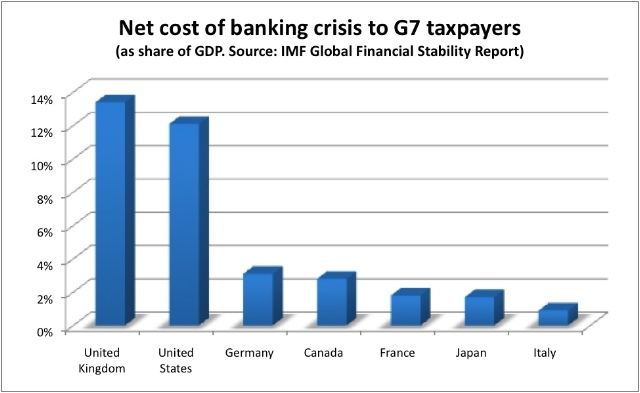

Forget the Budget. The IMF’s Global Financial Stability Report has just produced the figures Gordon Brown didn’t want you to read: the cost to the UK taxpayer of the banking crisis. The Treasury’s approach is to airbrush banks out of the picture, and kid us on that we’ll get the money back eventually. The IMF gives it to us straight. It estimates (p44, pdf) that when this is over British taxpayers will have the largest bill in the G7. The bank crisis will cost the UK some 13.7% of GDP – which works out as about £190bn (see graph below). The figure for the US is 12.1% and Canada just 2.8%. Again: this isn’t a paper loss. This isn’t made-up money. This is the net fiscal cost to the taxpayer of the bank rescues: money that can only be recovered by raiding our wallets, pay packets or pension funds.

Why so big? As the IMF report makes devastatingly clear, no country has ever experienced the credit/financing dependency that the UK had developed. From page six:

“The buildup of leverage that preceded this crisis was substantial, and certainly on a par with other periods in history that have ended in a collapse in credit. Figure 1.4 compares the ratio of bank credit to GDP in the current crisis to that of Japan and Sweden in the runup to their crises in the early 1990s. Three features are apparent. First, the rise in bank credit in the UK has been massive… and greater than Japan preceding its bubble. Second, the crisis in Japan and Sweden both caused the bank-credit-to-GDP ratio to drop by a quarter. Third, Sweden achieved its deleveraging rapidly and then started to rebuild while redeveraging in Japan continued over more than a decade.”

The IMF also suggests (p xiii) that a further $250bn of capital will be needed for UK banks. Don’t expect to see any of this in the Budget – this is the truth that dare not speak its name. It is airbrushed out, there will be small print in tomorrow’s Budget saying “excluding financial interventions”. As the IMF makes crystal clear, this is anything but a footnote. The £190 bn figure is for what is described by the IMF report (p45) as “net costs of direct support to banks, expected eventual costs of guarantees; and costs, net of recoveries, of central bank liquidity provision.” When all is done and dusted, flogged and floated, the UK banking crisis will go down in history as the biggest fiscal disaster in peacetime history. And the Brown-Balls tripartite bank regulation system will go down as perhaps the biggest single calamity in modern UK economic history.

UPDATE: The Treasury was furious about this, and pulled strings in the IMF to have them pull the table I reproduce above around midnight last night. They are now talking about a £130bn hit to the UK, not one of £190bn – but there are so many variables that we should see this as two stabs in the dark. The IMF study did provide very scant figures to back up its original figure, and the FSA’s objections to a second point – that the UK will have to raise up to $250bn more – do seem fair to me. More as it develops.

Comments