It’s sometimes said that Rishi Sunak has been playing politics on easy mode: when you’re giving away loads of cash, it’s hard not to be popular. Now, as summer fades and autumn beckons, politics gets harder. The chancellor is facing his first real test with Conservative MPs over reports that his Treasury is considering a range of tax rises to help repair, in part, the public finances.

A number of those Conservative MPs have made clear in recent days that they do not want taxes to rise. On one level, this is unsurprising: not many people who get elected to Parliament as Conservatives are keen on higher taxes.

Yet what is surprising is the lack of significant Tory engagement with the wider fiscal context of this debate. By which I mean unprecedented government borrowing and a national debt big enough to be visible from space.

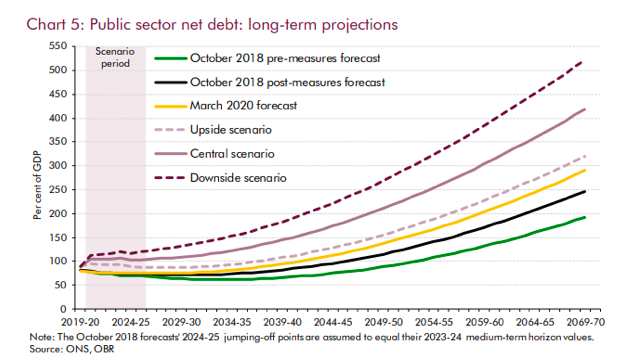

The national debt is now as big as the entire UK economy. That’s not surprising or terribly worrying. What happens next is more interesting. According to the Office for Budget Responsibility, the debt will very likely reach 200 per cent of GDP over the next 30 years, or sooner if things go badly.

These numbers are not normal. Changing them will require major changes in the public finances, meaning either big, big cuts in public spending, or big, big increases in tax, or a combination of the two.

I think the cutting option is politically near-impossible. Yes, there are some entitlements that could and should be trimmed: the Triple Lock, for instance. But the fact that the PM himself is resisting that cut speaks volumes. So too does Boris Johnson’s promises that there will be no return to austerity: No 10 knows that the voters who will decide the next election have clear expectations of the State. The Red Wall will not remain in Tory hands if voters there conclude that voting Tory led to their schools, hospitals, roads and policing getting worse.

What about tax cuts? Could debt-financed tax cuts push Britain up the Laffer Curve and help address those galactic-level debt-levels? I am not an economist, but I humbly suggest that one needs to have truly heroic assumptions to think that tax cuts could generate the sort of revenue needed to change those national debt numbers significantly.

And those figures really aren’t the sort of numbers Tories are usually sanguine about. I’m old enough to remember the 2010 election campaign, when the Conservatives ran brutally effective posters of a newborn baby under the headline: Dad’s Nose. Mum’s Eyes. Gordon Brown’s Debt.

Then, the Tories were clear that debt was simply deferred taxation, a burden imposed by this generation on the next. The party of Burke had no time for those who wanted to saddle their children and grandchildren with debt.

These days, instead of talking about Sound Money, it’s more typical to hear Tories celebrating Cheap Money, waxing lyrical about how easy it is for HMG to rake in cash from bond-buyers. Why worry about fiscal consolidation when you can borrow as much as you like?

Now, it is indeed true that right now, governments can borrow cheaply. There’s a lot of institutional cash around that has little choice but to flow into government bonds, and with central banks standing ready to support demand by buying bonds, it’s easy to see how some people are starting to think we’re entering a new paradigm in which huge deficits can be funded indefinitely at little cost.

I am no fiscal hawk, but any economic policy that rests on the assumption that a set of unusual conditions will not change for several decades leaves me feeling rather uneasy. Simply, what happens if borrowing costs rise or, worse, markets are one day unwilling to lend all the money that Britain wants to borrow? A bad Brexit outcome and the – sadly plausible – break-up of the Union might trouble gilts. And can we really rely on the Bank of England forever? There are serious unanswered questions, both economic and political, about the role of central bankers in sustaining current economic policies.

So I think a serious conversation about tax rises would be wise. I think voters would accept that too, if they felt that the politicians talking about tax were doing so as part of a serious, honest discussion about the responsible management of the economy. People aren’t daft, and they don’t generally expect a free lunch. Last week over a genteel Sussex pub lunch made cheaper by the Eat Out to Help Out scheme, I was struck by hearing more than one fellow diner joke that they might as well enjoy the Chancellor’s discount now, ‘because we’ll all be paying for it sooner or later’.

There is never a good time to talk about tax cuts, and Sunak’s challenge here is all the greater because of the way economic and political cycles are likely to clash. Since there’s no question of making tax rises any time soon – the downturn is far from over – any consolidation is likely to come closer to the end of this Parliament, or even in the next one. Hence the Tory warnings: MPs don’t want to run for re-election on a promise of higher taxes.

But that imperative should be examined closely. To repeat my point, voters aren’t stupid. They know that at least some of the huge, necessary spending now taking place will, one day, need to be paid for. Will they really reward a governing party that goes into the next election promising yet another slice of cake, with no obvious plan to pay for it?

Never mind all the talk about identity politics and culture wars. Politics usually comes down to the boring questions of competence and responsibility. Who do voters most trust to do the stuff that has to be done? Last year it was Brexit. At the next election it’s likely to be rebuilding the economy and the public finances in a way that leaves the state intact.

Tories who today scream blue murder about the mere suggestion of tax rises are making it harder for their party to have the sort of grown-up economic conversation that voters expect from a competent government. They are also offering Keir Starmer a remarkable opportunity to repeat Tony Blair’s pre-97 trick of presenting Labour as the party of responsible economic management.

Starmer has already shown his willingness and ability to sidestep the culture-and-values elephant traps Tory culture warriors dig for him: he celebrates VE Day, backs Land of Hope and Glory and keeps quiet on transgender issues. Could he keep that up and go into the next election offering competence and fiscal responsibility? It’s far from certain, but the unreality of the Tory ‘debate’ about tax cuts surely makes it more likely.

Comments