With about 5,000 people being laid off every day, it sounds strange to talk of an economic recovery – as Stephen Timms did at the World at One. But he’s right. I reckon that, even now, the recession is over and that the economy will be shown to have grown in Q3 – ie, July, Aug and Sep. This is, of course, just the end of the beginning. We will have started the long crawl to recovery – and it will be about five years before the British economy gets back to where it was before the downturn. So it is a rash politician who will say “all clear, recession over” – unemployment will keep rising until about the middle of next year and then may take a very long time to recover. We are used to relatively quick economic recoveries – as per the early 1980s and 1990s. But inflation-induced recessions are far easier to fix.

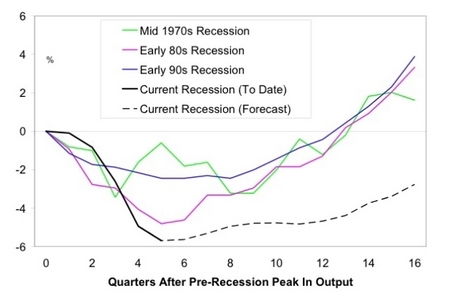

Debt-induced recessions, like this one, can be cured only by paying off money we owe. I first thought that this payback would be done very quickly, making the current recession more painful but recovery in two or three years. It now seems that we have bottomed out (helped by cheap borrowing and an avalanche of freshly-printed money); but it will take five or six years to get back to the peak of the Brown bubble. So the recession may be over; but, as the below graphs from Citi (first) and the IMF (below) show, we have just started a miserable new journey.

Comments