To address the deficit, George Osborne will probably have to raise taxes. This is a grim truth to which most people are reconciled. But raising taxes and raising revenue are two different things. If the Chancellor is serious about closing that deficit, then he would doubtless be interested in the idea that a Capital Gains Tax raise from 18 per cent to 50 per cent might be a chimera tax. That is to say, one which raises no money at all. Worse, in fact, the odds are that tax revenues will fall and the deficit will be made worse by this tax rise.

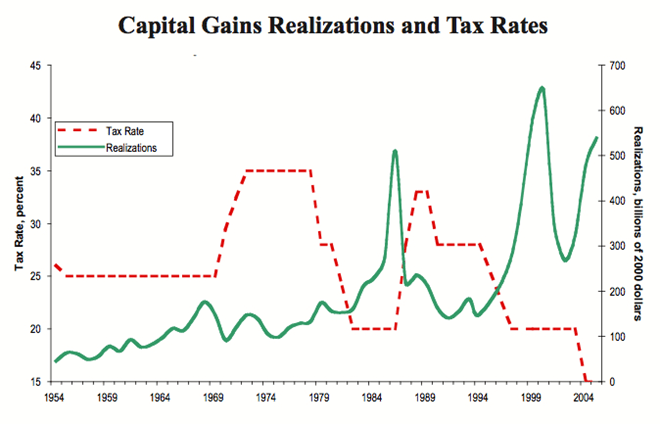

The international evidence is absolutely clear. As sure as night follows day, tax revenues go down when CGT rates go up. Revenue rises when CGT is lowered to a rate which is attractive to investors (and this includes those investing in a second home by means of pension provision). The chart below provides the US evidence, where CGT rates have changed significantly over recent decades:

A few highlights from the post-war American experience with Capital Gains Tax:

i) Between 1968 and 1972 rates increased by 10 percentage points and revenues

fell 21%.

ii) In 1978 the rate fell from 35% to 20% and revenues increased by 46%.

iii) In 1986 the rate was raised to 28% and by 1991 15% less revenue was being

raised

iv) In 1996 the rate was reduced to 20% again and by 2000 revenues had grown

by some 50%

v) In 2003 the rate was cut to 15% and revenues again grew very sharply.

Other international evidence paints a similar picture. After Australian CGT rates for individuals were halved in 1999, revenue from individuals nearly doubled over the subsequent nine years.

Why this strong effect? Working is compulsory: income taxes can guarantee a haul (up to a certain level. Push it too high, and high earners emigrate as anyone who watched last weekend’s Rolling Stones documentary will have seen). But when it comes to investment taxes: well, these are optional. No-one needs to sell their investment and pay capital gains taxes – except in times of financial distress. In this regard, CGT is largely a voluntary tax and when rates rise it is no surprise that the number of volunteers declines.

One myth that is consistently peddled is that lower CGT rates will somehow result in people shifting income to capital gains. But if it is so easy to convert income to capital gains then how do countries which have a CGT rate of zero still manage to raise so much revenue from income taxes?

Australia’s personal income tax yielded at least as much revenue when the capital gains tax was zero as it did after adopting the highest capital gains tax in the world. And what about New Zealand, which has no CGT? Or Belgium, which also has no CGT but a top rate of 50% like the UK? Why can it still collect income tax at these high rates? Converting capital gains to income is very difficult. Tax authorities are perfectly capable of limiting attempts at shifting taxable income into non-taxable capital gains.

The remaining argument for CGT rises, that of ‘fairness,’ or – to put it more bluntly – taxing the rich, is predicated on a fundamental misconception: that CGT is paid primarily by the rich. In fact a capital gains tax on individuals is mainly a tax on the old. People build up assets during their life which they draw down when they are old. In The Sun last week, Kelvin MacKenzie provided a breakdown of the social classes who own a second property: these are builders, hairdressers. etc. who are saving for a second pension. When the Sun, and not the Financial Times, is squealing in pain about a tax then it is sign that the rich are not effectively being squeezed.

Most likely, Britain’s CGT rises will lead to even sharper revenue falls than we saw in America. Not only because the planned rises are significantly larger but also because investors know that they are likely to be temporary, that the increases are being introduced largely for political and presentational reasons – as part of horse-trading within a coalition – and that the major party in the coalition does not believe in them and will seek an early opportunity to reverse them. Why sell your house, or asset, now when you would be whacked for 50 percent?

Given these factors, it will therefore be entirely rational for most investors to defer capital gains realizations for a few years and to avoid the purchase of new assets that incur the tax. Indeed, surveys by financial advisory firms suggest that this is already happening.

In truth, if we want to increase CGT revenues then we need to cut rates, not increase them.

Peter Young is a contributor to the Adam Smith Institute publication The Effect of Capital Gains Tax Rises on Revenues.

Comments