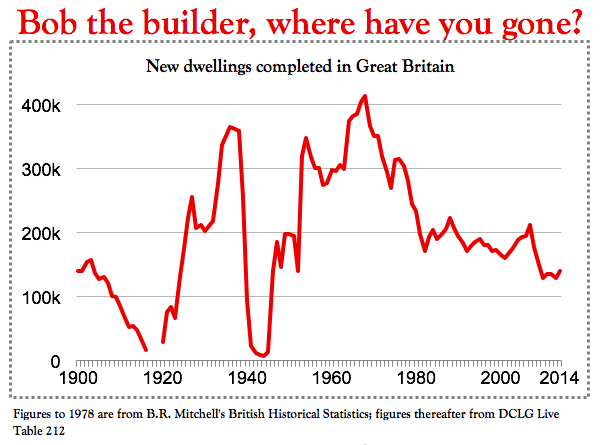

Things are pretty good in Britain right now: poverty rates are at a record low, employment is at a record high with rising wages and zero inflation. But for the young, there’s a problem: property prices are still sky high and the basic dream of home ownership (especially in London) looks cruelly unobtainable. The above graph might help explain why.

The construction of new houses has been falling steadily, while the population has been rising steadily. At the same time families have been fracturing, increasing the need for more dwellings. In the last 15 years, net immigration has gone from zero to 350,000 a year. The new Brits need somewhere to live, especially as they tend to have more children. Most children born in London are born to immigrant mothers (including, I should add, my three kids). The situation in London is far worse than the rest of the UK (see graph, right, from the Nationwide database) but everywhere things are pretty tough.

steadily, while the population has been rising steadily. At the same time families have been fracturing, increasing the need for more dwellings. In the last 15 years, net immigration has gone from zero to 350,000 a year. The new Brits need somewhere to live, especially as they tend to have more children. Most children born in London are born to immigrant mothers (including, I should add, my three kids). The situation in London is far worse than the rest of the UK (see graph, right, from the Nationwide database) but everywhere things are pretty tough.

When apportioning blame for the housing crisis, too much weight is placed on the undersupply of houses – the very notion of undersupply is open to question, as Andrew Lilico brilliantly pointed out here. It’s also easier to blame Nimbys than it is to work out how asset prices have been hurt by rock-bottom interest rates and 2pc mortgages (see below).

UPDATE: The problem is particularly bad in London, where most policymakers and national journalists live. In the FT, Merryn Somerset Webb says she’s still down about 15pc on the Edinburgh house she bought 15 years ago and the below tweet is a reminder that many parts of the country remain froth-free.

But the slowdown of house buildings certainly is a distinguishing factor in modern Britain, and one that looks anomalous in a historical context.

Comments