contractors and consultants, the Chancellor has only opened the scheme to workers trading with profits up to £50,000. To avoid fraud, it only applies to those already self-employed, with a 2019 tax return to prove it. And to avoid splashing cash on those who use their self-employment status to top-up their salary, the scheme only applies to those who get the majority of their income from being self-employed. And while questions will linger about the gaps in the package and the timeline of the rollout, the complexities around self-employment status in the UK make this an extremely comprehensive package, given the scope of the challenge and the limited time in which the Treasury had to deploy it.

Tonight, for the first time since his Budget, the Chancellor paid lip service to the country’s finances when we come out crisis mode

But while stimulus announcements are becoming a weekly (if not bi-weekly) occurrence, talk of the future is rare these days – and tonight, for the first time since his Budget, the Chancellor paid lip service to the country’s finances when we come out of crisis mode: when we get through this, he said, we are ‘chipping in together to right the ship’.

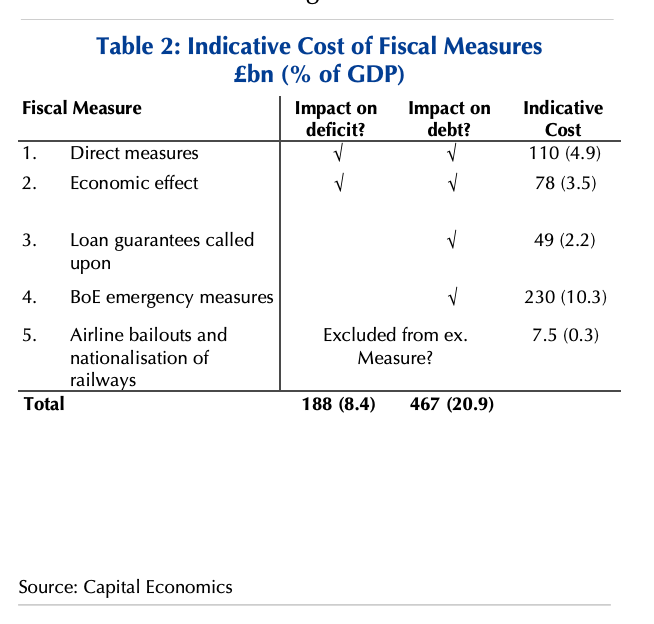

Sunak’s comments came alongside his argument that this intervention makes it ‘harder to justify the inconsistent contributions between people of different employment statuses,’ indicating that the tax benefits granted to the self-employed will come under review. In other words, the self-employed are likely to pay more in future. This is the first, albeit small, acknowledgment we’ve had from Government that they’re aware a near-decade’s worth of efforts to get government spending under control have been wiped out in a matter of weeks. Capital Economics’ latest financial forecast for the UK (which doesn’t yet include today’s self-employment measures) cites the possibility of a 60-year high budget deficit and a national debt peak of over 100 per cent of GDP. This unprecedented emergency spending on Covid-19 doesn’t just jeopardise this Government’s other spending projects (‘levelling up’ Britain, investing in the NHS), but puts Britain in a state of existential financial crisis.

The Chancellor will know – if anything like this prediction proves true – that it will become it harder to borrow, harder to spend, and require tough choices to get Britain’s finances back on track.

So he’s starting to brace us for it: the tough choices down the road that will be necessary to mitigate the even tougher circumstance we are living through now. The self-employed were warned today, but they are likely to be the first of many groups needed in future to re-balance the government’s coffers.

Comments