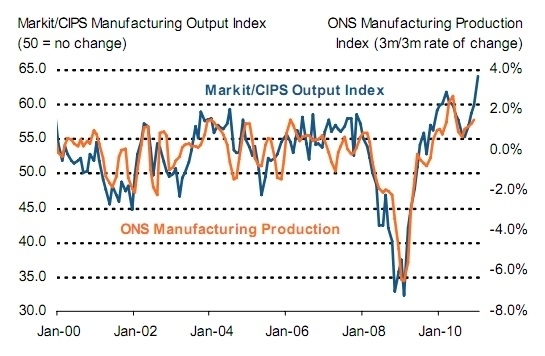

It will have been a quiet morning in the Balls household. Fresh economic indicators suggest that the British economy is not in some cuts-induced recession but, instead, doing rather nicely, thank-you. As I said last week, economic health is assessed by all manner of indices – and the ONS (which is forever having to tear up its GDP forecasts) might just have boobed last week with its preliminary Q4 GDP figures. Today we have the Manufacturing PMI surging to heights not even reached in the early 1990s:

Now, this might be a flash in the pan, you say. But then consider corporate liquidity – that is, how much debt Britain’s companies have lurking on their balance sheets. The figures out today are not too bad either. The graph below shows that the deposits-to-debt ratio is now back to normal (i.e. the average from 1970 to 2010, the pink line). So companies are steadily inching back into the black:

So is it time to sound the all clear? Not at all. As a great man once said, economic forecasting exists only to make astrology look good. These indicators give little glimpses: fragments of a picture, but never the whole picture. And often a misleading one. As Johan Norberg warned in his seminal cover story five weeks ago, the road ahead is strewn with landmines.

In March, Portugal has to renew several billion Euros of debt. If it can’t, we risk a sovereign debt crisis (which would certainly push up the price of British debt, which is rising already thanks to levels of inflation that are being mocked even in Zimbabwe) And UK household debt is still the highest any G7 country has ever known:

The real economic test will be what happens when interest rates start their (dangerously-delayed) march back up to 5 per cent. But insofar as it’s possible to determine a pattern, Britain is heading for economic growth of about 2 per cent this year – not good, and not bad. Today’s data supports that narrative. Balls might have to wait a little longer for the apocalypse he wants so badly.

Comments