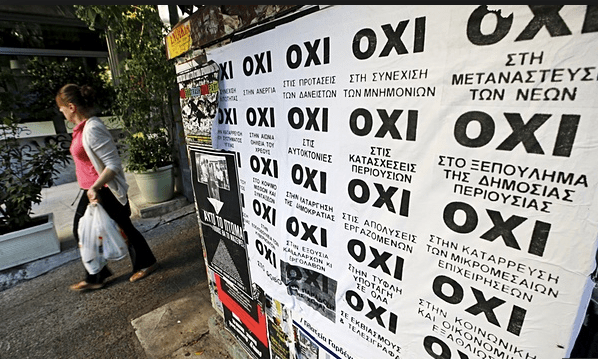

In a landslide vote, the Greeks have said ‘no’ to the latest EU bailout deal – and, perhaps, to the Euro itself. Alexis Tsipras will stay as Prime Minister, and treat the result as a mandate to negotiate a better deal. But that’s not how the Germans see it: their economic affairs minister, Sigmar Gabriel, has just told the Tagesspiegel newspaper that the Greek ‘no’ has just ‘torn down the last bridges on which Greece and Europe could have moved towards a compromise’ and furthermore:

‘With the rejection of the rules of the eurozone … negotiations about a programme worth billions are barely conceivable.’

So events may now well spiral out of anyone’s control. Here’s what we’re facing…

1) Huge inflation, mass unemployment: Greece now faces its nightmare scenario. A recent poll showed 80pc of Greeks want to stay in the Euro, but by voting ‘no’ they may now be kicked out. There’s no formal way of doing this, but quite a few informal ways. Jean-Claude Juncker, EU president, has already said that a ‘no’ vote means ‘Greece is saying no to Europe’. The Greek Central Bank agrees. Here is its stark warning on what could now follow:

Failure to reach an agreement [with its creditors] would mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country’s exit from the euro area and – most likely – from the European Union. A manageable debt crisis… would snowball into an uncontrollable crisis. An exit from the euro would only compound the already adverse environment, as the ensuing acute exchange rate crisis would send inflation soaring. All this would imply deep recession, a dramatic decline in income levels, an exponential rise in unemployment and a collapse of all that the Greek economy has achieved over the years of its EU. From its position as a core member of Europe, Greece would see itself relegated to the rank of a poor country in the European South.

2) European markets will take a hit when they open tomorrow. They had banked on a ‘yes’ vote, given how high the stakes are. ‘The majority of our clients went into the weekend expecting a ‘yes’ result,’ said Goldman Sachs’s Francesco Garzarelli earlier today. Now the Euro, equities, bonds – everything will be sent sprawling, and the volatility will last for some time. The Euro has already fallen 1pc against the dollar (below).

3) Risk of contagion. The chaos won’t be confined to Greece, especially if markets think other austerity-hit countries will be inspired by Syriza’s antics: Italian bonds took a hit last week when the Greek referendum was called. Spanish bonds will look vulnerable too, given that a poll published by El Pais yesterday pointed to a Socialist/Podemos coalition. Hundreds of Podemos supporters gathered in Madrid today urging a Greek ‘no’. All this raises the prospect of a Spanish rerun of the Syriza drama. Here’s the El Pais poll:

4) There will be pressure for the Greeks to start printing the ‘New Drachma’. Designs have already started to circulate (below). Greece has the power to do bring back the drachma under international public law, known as Lex Monetae. If the drachma does return, perhaps as the only way to supply cash to the banks, its value would likely fall by up to 40pc. So any Greek who owes money in Euros sees the value of that debt surge by 66pc; similarly, exports (and holidays) become 40pc cheaper. The hope would be that an export-led stimulus begins: a long road to recovery. While benefits would take years to emerge, the pain would be deep and immediate.

5) The ECB will have to increase the risk premium on any money loaned to Greek banks. You don’t need a PhD in economics to work out that investing there has just got a lot riskier. The ECB is guided by rules, so cannot use discretion to keep providing emergency liquidity assistance (ELA). It if does the Greeks any favours, it may end up violating EU law, which bans monetary financing. The ECB simply needs to see that there is either a deal on a table, or progress to a deal. Neither look likely. Greece defaulted on an IMF loan last Tuesday. On 20 July, it needs to repay €3.5 billion to the ECB; that’s unlikely to happen.

6) Greek banks are unlikely to open  tomorrow – or on Tuesday, as Tspiris had predicted. The ATMs that are supposed to be issuing €60 a day at the moment could well run dry tomorrow. Here’s Constantine Michalos, head of the Hellenic Chambers of Commerce:

tomorrow – or on Tuesday, as Tspiris had predicted. The ATMs that are supposed to be issuing €60 a day at the moment could well run dry tomorrow. Here’s Constantine Michalos, head of the Hellenic Chambers of Commerce:

“We are reliably informed that the cash reserves of the banks are down to €500m. Anybody who thinks they are going to open again on Tuesday is day-dreaming. The cash would not last an hour.”

7) Eurozone parliaments will resist any further bailouts. The old deal is just not on the table anymore: that ship has left the harbor. Tspiris will want more ECB liquidity into the banking system; in other words, a third bailout. But can anyone see Eurozone parliaments giving their approval? Look around. The Finns (like the Danes) now have a more Eurosceptic government. Francois Hollande is terrified of Madame Le Pen – whose National Front is having a field day with all of this. She has already hailed the Greek ‘no’, saying the next task is to…

‘organise the dissolution of the single currency system, which is needed to get back to real growth, employment and debt reduction.’

Wolfgang Schaeuble, Germany’s finance minister, known for having little sympathy with the Greeks, has seen his approval rating soar to a record 70pc. The same poll showed Germans split, 45/45, on whether Greece should stay in the EU. The front page of tomorrow’s Bild (right) says: “Greeks celebrate their ‘no’. What now, Chancellor?”

minister, known for having little sympathy with the Greeks, has seen his approval rating soar to a record 70pc. The same poll showed Germans split, 45/45, on whether Greece should stay in the EU. The front page of tomorrow’s Bild (right) says: “Greeks celebrate their ‘no’. What now, Chancellor?”

What indeed. She’s meeting Hollande tomorrow, and has called crisis talks for Tuesday. It’s going to be an interesting week.

Comments