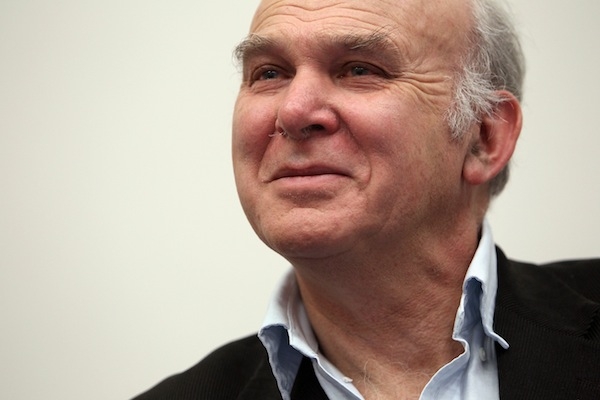

Vince Cable’s speech on the government’s industrial strategy today is expected to signal the end of a ‘laissez-faire’ approach to business. But the Business Secretary appeared un peu trop détendu himself when describing plans for a state-backed business bank on the Today programme.

‘This is, as I say, something we’re discussing within government at the moment. There is a scope for example for rationalising our activities as well as new lending. But the scale and scope is something that I’m discussing with the Chancellor at the moment.’

There wasn’t much detail on offer, other than that this bank ‘may well’ involve state lending. But as Sam Coates points out this morning, a real bank would take years to set up.

Cable offered more clarity on what he thinks the state’s role in these matters is – as a ‘catalyst’ for improving the banking sector in a way that small ‘challenger banks’ cannot because of their limited access to capital. ‘There are certain areas where the markets failed and we do think an intervention would help,’ he said in the interview.

One intervention that has not been quite so helpful thus far is the Regional Growth Fund, which MPs on the Public Accounts Committee today slammed as ‘scandalous’ for failing to get projects off the ground. The Committee’s report, published this morning, found that only £60 million of the £1.4 billion allocated in the fund has actually made it to front-line projects over the past two years. Members said they were ‘highly disappointed’ that so few projects had received the final go-ahead.

It also slammed the very low level of job creation, with the departments involved telling the committee that 2,442 new jobs had been created and 2,762 positions protected by the funding. The Fund is supposed to create 36,800 jobs over the lifetime of the projects it funds. That’s definitely the wrong sort of laissez-faire.

Comments