Has inflation peaked in the United States? Today’s update from the Bureau of Labor Statistics shows the annual rate of inflation has fallen slightly, from 8.5 per cent in March down to 8.3 per cent in April. There are signs of slowdown in the monthly figures, too: prices rose 0.3 per cent between March and April, after rising 1.2 per cent between February and March.

The Democrats will struggle to hail this relatively small dip as any kind of meaningful victory

Still, markets don’t seem particularly encouraged by the news. US stock futures immediately took a dip when the figures landed. Emphasis seems to be on the fact that inflation once again outpaced predictions, with CPI up 0.3 per cent on the month, despite the consensus predicting a rise of 0.2 per cent.

There are still plenty of reasons to fret over rising prices. While a fall in the energy index contributed to the fall in the headline rate – gasoline prices fell by a notable 6.1 per cent last month – other prices continued to rise. Food increased by 0.9 per cent, while the food index rate on the year rose to 9.4 percent: ‘the largest 12-month increase since the period ending April 1981.’

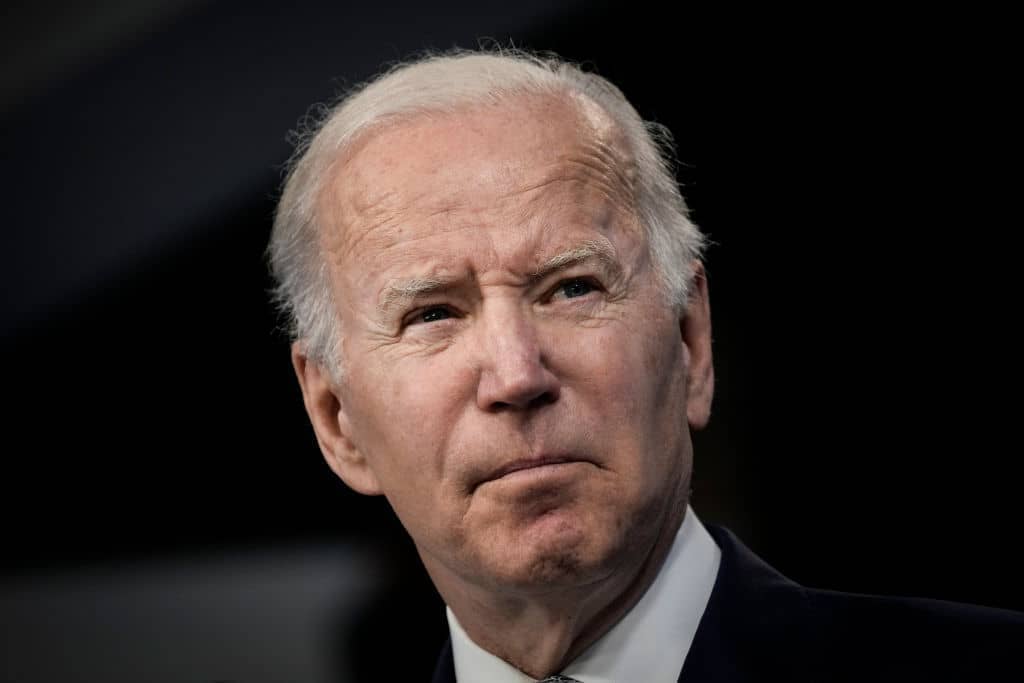

Still, this news will delight President Joe Biden and his party, which is facing huge losses in November’s midterm elections due to what Republican opponents have successfully dubbed ‘Bidenflation’. With price hikes still hovering around a 40-year-high, the Democrats will struggle to hail this relatively small dip as any kind of meaningful victory, nor is there any guarantee today’s figures start a consistent trend. But if they do, it could mean a (slightly) better economic outlook by the time the elections come around.

And what do today’s inflation numbers mean internationally? The US inflation rate has consistently been ahead of the UK rate, though until now both have been steadily going up. Up 7 per cent on the year now, the Bank of England predicted just last week that inflation in the UK will peak in double digits this autumn.

Today’s news out of the States might lead to slightly more optimistic thinking, that the global circumstances causing many of these price hikes are starting to calm, but the driving force of lowering US prices – energy costs – may only just be kicking off on this side of the pond, as the European Union prepares to fully crack down on Russian oil by the end of the year. As Europe’s energy prices all but certainly rise, the knock-on effects will no doubt be felt in the UK too.

Comments