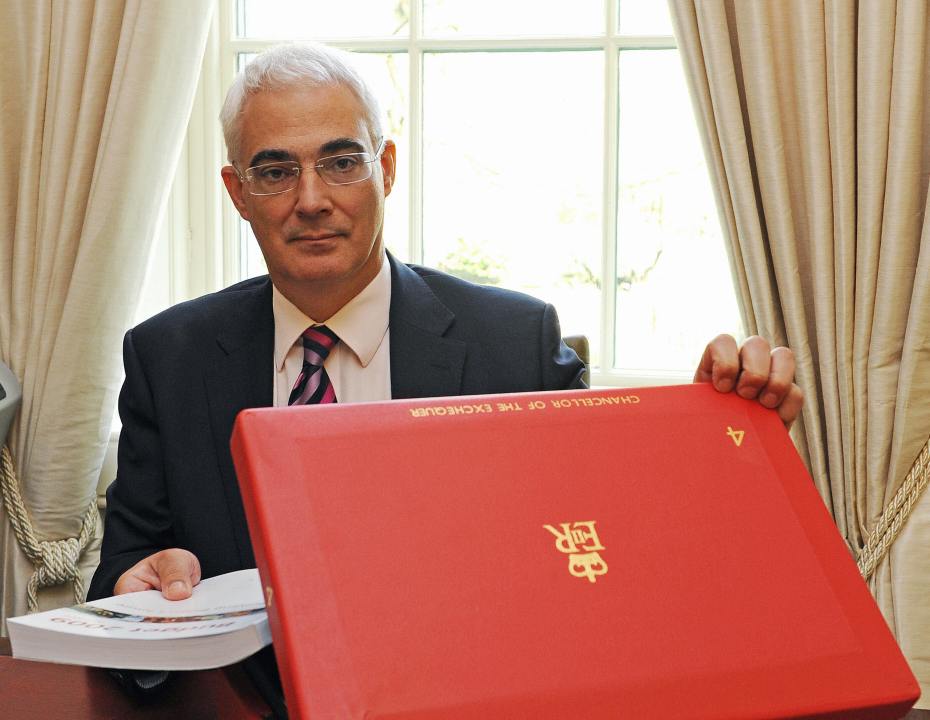

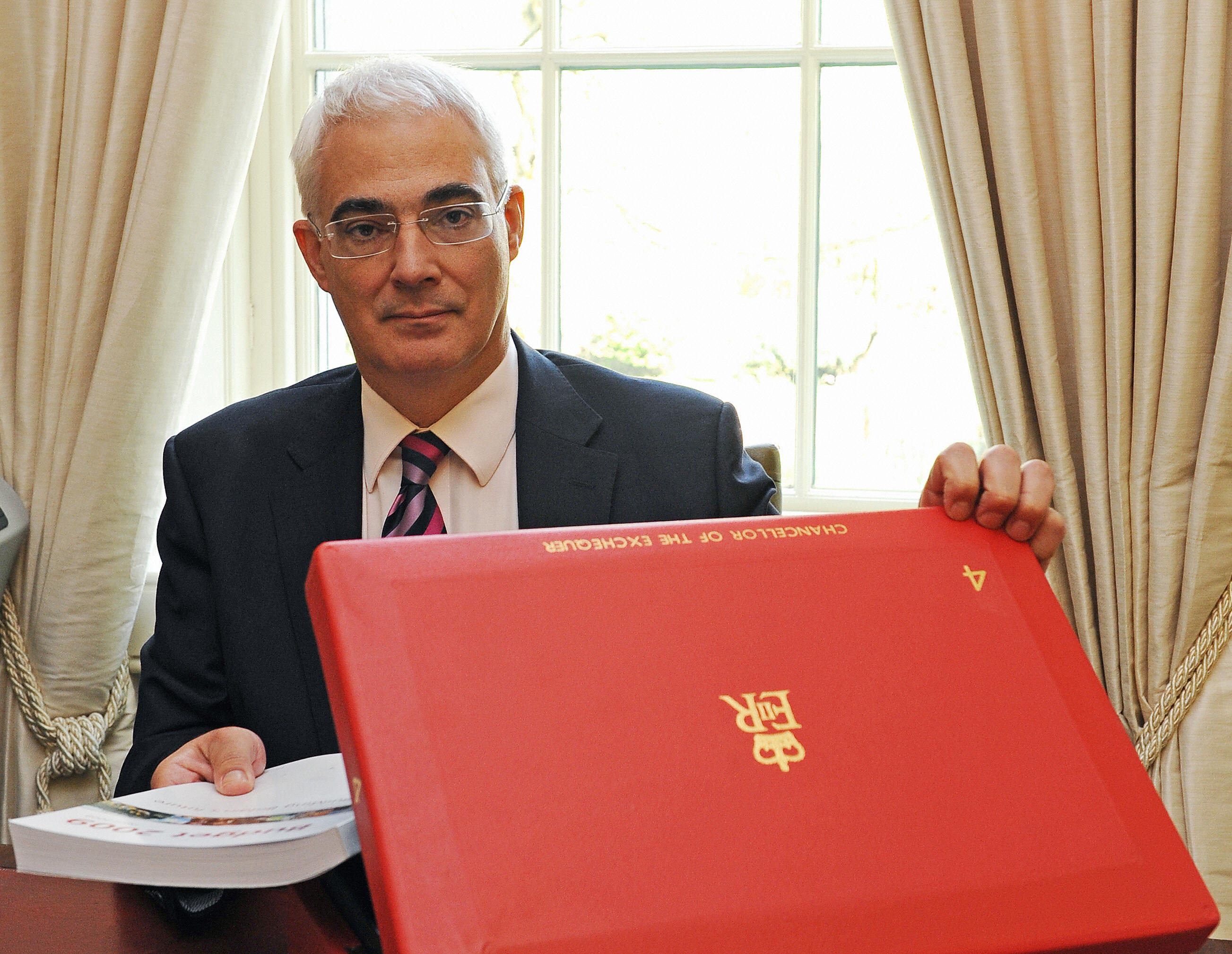

If, as expected, Alistair Darling reduces his borrowing forecasts tomorrow, it’s worth keeping two particular points in mind:

If, as expected, Alistair Darling reduces his borrowing forecasts tomorrow, it’s worth keeping two particular points in mind:

1) This government has always tended to underestimate its borrowing levels. Ok, so you might argue that the government couldn’t have foreseen that public sector net borrowing would rise to £178 billion in 2009/10 when it predicted £38 billion in Budget 2008. A recession has bitten, banks have collapsed, since then – that kind of thing. But Brown & Co. certainly have a track record when it comes to underestimating borrowing totals. In Budget 1999, they thought that borrowing would be at £3 billion in 2002-03 – it turned out to be £23 billion. In Budget 2003, they thought that borrowing would be at £22 billion in 2006-7 – it turned out to be £33 billion. And so on and so on. Throw in Brown’s various off-balance sheet ruses, and the future borrowing position is likely to be considerably worse than Darling’s forecasts tomorrow.

2) Borrowing is still at extremely high levels – and the debt burden is far, far worse. Let’s not forget that annual borrowing of around £180 billion is hardly a great accomplishment – and neither is £170 billion or £160 billion. But it’s our overall debt levels which should really terrify us. Here’s what the position looks like, as of last year’s Pre-Budget Report:

Comments