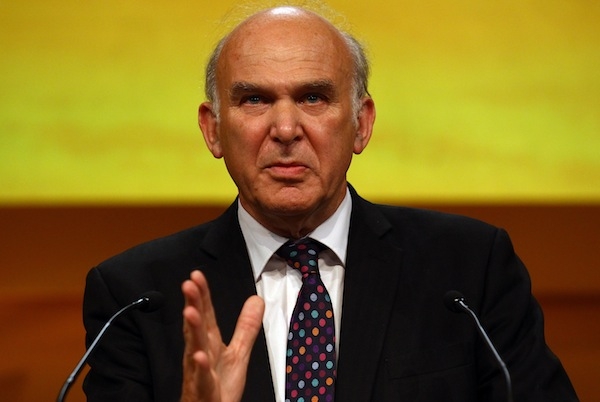

It is only towards the tail end of his lengthy New Statesman essay on ‘the long economic stagnation of post-crisis Britain’ that Vince Cable lets off one of his bombshells. He’s clearly freelancing, and not at a bad time, either, given it’s his party’s Spring Conference this weekend. Although it’s possibly not enormously helpful for the Prime Minister, who is giving a major speech on the economy tomorrow. The Business Secretary examines misinterpretations of Keynesianism and the effect of the government’s deficit reduction programme on the economy before dropping this:

‘Nevertheless, one obvious question is why capital investment cannot now be greatly expanded. Pessimists say that the central government is incapable of mobilising capital investment quickly. But that is absurd: only five years ago the government was managing to build infrastructure, schools and hospitals at a level £20bn higher than last year. Businesses are forward-thinking and react to a future pipe – line of activity, regardless of how ‘shovelready’ it may be: we have seen that in energy investment, where the major firms need certainty over decades.

‘The more controversial question is whether the government should not switch but should borrow more, at current very low interest rates, in order to finance more capital spending: building of schools and colleges; small road and rail projects; more prudential borrowing by councils for housebuilding. This last is crucial to reviving an area which led economic recovery in the 1930s but is now severely depressed. Such a programme would inject demand into the weakest sector of our economy – construction – and, at one remove, the manufacturing supply chain (cement, steel). It would target two significant bottlenecks to growth: infrastructure and housing.

‘Yet nobody knows how the markets might respond. While low interest rates are often an encouragement to invest more, they are also an indication of great uncertainty. But more investment is what the more traditional Keynesians are now arguing for (and essentially what Skidelsky is saying, stripped of the invective).

‘Such a strategy does not undermine the central objective of reducing the structural deficit, and may assist it by reviving growth. It may complicate the secondary objective of reducing government debt relative to GDP because it entails more state borrowing; but in a weak economy, more public investment increases the numerator and the denominator.

You can read the essay in full here, but let’s be clear about what Vince Cable is suggesting here. He wants to consider whether the government should finance capital spending projects to get the economy going not through spending cuts but through further borrowing. He is arguing that this would not undermine Plan A on deficit reduction, and that the investment would pay itself back through the uplift it would give to the economy.

Cable’s argument is not that dissimilar to one put forward by some of his party bedfellows in the Social Liberal Forum (the left-leaning pressure group within the Lib Dems), who have tabled an emergency motion for Spring Conference on ‘kickstarting economic growth’. The motion calls for ‘loosening the straight jacket preventing public capital investment by government and councils and realising a once in a lifetime opportunity to invest using low interest rates’, and for a housebuilding programme, which Cable has also made noises about over the past month or so.

Interestingly, the SLF also wants conference to oppose ‘pressures to agree to curbs on public spending beyond the lifetime of this parliament when this Coalition Government will be over’. That might be something Cable sympathises with, but Danny Alexander will be furious. Remember that he yesterday scolded the Cabinet for bickering about the 2015/16 spending review.

Comments