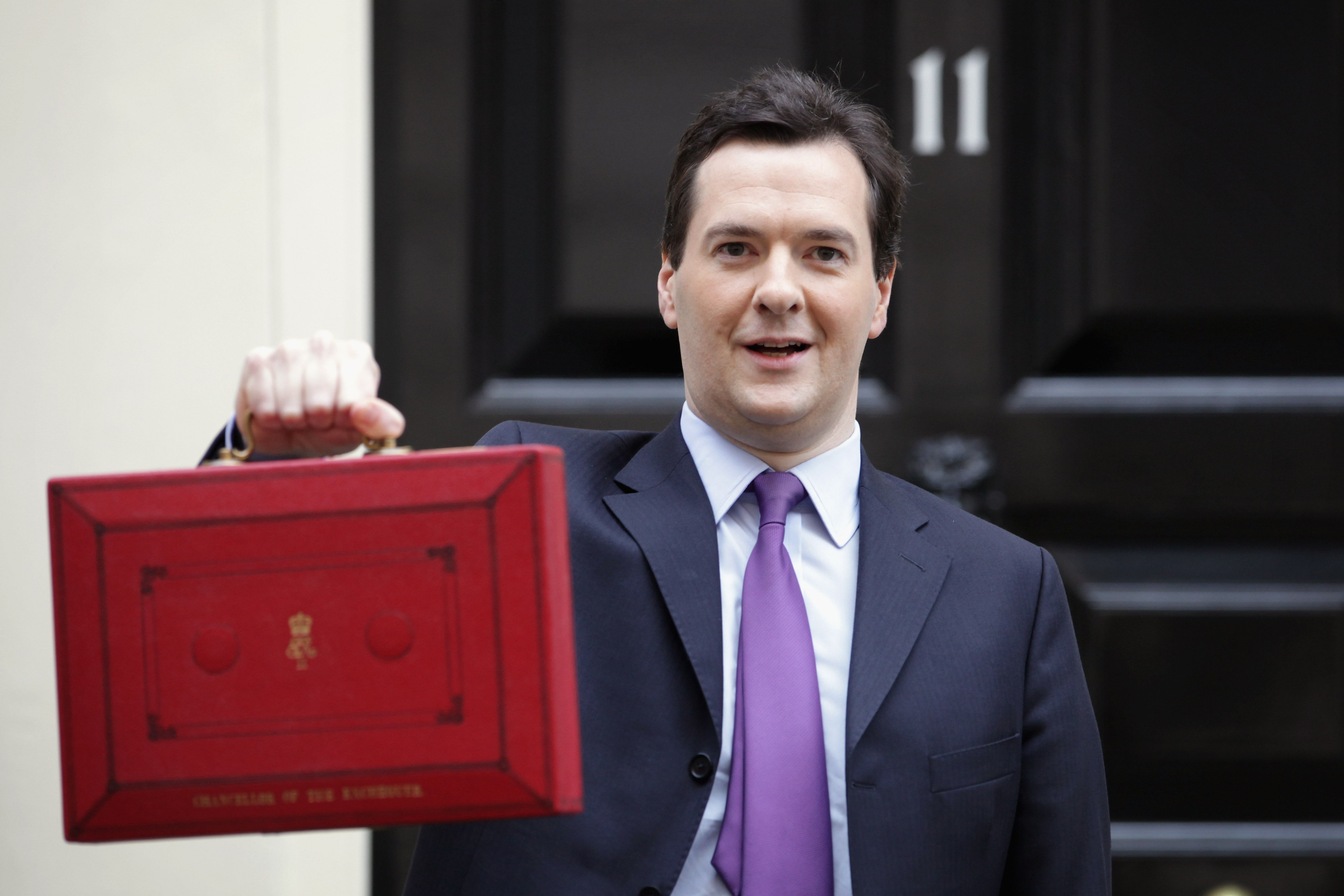

Just like fuel duty, George Osborne can’t shake off the fury and discontent over the 50p tax rate. This

morning, in a letter to the Telegraph, 537 bosses of

small-to-medium-size businesses have called on the Chancellor to drop the rate. ‘The tax, which is in effect a 58p tax after national insurance is taken into account,’ they note,

‘puts wealth creators like us in a very awkward position.’

Usually, it’s easy to be both sceptical and dismissive of these mass-signed letters. They tend to be party

political constructs, such that another group of ‘experts’ will soon reply to profess the opposite. But this one is different, and could help cast the whole battle over 50p in a

fresh light. This isn’t bankers or the mega-rich complaining about high taxes, but everyday entrepreneurs and SME owners — and few parties want to make an enemy of them. Hence why even Labour

are responding positively to the letter this morning, albeit by calling for a reduction in VAT rather than in the 50p rate.

The question, though, is how the government will respond. Their official position remains the same: that they’re waiting for HMRC’s review into the rate, which is expected to show that it’s

raising less revenue than expected. But what then? Do they keep it, on the grounds that

it is raising some revenue and that ‘we’re all in this together’, etc. etc. Or do they start moving to drop it, mindful of the wider argument — expressed in today’s letter —

that it’s bad for business and growth, if not the Exchequer’s short-term balance sheet.

The fear for those SME owners will be that the Treasury chooses not just the former option, but tries to maximise revenues by closing off loopholes and introducing other taxes too. As the IFS pointed out recently, there are various ways of eking more money out of the 50p rate, but that doesn’t mean it’s the ‘least harmful’ way of raising that money. In the end, ‘can’ isn’t the same as ‘should’ — just as revenues aren’t the same as growth.

Comments