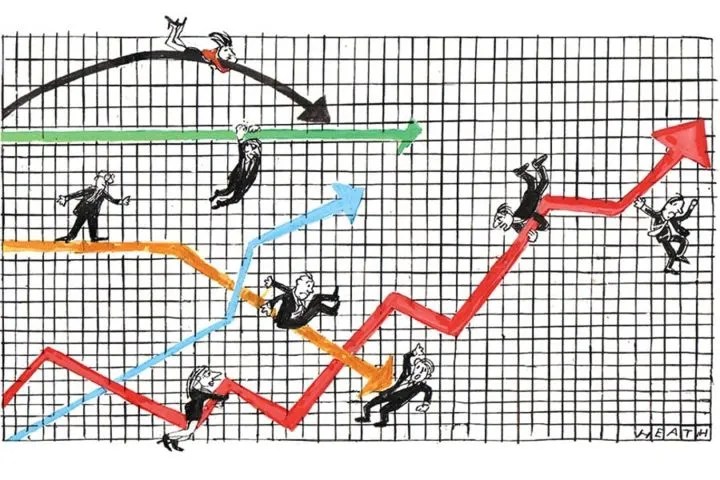

Another day, another all time high. As the week closed, the FTSE 100 index hit 8,433 — the highest level it has ever reached — and this is turning into a regular occurrence. The FTSE has now hit 11 all-time-highs over the last month, and it is close to equalling the record set way back in 1984 of 12 all-time-highs within a single four-week period. Add in a mega-bid and better than expected growth figures and it may look as if the UK is booming again.

Well, perhaps. In reality, however, all that is happening is that the FTSE 100 is finally recovering from two decades of miserable under-performance — and it would have to go a lot higher to break any real records.

The FTSE 100 would have to go a lot higher to break any real records.

There is no question the UK equity market is having a moment. It is up by 10 per cent since the start of the year, and breaking decisively though the 8,000 barrier for the first time. The Australian mining conglomerate Broken Hill Proprietary (BHP) has offered £31 billion for its London-listed rival Anglo American, and there is now the prospect of a three-way bidding war. There are tentative signs that global investors are getting interested again. After years of stagnation, with Paris over-taking London in total value and companies leaving to get better valuations elsewhere, it is starting to look like things have turned a corner.

The trouble is the FTSE 100 is a long way from where it should be. It has underperformed for more than two decades. It hit 6,930 on the last trading day of the 1990s, and it has drifted aimlessly since then. For a comparison, the S&P 500 index in the US has risen from 1,447 to 5,200, more than tripling over that time. The tech-based Nasdaq is up from 4,000 to 16,000. Here in Europe, Germany’s DAX index, which has also been hitting fresh all-time highs, has risen from 7,400 to 18,700, while France’s CAC-40 has gone from 5,400 to 8,200. Placed in that context, it is clear how badly the FTSE has done. It has underperformed for years.

With the UK’s departure from the EU, and a bewildering succession of prime ministers, most global fund managers regarded the UK as too bonkers a place to put their money. Over the last few weeks, however, they have started to notice the British market is very, very cheap compared with its major rivals. And there is nothing an investor likes more than ‘cheap’. The money is starting to flow back in — but we should not kid ourselves that it marks any real improvement yet. When the FTSE 100 hits 15,000 it will be time to start celebrating a record high. Until then, it is just making up for twenty years of miserable returns.

Comments