Many people around the world were glued to their screens in horror on 4 March, as they watched Russian shells raining down on Ukrainian cities. On a trading floor in central London, the oil traders at Shell were also glued to their screens – but watching the price of Russian oil. It was becoming a lot cheaper than normal (Brent) oil, due to the understandable reluctance to support Putin. But then again, everyone has their price.

The Shell traders watched, and waited, as every minute the price was lowered further– to a $23 a barrel discount, then a $24 discount, then a $25 discount. Finally, at around 4 p.m., the traders could no longer resist. They agreed to buy the Russian oil at $28.50 below the world oil price (then just over $118). They had picked up Putin’s oil for $20 million less than they’d normally pay for a cargo of 730,000 barrels.

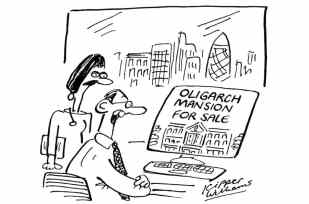

It wasn’t the first time commodity traders had found an opportunity for profit in Vladimir Putin’s Russia. Not all traders work for high-profile companies or fear censure. Indeed, such commodity traders had probably done more to help Putin remain in power than anyone else in the international business community since the West imposed sanctions on Russia in 2014 over the annexation of Crimea. Few outside the natural resources industry even know their names. And yet, as their recent history in Russia demonstrates, they wield enormous influence in the modern world.

Take Glencore, the world’s largest commodity trading company. Five years ago, it stepped in to help the Russian state raise $11 billion, putting together a consortium with the Qatari sovereign wealth fund to buy a stake in its energy giant Rosneft. Putin was so appreciative that he personally awarded Ivan Glasenberg, the trading house’s then chief executive, a medal at a ceremony in the Kremlin. Glencore is a FTSE 100 company owned by many UK pension funds: the odds of you personally owning a bit of Glencore (albeit indirectly) are quite high.

Trafigura, another leading trading company, even more recently bought 10 per cent of Rosneft’s flagship oil project, Vostok Oil, for €7 billion and has become one of the largest shippers of Russian oil. Its chief executive, Jeremy Weir, was quite open about why the company increased its dealings with Rosneft after the sanctions in 2014, saying that ‘We have seen a niche.’ And Vitol, the largest oil trading house, whose top executives work at an office a few yards from Buckingham Palace and who have been major donors to the Conservative party, invested in a €3.5 billion stake in Vostok Oil just last October.

There’s no suggestion that any of these deals were in breach of sanctions in place at the time. Still, it’s incontrovertible that a few commodity traders have got rich selling Russia’s resources. In the process, they have ensured that the cash has continued to flow to the Kremlin’s coffers.

The commodity traders’ mastery over the world’s essential goods gives them a significant geopolitical role. They help decide the outcome of wars and revolutions, they empower kleptocrats and dictators. They’ve become integral parts of the global financial system. In a way, they helped design it. Long before Putin came to power, commodity traders such as Marc Rich and David Reuben stepped in to smooth the transition from state-run Soviet economics to free-for-all capitalism – and in the process, laid the foundations for the system gamed by the oligarchs to such striking effect.

Traders help decide the outcome of wars and revolutions, empowering kleptocrats and dictators

The question is: what will they do this time? Get in line behind western policy or subvert it, and help Putin find new buyers to keep his war machine running?

Commodities are the bedrock of the Russian economy, with oil exports of about eight million barrels a day – making it second only to Saudi Arabia in importance for the global markets. But Russia is not just a powerhouse in oil: it is also the world’s largest exporter of gas, accounting for 25 per cent of global trade, as well as the top exporter of wheat and palladium, and an important supplier of aluminium, coal, copper, corn and nickel. Some 40 per cent of government revenue comes from selling oil and gas. Its commodity exports are worth more than a billion a day.

Boris Johnson has said he’ll stop the UK from importing Russian oil, which is significant given that it accounts for 13 per cent of our imports. When it comes to gas, Britain is less reliant on Russia, importing just 3 per cent. Germany, meanwhile, looks to Russia for almost half its gas, while for other countries, it’s a lot more. The European Union said this week that it aims to cut its consumption of Russian gas by two-thirds by the end of the year, but it’s not quite sure how. Householders are being asked to turn their thermostats down one degree, and countries are being asked to import more gas from Africa and America. But with Germany agreeing not to activate the Nord Stream 2 gas pipeline from Russia, the situation does seem to be serious.

In the two weeks after the invasion of Ukraine, a significant share of Russia’s commodity trade seized up. This was partly due to western sanctions, but also to a striking trend: what traders refer to as ‘self-sanctioning’. Ship-owners are refusing to allow their vessels to call at Russian ports. Insurers are refusing to underwrite the shipments – and banks are refusing to finance them. Even some of the largest traders have come out against Russia’s invasion. It’s a striking shift for an industry that has long put profit above politics, dealing happily with everyone from the Soviet Union to apartheid South Africa, from Pinochet to Castro.

Glencore says it ‘condemns the actions taken by the Russian government against the people of Ukraine’, and is reviewing all its activities in Russia. Trafigura says it is ‘reviewing’ its Vostok Oil investment. When it comes to their role in the export of Russian oil, however, the traders are more circumspect. Many have long-term contracts with Russian companies such as Rosneft, and intend to continue fulfilling them – as long as sanctions don’t prevent them from doing so.

Ships are continuing to load today with oil that was bought weeks ago, but almost no new deals for Russian oil have taken place since the invasion. Loading schedules used by traders to plan their shipments show that after 15 March, numerous oil cargoes have yet to secure a ship to load. That points to a drop-off in Russian exports of at least 20 per cent, although traders say it could be more. Something similar is occurring in grains and metals, although for now gas and oil shipments by pipeline are continuing.

Indian and Chinese buyers may yet step in and profit from discounts on offer for Russian oil, but so far they have been sitting on their hands. Shell’s deal to buy discounted Russian oil was an exception. And it caused an immediate backlash, with Ukraine’s foreign minister taking to Twitter to ask Shell whether the oil it had bought smelt like ‘Ukrainian blood’. After five days of relentless criticism, Shell apologised. The company said that its decision to buy a cargo of Russian crude ‘was not the right one and we are sorry’. Shell has now pledged to stop buying from Moscow.

So if this is for real – if both countries and traders are steering clear or Russia – it will punish Putin, but also the rest of the world. Supplies are drying up, wholesale prices are surging – and soon this will feed into costs. Surging oil prices will mean significantly more expensive petrol and diesel. Pain goes beyond the pump, extending to bread and many other goods that include commodities Russia produces. Over time, it will also extend into energy bills: the average household now pays £1,300 a year and a recent estimate by Investec says it could more than double to £3,000.

If this continues and Russian commodities stay off the market, global prices will go much higher. Putin has threatened to respond by cutting basic gas supplies to the continent – including via the Nord Stream 1 pipeline to Germany. Oil prices of $150 or $200 don’t seem out of the question, pushing inflation even further. The ‘stagflation’ of the 1970s oil crises could make a comeback. Saudi Arabia could cushion the blow, as the kingdom has the ability to boost production. But for now Riyadh (which is an ally of Moscow within the Opec oil cartel) has refused, siding with the Kremlin in all but name.

And the impact is likely to be more than economic. The countries of North Africa and the Middle East are highly dependent on Russia and Ukraine for wheat imports: it was a Russian drought in 2010 that caused a rise in bread prices that was one of the triggers of the Arab Spring. Wheat prices today are 55 per cent above that 2010 peak.

A full embargo on Russia’s commodity exports is quite possible. But if Boris Johnson and others are committed to sticking with it, they should prepare the public for the economic storm that will inevitably follow.

Comments