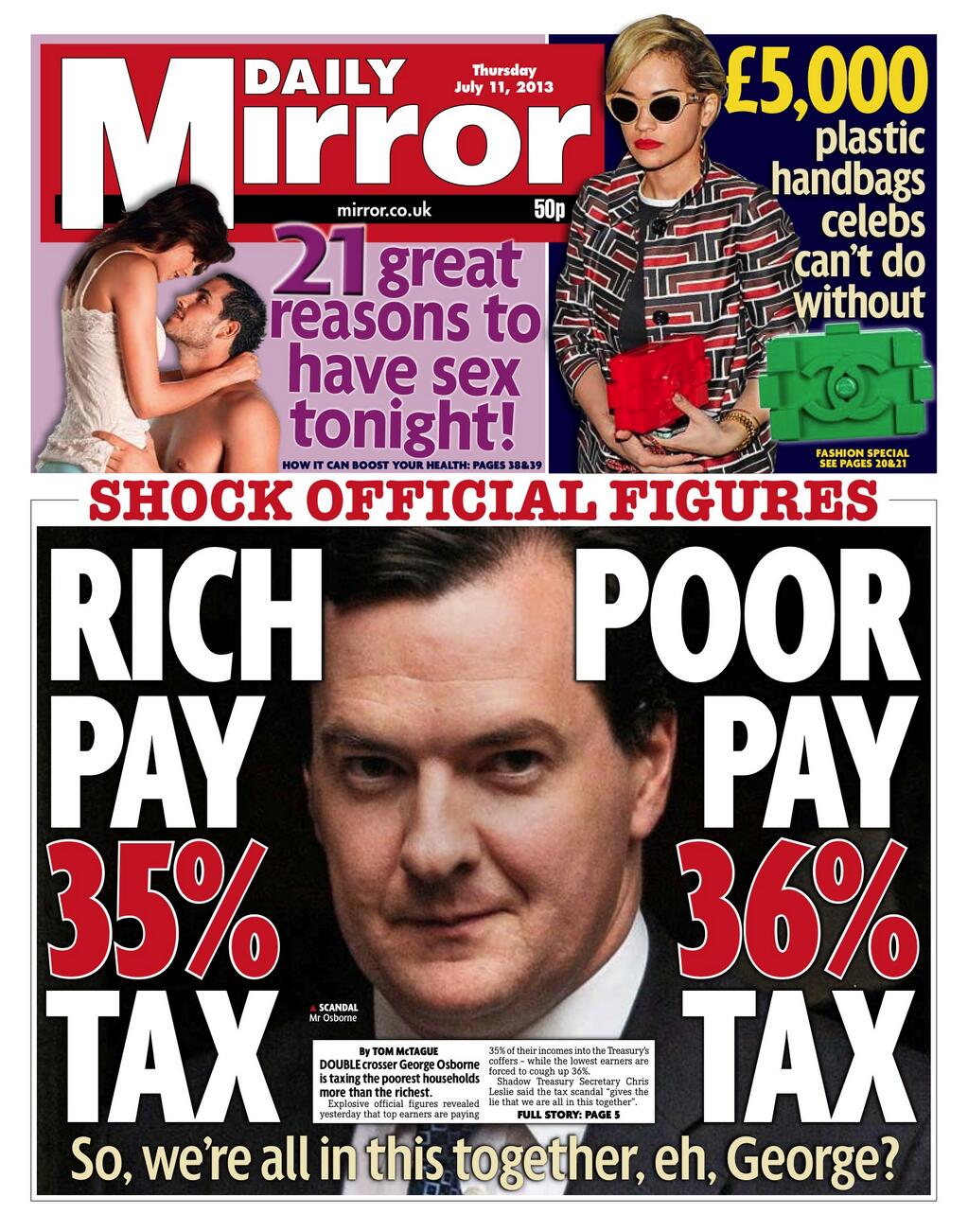

Today’s Daily Mirror has exposed half a scandal: that the tax changes under this government have hit the poor harder that the rich. That’s what you get when you jack up VAT: it hits everyone, but will hit the poor proportionally harder. But this year, the lower-paid half of British workers will be asked for less than 10pc of all income tax collected, the lowest proportion ever. The richest 1pc will contribute almost 30pc, the highest in recorded history. Osborne is actually squeezing the rich harder than any Labour Chancellor ever did (that’s what you get when you cut the top rate of tax). The ONS yesterday published figures suggesting that the top 20pc pay 35pc of their income in tax, and the poorest 20pc pay 36pc, when all taxes etc is considered. That tiny difference is enough for it to justify a cover story.

But here is the real scandal. If you’re doing low-paid, part-time work – and many millions have no choice but to do that – then the government will impose a de facto tax rate of up to 84pc on extra earnings depending on your circumstances. Here’s an example:-

Would you do extra work at a 84pc tax rate? I know I wouldn’t. No wonder immigrants (who get to keep most of the extra money they earn) are still coming in such numbers. The fault does not lie with lazy Brits but a cruel and purblind welfare system which is being reformed far too slowly. The above graph shows the real situation confronting Daily Mirror readers and others, yet it is never replicated by governmental authorities. Its a graph that shows a deeply inconvenient truth. As a result, our political leaders are – in the most part – blind to this hideously unfair system which is still, three years into the government, keeping the poor down. In fact, if you look at it a certain way, some marginal rates are as high as 98pc. David Cameron once said something to say about this.

“Thirty years ago this party won an election fighting against 98 per cent tax rates for the richest. I want us to show even more anger about 98 per cent tax rates for the very poorest in our country!”

Precious little sign of that anger now. Osborne has lowered the marginal rate for the rich, and it has worked. The effective marginal tax rates confronting the poor, meanwhile, are higher than ever. There doesn’t seem to be as much urgency.

This, of course, is the problem which Iain Duncan Smith’s Universal Credit is intended to solve. That is why it’s so sad that the project is moving at such glacial pace. It has never been more urgently needed.

PS Ryan Bourne, my colleague at the CPS, gives his take here. And here’s what the 1pc pay in tax, over the years:-

Comments