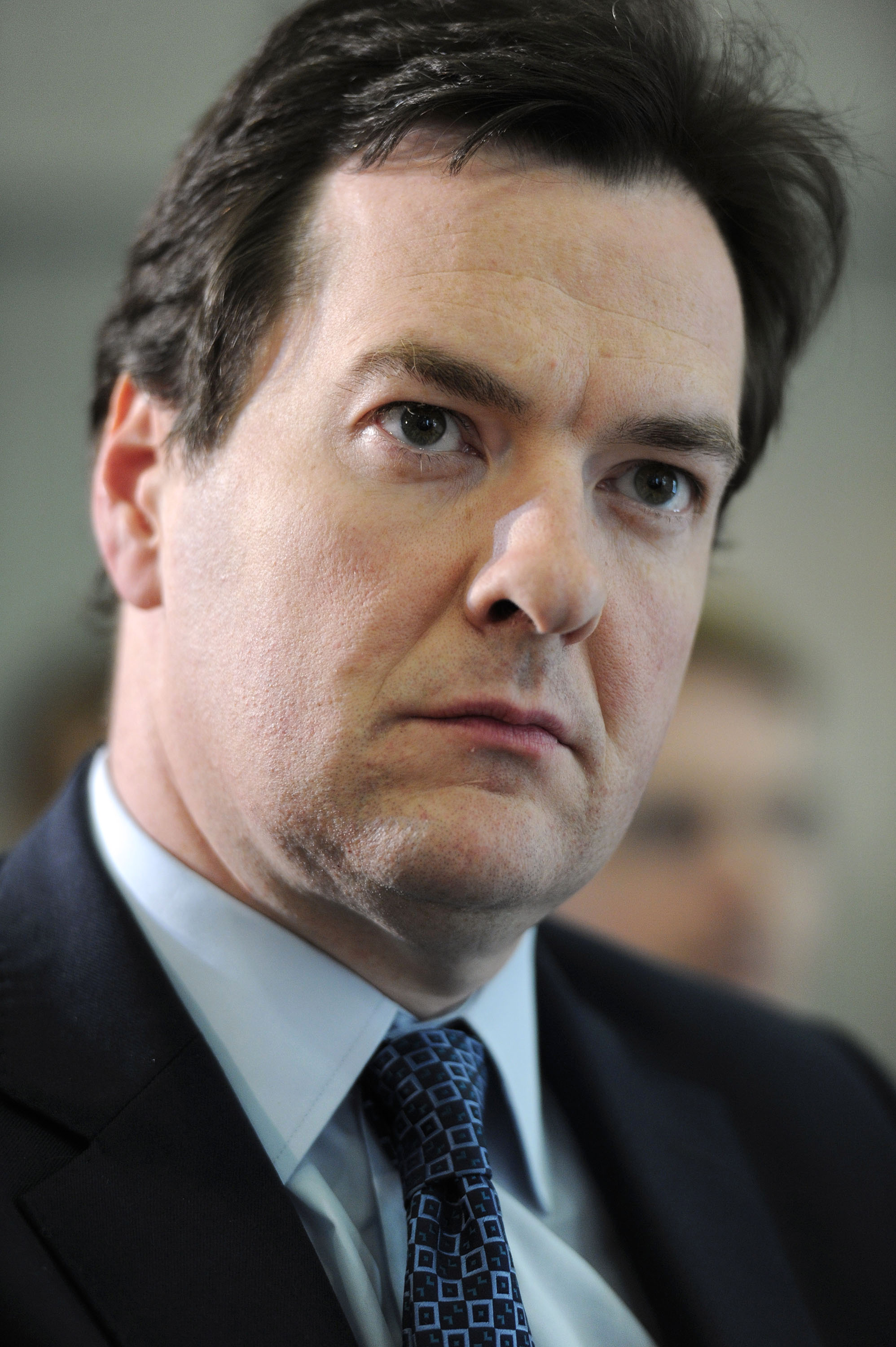

A bet-hedging sort of report into the UK’s economy from the IMF today, which largely supports George Osborne’s deficit reduction plan, but will also give some encouragement to his detractors. By way of a summary, here are the parts that might satisfy Osborne himself, as well as Vince Cable, Ed Balls and Mervyn King:

The passage that the Chancellor will flash around Westminster

comes on the very second page of the IMF document. “Strong fiscal consolidation is under way,” it reads, “and remains essential to achieve a more sustainable budgetary

position, thus reducing fiscal risks.” And the endorsements for the Chancellor’s deficit reduction plan continue inside, not least in the claims that the public finances were treading a

“clearly unsustainable path” before last year’s Emergency Budget, and that “the overall focus on expenditure reduction appears appropriate, as cyclically adjusted

spending rose by 9 percent of GDP over the last decade.”

The passage that the Chancellor will flash around Westminster

comes on the very second page of the IMF document. “Strong fiscal consolidation is under way,” it reads, “and remains essential to achieve a more sustainable budgetary

position, thus reducing fiscal risks.” And the endorsements for the Chancellor’s deficit reduction plan continue inside, not least in the claims that the public finances were treading a

“clearly unsustainable path” before last year’s Emergency Budget, and that “the overall focus on expenditure reduction appears appropriate, as cyclically adjusted

spending rose by 9 percent of GDP over the last decade.”

As for the wider economic picture, there is a good dose of optimism in the IMF’s forecasts: “[Our] central scenario is that rebalancing occurs and financial sector health continues to improve,” they say. “In this scenario, [we] project growth — led by investment and net exports — to gradually rise from 1.5 per cent in 2011 to around 2.5 per cent over the medium term.” And although they add that this central scenario might be upset by external shocks, such as the eurozone crisis, the overall emphasis is on a return to relative health within the next couple of years.

If Corporal Cable were scrabbling around for more ammunition in

his war against the banks, then he might reach for the IMF’s observation that “credit availability has improved for large companies, but remains restrictive for smaller businesses and for

CRE companies.”

If Corporal Cable were scrabbling around for more ammunition in

his war against the banks, then he might reach for the IMF’s observation that “credit availability has improved for large companies, but remains restrictive for smaller businesses and for

CRE companies.”

But I imagine he’ll be even more pleased with the organisation’s call for further quantitative easing should the recovery go awry, as recently recommend by one Vince Cable. In a blog post to accompany today’s report, the IMF’s mission chief to the UK writes that, “The U.K. government should be nimble in its policy response if it looks as though the economy is headed for a prolonged period of weak growth, high unemployment, and subdued inflation. Currently, we don’t expect this scenario to happen. But if such a scenario appears to be in prospect, we recommend responding quickly with some combination of further quantitative easing by the Bank of England and temporary tax cuts.”

Ed Balls will feast enthusiastically on one point within the IMF

document: that VAT hikes hurt growth. Not that the monetary-funders put it quite like that, of course. But they do come close to it in their suggestion that, “[The recent] slowdown [in

growth] partly reflects intensifying fiscal consolidation — most notably with a 2.5 percentage point VAT hike on January 1, 2011 — and weak consumer confidence in the wake of spiking

import prices and a soft housing market.” And then there’s the line that, “Unlike in other countries, indirect tax hikes have been a key driver of UK inflation. They include VAT

hikes of 2.5 percentage points each in January 2010 and January 2011”

Ed Balls will feast enthusiastically on one point within the IMF

document: that VAT hikes hurt growth. Not that the monetary-funders put it quite like that, of course. But they do come close to it in their suggestion that, “[The recent] slowdown [in

growth] partly reflects intensifying fiscal consolidation — most notably with a 2.5 percentage point VAT hike on January 1, 2011 — and weak consumer confidence in the wake of spiking

import prices and a soft housing market.” And then there’s the line that, “Unlike in other countries, indirect tax hikes have been a key driver of UK inflation. They include VAT

hikes of 2.5 percentage points each in January 2010 and January 2011”

But aside from VAT, Balls might also take hypocritical glee from the IMF’s prediction that Osborne will struggle to meet his deficit reduction targets on time. According to their forecasts, the UK’s structural deficit will be eradicated during 2015-16, over a year after Osborne’s plan. Presumably, this is because: “As consolidation becomes more reliant on structural spending cuts going forward, implementation challenges may rise” — a crucial point that we have raised on Coffee House before now. (The New Statesman’s George Eaton has more on this here)

Mervyn King’s argument on inflation has effectively been that we

shouldn’t worry about it unduly; that it’s down to a range of temporary factors, and should simmer down towards target levels next year. And, happily enough, the IMF’s argument on inflation is that

we shouldn’t worry about it unduly; that it’s down to a range of temporary factors, and should simmer down towards target levels next year. Or as they put it in today’s report: “The

inflation overshoot is driven largely by transitory factors, and hence maintaining the current scale of monetary stimulus is appropriate given fiscal adjustment and subdued wage growth.”

And they add, with regards to interest rates: “The current monetary stance remains appropriate for now. The BoE[‘s] highly accommodative stance is appropriate given the central scenario

projection that inflation will return to target within a reasonable timeframe, the uncertainty regarding the strength of recovery, and the need to offset significant disinflationary impulses from

fiscal policy.”

Mervyn King’s argument on inflation has effectively been that we

shouldn’t worry about it unduly; that it’s down to a range of temporary factors, and should simmer down towards target levels next year. And, happily enough, the IMF’s argument on inflation is that

we shouldn’t worry about it unduly; that it’s down to a range of temporary factors, and should simmer down towards target levels next year. Or as they put it in today’s report: “The

inflation overshoot is driven largely by transitory factors, and hence maintaining the current scale of monetary stimulus is appropriate given fiscal adjustment and subdued wage growth.”

And they add, with regards to interest rates: “The current monetary stance remains appropriate for now. The BoE[‘s] highly accommodative stance is appropriate given the central scenario

projection that inflation will return to target within a reasonable timeframe, the uncertainty regarding the strength of recovery, and the need to offset significant disinflationary impulses from

fiscal policy.”

Whether that vindicates the Bank, we shall see. They have, after all, had a horrible tendency to underestimate our country’s inflationary problems in recent years.

Comments