There was much sly amusement earlier this week when George Osborne, responding to the latest growth figures, described Britain as “a safe haven in the storm”. The idea that our high

inflation, low growth economy might be a “safe” anything seemed, to many, a grotesque idea. But, in truth, the Chancellor may have had a point — and it’s a point that he’ll want to

make again and again as the recovery stumbles on, and as other indicators fluctuate against him.

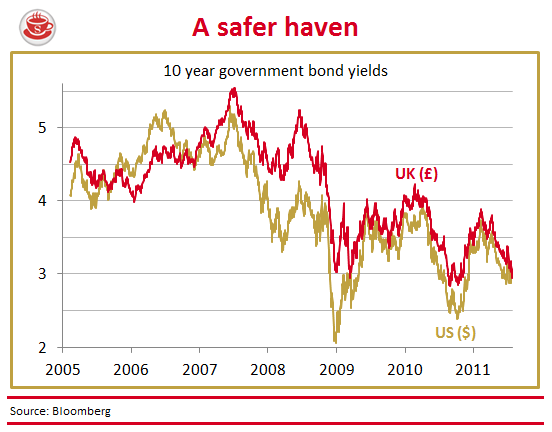

What the Chancellor was referring to, I’m sure CoffeeHousers know, is the interest rates set by the markets on the UK bonds that fund our borrowing. Broadly speaking, the higher the rates, the less certain our creditors are that the Exchequer can meet its debts. The lower, the more confidence they have in our creditworthiness. So we ought to take some heart from the graph above, which shows that the rates on benchmark 10-year bonds are on a downwards trajectory, and pushing towards their lowest level for years. The cost of borrowing is going down despite our swelling debt burden.

I mention this now because a minor, and fairly infrequent, milestone has been passed over today and yesterday: the rates on UK 10-year bonds are now falling below their US equivalents (see here and here, at time of writing). It may not tell the whole story about out economy, and it may have something to do with America’s ongoing political conflict over debt. But it’s a solace for Osborne nonetheless.

Comments