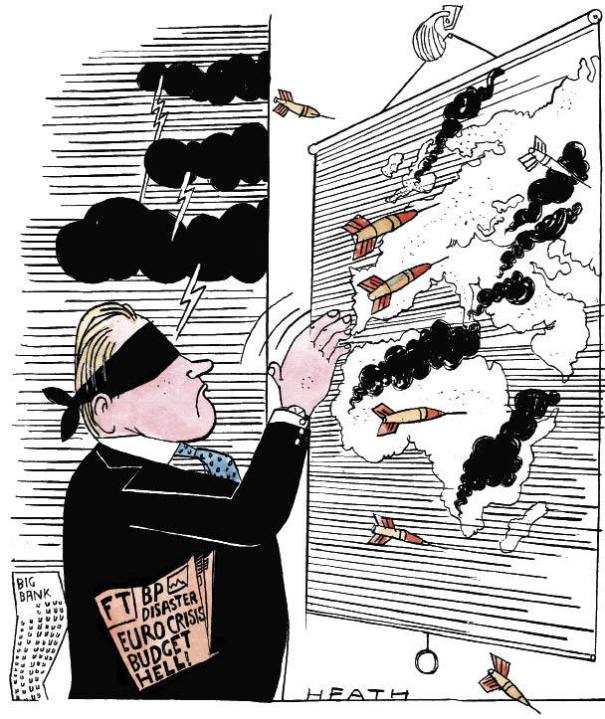

Jonathan Davis thinks this week’s Budget will prove positive for British investors, but that it’s increasingly important to take a global view of markets and currencies

There was nothing in George Osborne’s emergency Budget on Tuesday to contradict the idea that the transition from Labour to Conservative (or in this case Conservative-led) governments tends to be good for the investing classes. The fall of the Callaghan government in 1979 was followed after an initial period of uncertainty by the start of an 18-year bull market that was resilient enough to survive two nasty recessions, the 1987 crash and our undignified exit from the ERM in 1992. There were similar bull markets for shares in the mid-1930s, following the formation of a Conservative-dominated National Government, and in the Eden-Macmillan years in the 1950s.

This time round, the stock market’s response is again likely to be positive, once it has had time to digest unpalatable items such as the rise in capital gains tax for higher-rate income tax payers. Raising the top rate to 28 per cent rather than 40 per cent or worse is less of a sop to the Lib Dems than many Tories had feared. Osborne’s measures are generally a boost for the private sector. Indeed, by leaving the onus on the private sector to lead the UK out of economic recovery, he has firmly rejected neo-Keynsian solutions in favour of hitching the administration’s fortunes to those of its natural constituency.

The proposed year-by-year cut in corporation tax down to a record low of 24 per cent, and the commitment to ‘simpler rules and greater certainty’ for companies generally, are all to the good. At the macroeconomic level, his vigorous assault on the fiscal mess that Labour left behind is what markets had expected. The devil is in the detail however, and the numbers will be rigorously scrutinised for faultlines. It will take time before we can judge whether the results succeed in confounding the jeremiahs who insist that keeping the public spending spigots open for longer is essential to avoid a second recession.

Prospects for those whose investment horizons do not extend beyond home shores are certainly better than they were under Gordon Brown, but not yet as good as those who are prepared to venture abroad. UK companies which have succeeded in surviving the debt crisis have rarely been in better shape financially, and in many cases shares look reasonable value. If what Keynes called the corporate sector’s ‘animal spirits’ can be roused, and sterling remains competitively priced, then there is room for profits and investor returns to exceed expectations.

But the fortunes of the UK will remain constrained by the burden of public debt and the painful side-effects for employment and growth of Osborne’s campaign to diminish it. At best it will be a case of two steps forward and one step back for UK plc, forced to compete in international markets against less constrained rivals. The weakness of the euro is already doing wonders for German industry, for example.

Fortunately, 20 years of free-moving global capital flows have significantly increased the correlation between the performance of the main asset classes in different countries. Innovation has also greatly increased the range of markets in which private investors can readily invest. No UK investor any longer has to place a binary bet on the success of Osborne’s strategy.

Despite gloomy headlines about possible meltdown in the eurozone and fears that the US may be heading for a double dip, the global news has been good. The annualised rate at which global industrial production has been recovering since the dark days of the credit crisis has been unprecedented. Giles Keating of Credit Suisse points out that car sales in the three largest economies (Germany, Japan and the US) are still well down on pre-crisis levels, yet in the eight largest emerging markets they are growing strongly. Taken together, global sales of cars in these 11 economies are already back above their pre-2008 average.

Indeed, so well are low-debt and emerging economies doing that some are already starting to confront the problems of too rapid growth, through interest rate rises and tighter monetary control. China’s attempts to control its real-estate bubble have captured most of the headlines, but the Chinese are not alone. Brazil grew at an annualised rate of 10 per cent in the first quarter and interest rates there are heading up; so too in Australia and Canada. The evidence to date has confounded the many who doubted that there might be a V-shaped economic recovery.

In the absence of serious mistakes by governments and central bankers the odds on further recovery are improving, but with the indebted developed world continuing to lag the developing world. It is true that many investors remain to be convinced. Risk aversion explains why, although share prices are still handsomely above the lows of early last year, yields on government bonds remain stubbornly low. So too, with the notable exception of gold, are the prices of most commodities. That is not a pattern you would expect to see if sustainable economic recovery was a universally accepted fact. But banks in the eurozone still need to be recapitalised, while the blundering way that the EU and ECB have handled the Greek debt crisis is not an encouraging omen.

Experience shows that a good investment strategy has several elements: an understanding of value; diversification, to protect against mistakes and unforeseen risks; longer-term focus, for consistency and the avoidance of pointless trading costs; and a strategy that matches the investor’s tolerance for risk. One Budget can make only so much difference.

Looking back to 2000, half a dozen good strategic calls, some contrary to consensus opinion, would have ensured a profitable decade. One was to buy government bonds, which have been in a more or less continuous bull market since 1981. Another was to buy commodities, which despite recent stalling, remain in one of their generation-long cyclical upswings. A third was to be out of equities when valuations rose above historic norms, as they were in 2000 and 2007, while increasing (for those tolerant of short-term volatility) the proportion in emerging markets. Property remained a good bet for the first half of the decade, but killed anyone with excessive leverage when the credit crisis hit. Sterling, surprisingly perhaps, ended the decade at almost the same price in dollars at which it started. Wine and art had a terrific decade. Anyone who got those calls right could easily have trebled their wealth over the period.

Looking forward to the next decade, some of these trends, including the rise in emerging markets, are set to continue. Current prices for emerging-market equities still leave room for long-term gains. So too do prices of many large dividend-paying companies in developed markets. Equities in general are certain to enjoy a better decade than the one just finished: there has never been an example in history when a decade of flat equity returns failed to produce above-average returns in the next one.

Other trends will reverse completely. For the first time in nearly 30 years government bonds in the main issuing countries look extremely unattractive on anything but a short-term view. Bonds issued by stronger, more stable emerging countries look better value. However firmly the new government wrestles with the public finances, all historical experience will have been defied if higher inflation is not part of the eventual solution. Unfortunately inflation-linked bonds, one obvious hedge, are currently dear.

The factors behind the global commodity upswing remain in place. Expect higher prices over at least the next five years not just for gold and silver, which are bulwarks against the monetary debasement now being practised around the world, but also for oil, timber, industrial metals and agricultural commodities. Although the UK’s abi

lity to devalue has given us a helpful jump-start over eurozone competitors, the longer term implication is that the dollar, sterling and the euro (if it survives) may continue to weaken over the next decade relative to the currencies of faster-growing or resource-rich developing countries. The UK’s fortunes are looking up after this week’s Budget, but economic miracles sadly need more time to gather real momentum. It is a start.

Jonathan Davis is the founder and editor of Independent Investor.

Comments