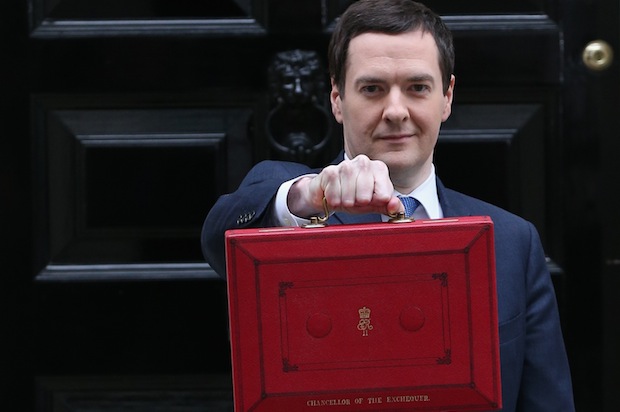

1. Two million more top-rate taxpayers

The number of people paying tax at the 40p or 45p rates is to increase by two million under the coalition, going from 3.3 million in 2010-11 to 5.3 million in 2015-16. If the coalition had stuck with the tax policy they’d inherited, there would be 1.3 million fewer top-rate payers at the general election.

2. Permanent giveaways, temporary taxes

At the Budget, George Osborne promised £4.9 billion of permanent giveaways, including another increase in the personal allowance to £10,500 from April 2015, an increase in ISA limits to £15,000, a reduction in the tax on savings income and reductions in alcohol duties. But there were only £0.7 billion worth of permanent tax increases to pay for them – the rest will be covered by bringing tax forward and cutting more.

Measures such as taking money from tax avoiders and making them claim it back through the courts if they think they’ve been unfairly treated and changing tax on pensions drawdowns will raise money in the short-term, but are at best neutral overall. In his Budget red book Osborne gave numbers for what his reduced tax on pensions withdrawals will raise, and it reached £1.2 billion in 2018-19. He didn’t show it dropping like a stone after that, and eventually losing the government money.

As the IFS’s Gemma Tetlow put it: ‘The Chancellor’s been getting into some bad habits’ with ‘temporary measures paying for permanent giveaways’.

3. Personal allowance increases cost as much as the VAT increase raised

Increases to the personal allowance came in for some criticism – the level has got so high that rises no longer help those on low incomes. But the IFS also revealed that the cost of increasing the personal allowance has almost swallowed up the money raised by lifting VAT to 20 per cent.

4. The government’s tax and benefits changes have stung the worse-off

The richest 10 per cent of people have been hit hard by the coalition’s tax changes, but so have the very poor. The poorest decile have lost almost 5 per cent of their income thanks to the government’s changes to taxes and benefits, while the government’s changes have hit the average person’s income by about 3 per cent.

Comments