As a general rule, it is a mistake to go through life thinking about how much one’s house is worth. In the summer of 2002, when I bought my ‘lovely end of terrace period cottage providing compact character accommodation’ in Gospel Oak, London NW5, I assumed I had managed, with unerring incompetence, to buy at the very top of the boom. It seemed to me unimaginable that anyone would be willing to spend more than the grossly inflated sum of £385,000 which I had paid for my small, damp, jerry-built house.

My imagination was defective: to my stupefaction, the property boom continued for another five years, until the collapse of Northern Rock in September 2007. So instead of avoiding thinking about the value of my house because it was worth less than I had paid, I avoided thinking about it in order not to succumb to the smug illusion that I was several hundred thousand pounds richer.

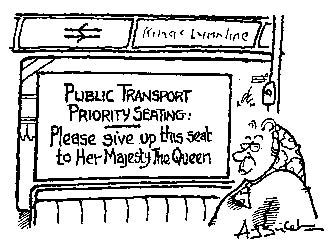

This was bound to be a transient gain, for boom would be followed by bust. Such ludicrous prices could not last: the bubble would burst, and although this would be reported as a disaster in the press, it would have the great advantage that people of modest means — nurses, police officers, bus drivers — would once again have some hope of buying a house. MPs tended not to worry very much about the hardships endured by other public servants, for our legislators had made special arrangements for themselves, and had acquired a vested interest in high house prices.

But now we come to the oddest bit: the bust has not taken place. There has been no drastic adjustment of the kind that casino capitalism ought to be so good at providing. Instead of collapsing, the market froze, and hardly any houses changed hands: in 2008, Day Morris, the small firm of estate agents in north-west London through which I bought my house, experienced an 80 per cent fall in transactions. But according to John Morris, one of the founders of the firm, prices only came down 20 per cent from the peak, and in the majority of cases they have since recovered. Mr Morris reckons my own house is now worth twice what I paid for it, and points to a smaller one down the road which is on the market at £675,000. My neighbour Bruce Robertson has done some research which shows that in 1966, the average house price in our street was £11,250 (this admittedly at a time when Camden Council wanted to knock the whole street down). How our currency has been debauched.

The national index of asking prices run by Rightmove tells a similar story to Mr Morris. The index, which started at 100 in January 2002, peaked at 197 in October 2007, fell in January 2009 to a low of 174 and last month stood at 180. In other words, houses are still about twice as expensive as they were a decade ago, and almost as expensive as they were before the run on Northern Rock. If you want to sell your house, now might not be such a bad time as you may have assumed. We are not yet in the kind of property slump seen last time round, with five years of falling prices from 1988 to 1993 and millions trapped in negative equity.

In fact, when you look at house prices as a multiple of average incomes, they remain higher than at the 1980s peak, according to Nationwide. Jeremy Grantham, a Briton who runs a Boston-based investment firm called GMO, recently told the Wall Street Journal that he regards the British property bubble as the biggest since the infamous one in Japan 20 years ago. Tokyo’s bubble, of course, deflated in fits and starts over the so-called ‘lost decade’. This could well be the trajectory on which Britain has embarked.

Gordon Brown is derided for his claim to have abolished boom and bust, but as far as house prices are concerned, he and the Bank of England appear to have managed, by a titanic effort and at ruinous cost to the taxpayer, to have postponed the bust. In the end, I believe, the fall will still happen, because the housing market cannot function as long as it excludes everyone but the very rich. But every prediction I have ever made about property prices has turned out to be wrong.

Although prices have not moved much, conditions are already quite different to those of a few years ago. Nick Reed, a young man who has worked at Day Morris for the last three and a half years, said: ‘When I started, things were very, very busy. There was generally a fight for every property, unless there was something drastically wrong with it.’

Nor is it any longer possible to obtain a mortgage for 100 per cent of the value of a property: lenders tend to demand at least a 15 per cent deposit, and even then they charge far higher than the Bank of England base rate. Among first-time buyers, this is most often provided by parents who downsize and split the proceeds among their children.

In London, foreign buyers have helped to keep prices up. Mr Morris says that in 2006 he noticed a huge influx of Americans, with quite a few Russians too, while more recently the Chinese have been buying property in central London. I cannot help feeling sorry for those British buyers who do not have rich parents and who find themselves unable to compete against wealthy foreigners. Little wonder social mobility has declined.

Mr Morris adopts a more robust attitude. He says that where there’s a will there’s a way: ‘If anybody’s motivated they will buy a house even if it means starting off with a 50:50 purchase with a housing association.’ And Mr Morris points to one of our national characteristics, namely a readiness to pay over the odds when we find a house with which we fall in love. ‘Most people do pay more than they expect to pay. If I want it, I want it, and if I can afford it I’ll do anything to get it.’

All the same, I cannot help feeling that there is something unhealthy in our willingness to spend the greater part of our lives toiling to become the owners of houses which are not in the slightest bit remarkable. Tolstoy described this better than anyone in his story ‘The Death of Ivan Ilyich’.

Ivan Ilyich is tremendously proud of his new house, but as Tolstoy says:

In reality it was just what is usually seen in the houses of people of moderate means who want to appear rich, and therefore succeed only in resembling others like themselves: there were damasks, dark wood, plants, rugs, dull and polished bronzes — all the things people of a certain class have in order to resemble other people of that class. His house was so like others that it would never have been noticed, but to him it all seemed to be quite exceptional.

That was one of the most depressing things about looking for a house: so much money had been spent in order to make most of them look identical to each other. In those days, I had a profitable line in what one of my patrons described with a merry laugh as ‘the journalism of humiliation’: the description of my failure to find somewhere for my family to live. But if it was awkward for me in the years 2000 to 2002, when I had just returned from Berlin to London, how much more difficult it must be now. It may be that a proper crash is on its way. Until we get one, London will remain a barbarously expensive city.

Andrew Gimson is the Daily Telegraph’s parliamentary sketchwriter.

Comments